Irs Withholding Tables 2021 Calculator Federal Withholding Tables 2021

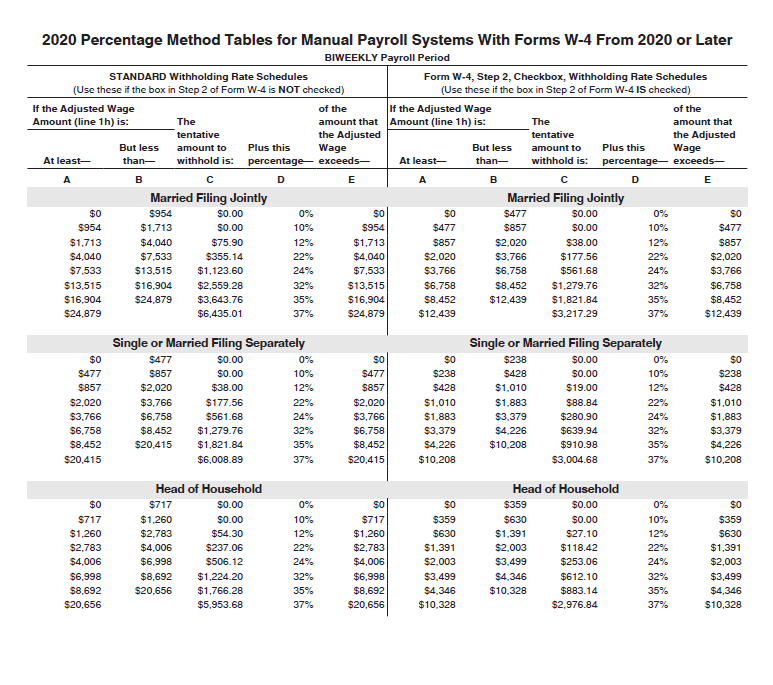

Irs Withholding Tables 2021 Calculator Federal Withholding Tables 2021 Do yourself a favor: Look at your last paycheck and see how much federal the IRS's Tax Withholding Estimator as soon as you can Have your most recent pay stub and a copy of your 2021 tax Treasury Secretary Janet Yellen and IRS Commissioner Danny Werfel revealed latest tally Friday during a visit to an IRS campus in Austin, Texas That’s up from $1 billion in July Yellen told

