Is There A New W9 Form For 2021

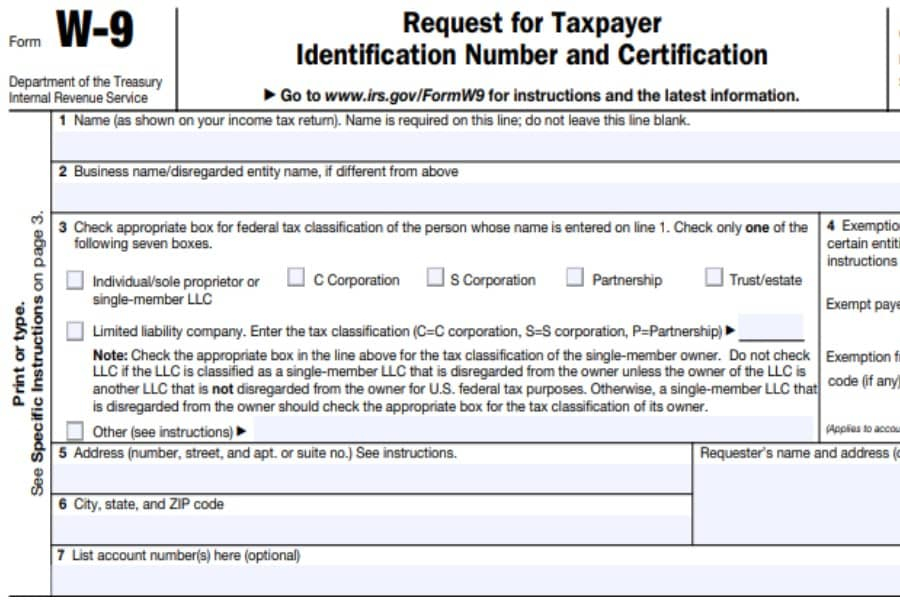

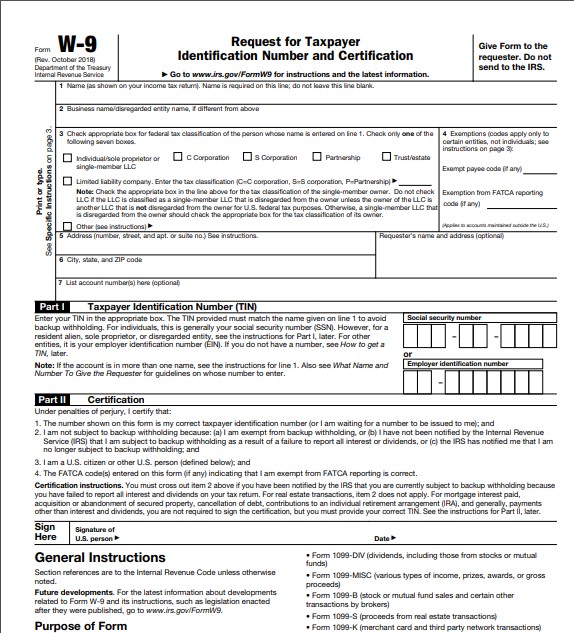

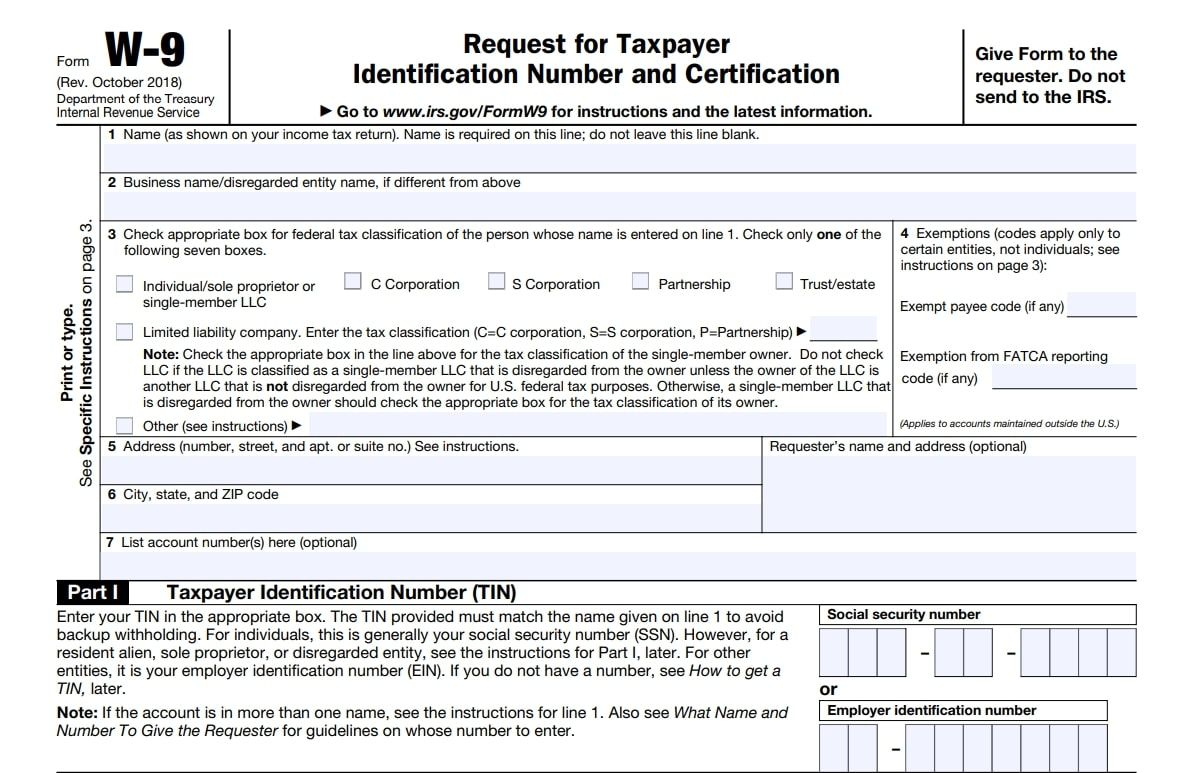

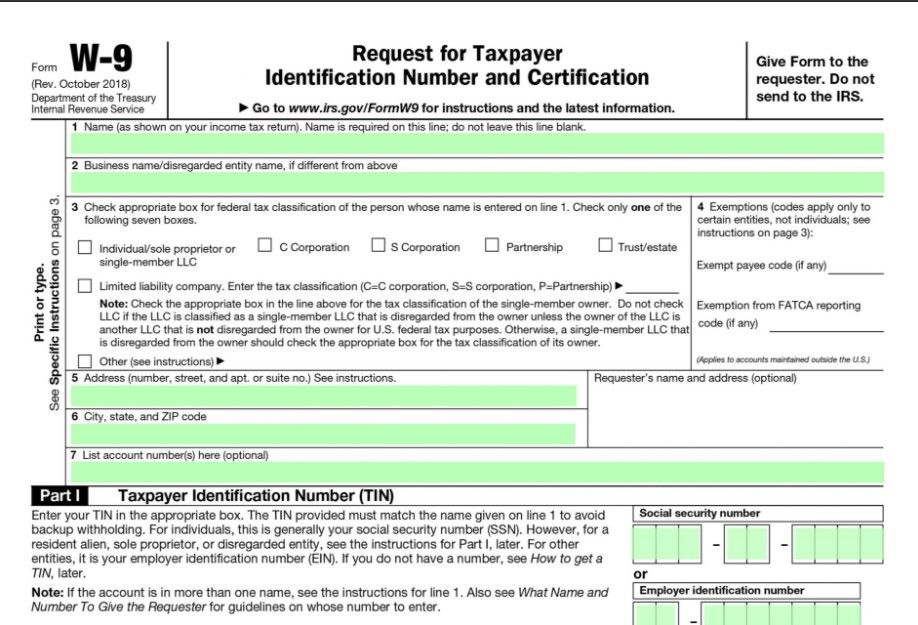

W9 Tax Form 2021 Printable Paperspanda Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs. If you are a u.s. person and a requester gives you a form other than form w 9 to request your tin, you must use the requester’s form if it is substantially similar to this form w 9. definition of a u.s. person. for federal tax purposes, you are considered a u.s. person if you are:.

Irs W9 Form 2021 Printable W9 Form 2021 Printable The irs has released a final revised version of form w 9, request for taxpayer identification number and certification, with a new reporting requirement for flow through entities. the updated form w 9 has a march 2024 revision date. withholding agents should use of the new form as soon as possible, especially if the withholding agent is a flow. Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services. The new form w 9 contains two changes: new note within line 3a: the form w 9 now includes a clarifying note on how to properly complete the form for a limited liability company (llc). for an llc that is not a disregarded entity, line 3a has a single box to check and available entry space for the llc to note the proper tax classification as. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9.

