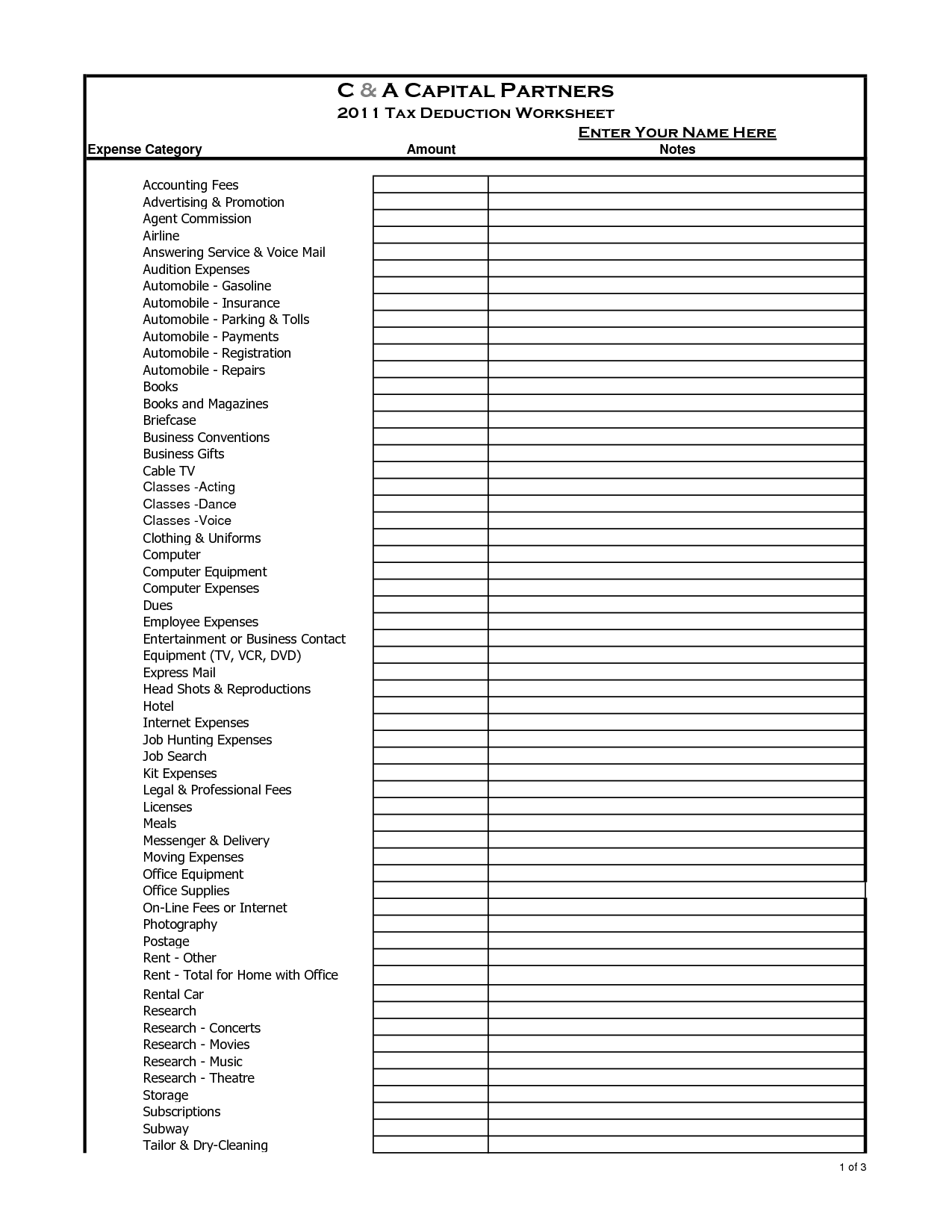

Itemized Deduction Worksheet Template Free

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign Work out a proposed household budget by inputting your sources of income and projected expenses into Kiplinger's exclusive worksheet below You can add and delete rows as necessary to reflect your Prior to the 2023 tax year, self-employed tax filers would fill out the Self-Employed Health Insurance Deduction Worksheet found is needed for both itemized deductions and self-employment

Itemized Deductions Worksheet 2018 Printable Worksheets And You can find her jogging through Austin, TX, or playing tourist in her free time sense for your situation to do a standard deduction versus an itemized deduction 2 Request Form 1098 From Read more: we researched free tax software and put together best thing you can do to optimize your itemized deductions Not every type of tax deduction is an itemized deduction As you might expect, those with more income are more likely to choose to itemize their deductions, while those earning less favor the standard deduction Taxpayers earning $1 million or more filed 168 If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction Enter your total 401k retirement contributions for 2022 For 2022

Printable Itemized Deductions Worksheet As you might expect, those with more income are more likely to choose to itemize their deductions, while those earning less favor the standard deduction Taxpayers earning $1 million or more filed 168 If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction Enter your total 401k retirement contributions for 2022 For 2022 Nearly 90% of taxpayers claim the standard deduction vs itemized deductions As you prepare to file your next tax return, should you do the same? Claiming the standard deduction is certainly easier Every year, millions of American taxpayers decide whether to take the standard deduction the Internal Revenue Service (IRS) offers or to claim itemized deductions to maximize tax savings Read on to discover the pros and cons of a standard deduction vs itemized deduction to decide which approach is best for you To compensate for the loss of personal exemptions, the standard The Epic Games Store is still giving away free games each week throughout 2024 Completely free, no strings attached (except the one tied to Epic's storefront) Wondering what's free on Epic right

A List Of Itemized Deductions Nearly 90% of taxpayers claim the standard deduction vs itemized deductions As you prepare to file your next tax return, should you do the same? Claiming the standard deduction is certainly easier Every year, millions of American taxpayers decide whether to take the standard deduction the Internal Revenue Service (IRS) offers or to claim itemized deductions to maximize tax savings Read on to discover the pros and cons of a standard deduction vs itemized deduction to decide which approach is best for you To compensate for the loss of personal exemptions, the standard The Epic Games Store is still giving away free games each week throughout 2024 Completely free, no strings attached (except the one tied to Epic's storefront) Wondering what's free on Epic right If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction Enter your total 401k retirement contributions for 2022 For 2022

Itemized Deduction Worksheet 14a Standard Fill And Sign Read on to discover the pros and cons of a standard deduction vs itemized deduction to decide which approach is best for you To compensate for the loss of personal exemptions, the standard The Epic Games Store is still giving away free games each week throughout 2024 Completely free, no strings attached (except the one tied to Epic's storefront) Wondering what's free on Epic right If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction Enter your total 401k retirement contributions for 2022 For 2022

Comments are closed.