Irs W9 Form 2021 Printable New Printable Form Letter For о

W9 Tax Form 2021 Irs Paperspanda • form 1099 misc (various types of income, prizes, awards, or gross proceeds). • form 1099 nec (nonemployee compensation). • form 1099 b (stock or mutual fund sales and certain other transactions by brokers). • form 1099 s (proceeds from real estate transactions). • form 1099 k (merchant card and third party network transactions). Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs.

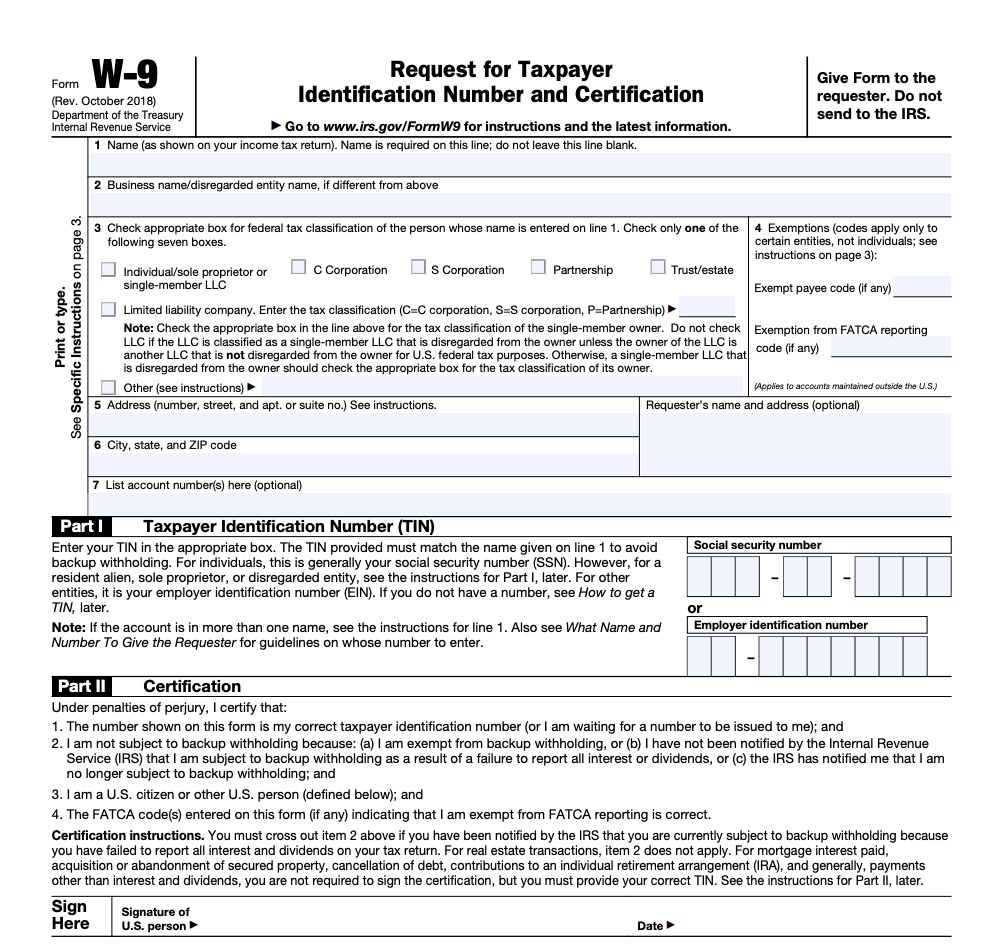

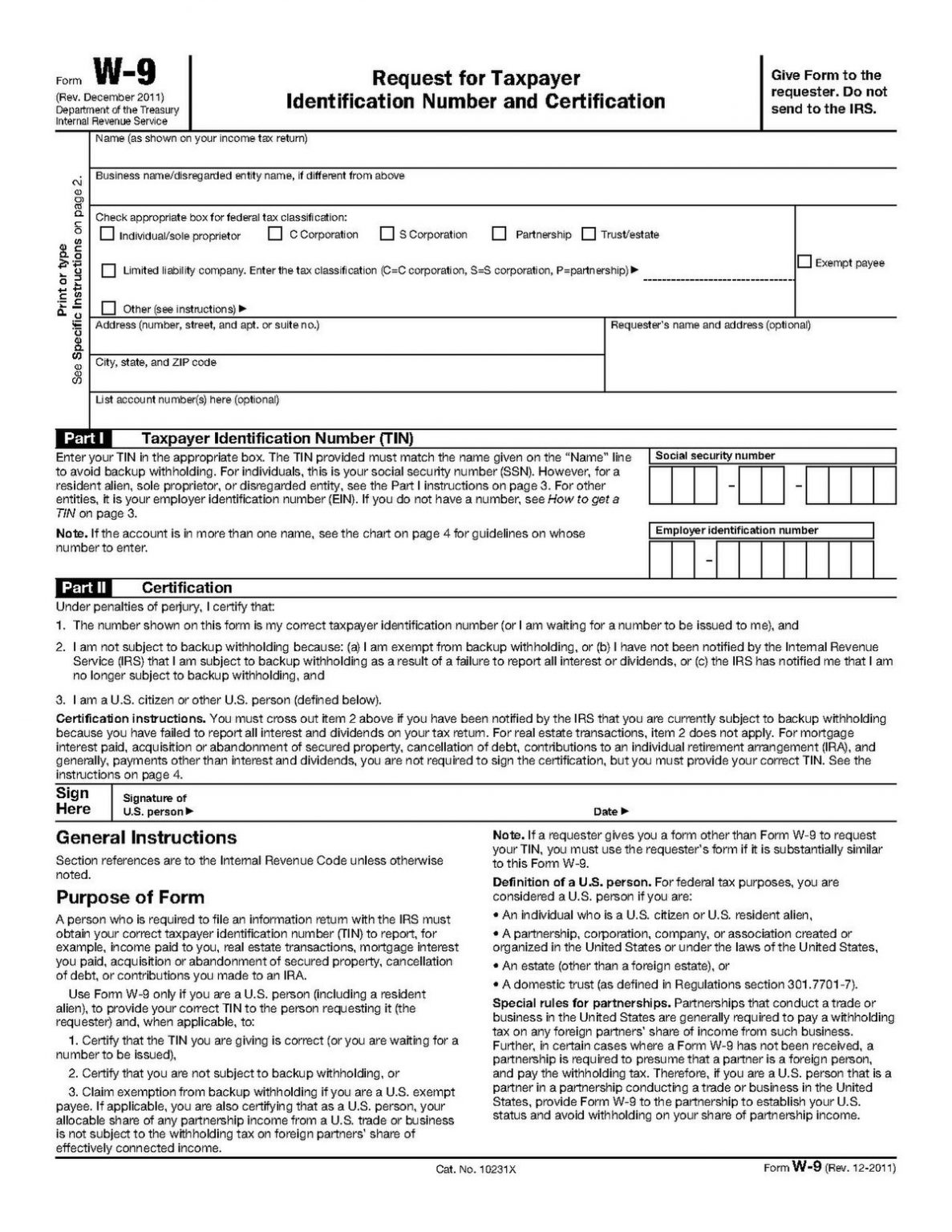

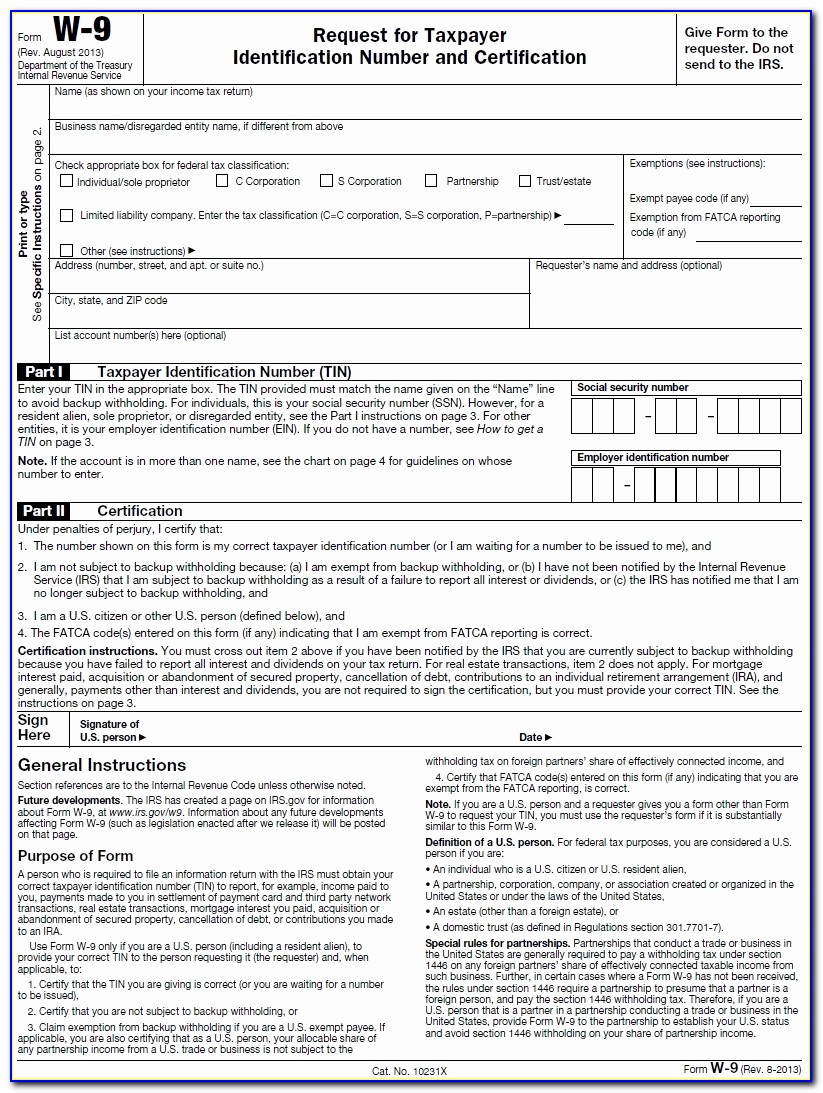

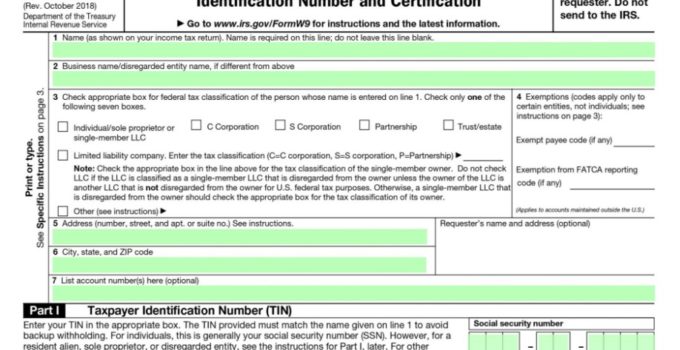

Irs Free Printable W9 Form Printable Forms Free Online Sample w 9 request letter. date. dear vendor, enclosed is form w 9, request for taxpayer identification number and certification. irs regulations require that we issue 1099 forms to certain companies and individuals. in order to accurately prepare these forms, the irs requires that we obtain and maintain form w 9 for all of our vendors. Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services. Irs form w9 (2024) an irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. Form w 9 is an internal revenue service (irs) tax form that self employed individuals fill out with their identifying information. businesses issue this form and collect it once the self employed individuals have completed it. then, they use the details the self employed individuals provided to report nonemployee compensation to the irs properly.

Irs Form W 9 Fillable Printable Forms Free Online Irs form w9 (2024) an irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. Form w 9 is an internal revenue service (irs) tax form that self employed individuals fill out with their identifying information. businesses issue this form and collect it once the self employed individuals have completed it. then, they use the details the self employed individuals provided to report nonemployee compensation to the irs properly. Form w 9, request for taxpayer identification number and certification. say that a lawyer settles a case for $1 million, with payment to the lawyer’s trust account. assume that 60 percent is for. How to fill out a w9 form. before you file information from a w 9, verify that your contractor has filled out all the pertinent fields. line 1. the payee’s name. this name should be the payee’s full legal name and match the name on the payee’s income tax return. line 2.

Irs W9 Form W9 Form 2021 Printable Form w 9, request for taxpayer identification number and certification. say that a lawyer settles a case for $1 million, with payment to the lawyer’s trust account. assume that 60 percent is for. How to fill out a w9 form. before you file information from a w 9, verify that your contractor has filled out all the pertinent fields. line 1. the payee’s name. this name should be the payee’s full legal name and match the name on the payee’s income tax return. line 2.

Comments are closed.