Downloadable W9 Tax Form 2021 Paperspanda The new form w 9 contains two changes: new note within line 3a: the form w 9 now includes a clarifying note on how to properly complete the form for a limited liability company (llc). for an llc that is not a disregarded entity, line 3a has a single box to check and available entry space for the llc to note the proper tax classification as. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9. Here’s the w 9 form meaning, in a nutshell: the form, officially called form w 9, request for taxpayer identification number and certification, is typically used when a person or entity is required to report certain types of income. the form helps businesses obtain important information from payees to prepare information returns for the irs. A form w 9 is reasonable when it is the most recent version of the form when obtained and includes a name on line 1, tin, signature, and date. a new form w 9 is not required to be collected unless there is a substantial change in circumstances of the payee that make the certifications on the form w 9 unreliable or incorrect.

2021 W9 Form Fill Out Online Paperspanda Here’s the w 9 form meaning, in a nutshell: the form, officially called form w 9, request for taxpayer identification number and certification, is typically used when a person or entity is required to report certain types of income. the form helps businesses obtain important information from payees to prepare information returns for the irs. A form w 9 is reasonable when it is the most recent version of the form when obtained and includes a name on line 1, tin, signature, and date. a new form w 9 is not required to be collected unless there is a substantial change in circumstances of the payee that make the certifications on the form w 9 unreliable or incorrect.

Comments are closed.