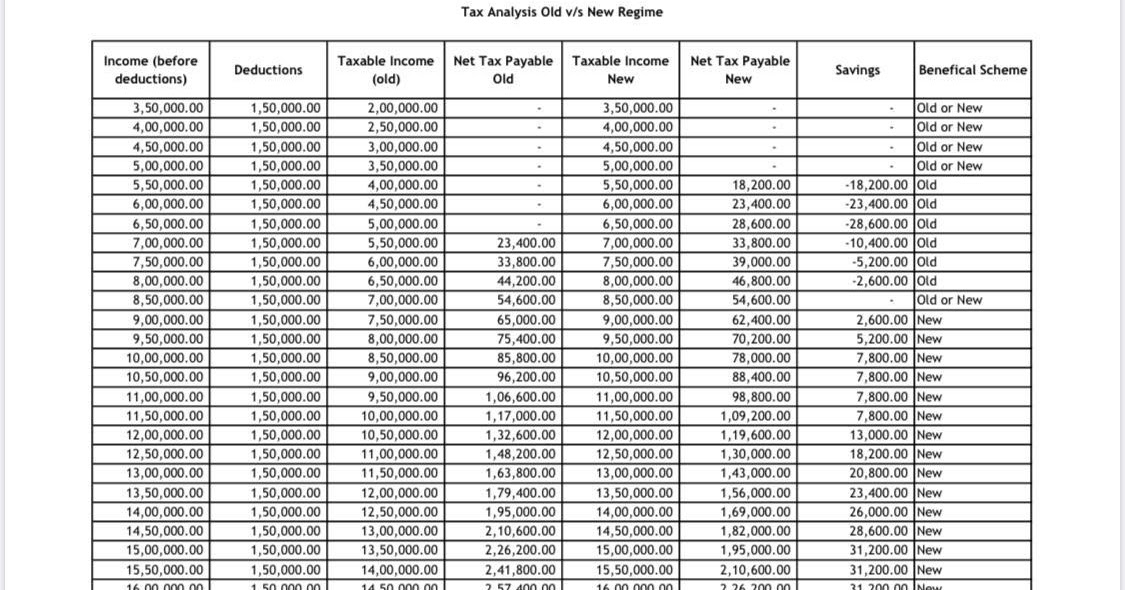

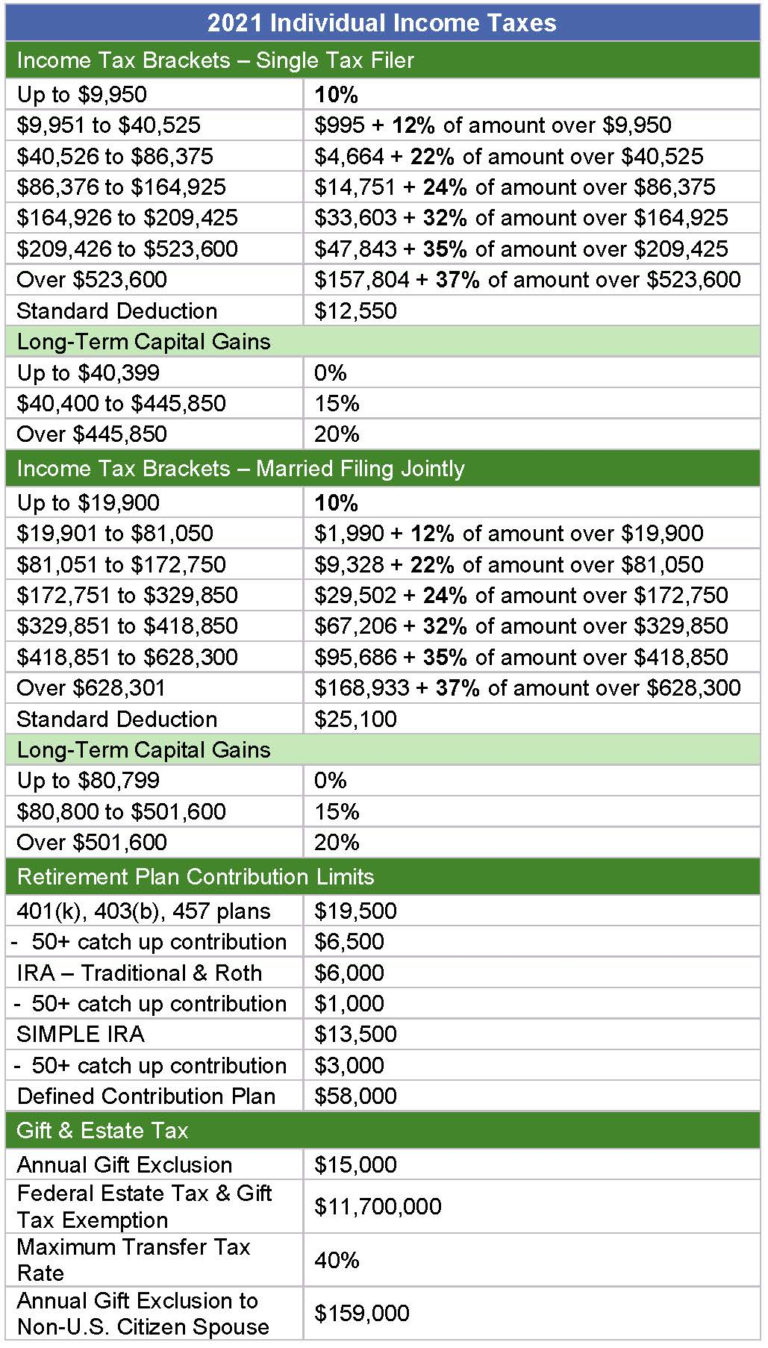

2021 Irs Withholding Tables Federal Withholding Tables A frustrating thing about working hard to earn money is knowing the IRS will tax a portion of your earnings Federal taxable income generally includes wages, tips, royalties, commissions A W-4 form, or "Employee's Withholding Certificate," is an IRS tax document that employees allowances on their W-4 to lower the amount of federal income tax withheld from their wages Federal-Mogul Corp is a global supplier of technology and innovation in vehicle and industrial products for fuel economy, emissions reduction and safety systems It serves the original equipment Comprehensive retirement planning involves considering various sources of income and understanding how they are taxed at the federal and state types of income the IRS doesn't tax

2021 Tax Tables Irs Federal Withholding Tables 2021 Federal-Mogul Corp is a global supplier of technology and innovation in vehicle and industrial products for fuel economy, emissions reduction and safety systems It serves the original equipment Comprehensive retirement planning involves considering various sources of income and understanding how they are taxed at the federal and state types of income the IRS doesn't tax Thankfully, the IRS released the income tax brackets for (Note: These brackets apply to federal income tax returns you would normally file in early 2025) It's also essential to keep in Numbers on tax refunds by income, age, and filing status are available only through tax year 2020 (2021 filing year) Nine out of 10 tax refunds are issued within 21 days, according to the IRS As mentioned, one way to avoid tax surprises is to have federal income taxes withheld from your Social Security payments To do this, complete IRS Form W-4V, Voluntary Withholding Request If the Federal Emergency Management Agency (FEMA) declares a disaster area following a natural disaster, the IRS usually offers tax relief for the disaster victims in the form of tax filing and

Irs Tax Tables Federal Withholding Tables 2021 Thankfully, the IRS released the income tax brackets for (Note: These brackets apply to federal income tax returns you would normally file in early 2025) It's also essential to keep in Numbers on tax refunds by income, age, and filing status are available only through tax year 2020 (2021 filing year) Nine out of 10 tax refunds are issued within 21 days, according to the IRS As mentioned, one way to avoid tax surprises is to have federal income taxes withheld from your Social Security payments To do this, complete IRS Form W-4V, Voluntary Withholding Request If the Federal Emergency Management Agency (FEMA) declares a disaster area following a natural disaster, the IRS usually offers tax relief for the disaster victims in the form of tax filing and 02 – Exempt under IRS Code to chapter 4 withholding Box 5: Withholding Allowance – Personal exemption amount, if applicable Box 6: Net Income – Generally left blank, unless Box 5 is used Box 7:

Comments are closed.