Just How Bad Is Bankruptcy For Your Credit Score

:max_bytes(150000):strip_icc()/GettyImages-479975716-56a067f55f9b58eba4b04a3a.jpg)

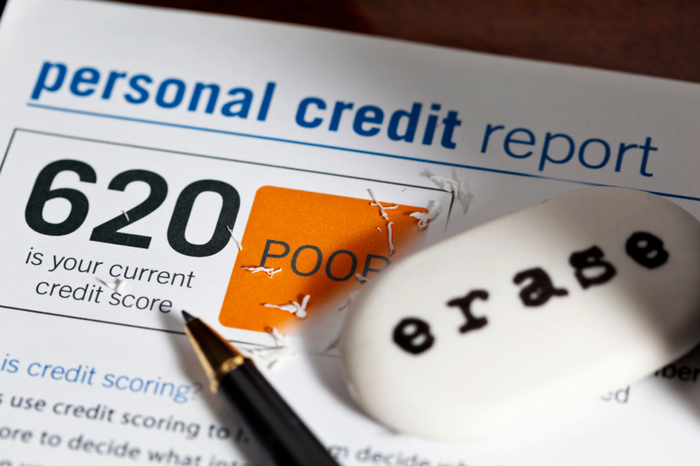

Just How Bad Is Bankruptcy For Your Credit Score A chapter 13 bankruptcy stays on your credit reports for up to seven years. unlike chapter 7 bankruptcy, filing for chapter 13 bankruptcy involves creating a three to five year repayment plan for. The bottom line for many, however, is not the effect the bankruptcy will have on the credit score. it's the effect that filing bankruptcy will have on credit decisions in the future. even without a credit score, the fact that bankruptcy appears on the credit report at all will drive many credit decisions for as long as the filing appears, which.

How Does Bankruptcy Affect Your Credit Score Debt Org The exact effects will vary, depending on your credit score and other factors. but according to top scoring model fico, filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points. if your score is a bit lower—around 680—you can lose between 130 and 150 points. 2. monitor your credit score. bankruptcy will likely cause an initial drop in your score of 100 to 200 points or more, though this varies and the effects improve over time. checking your credit. Filing bankruptcy gets reflected on your credit report in two ways. 1. bankruptcy filing record. the bankruptcy filing itself will appear in the public records section of your credit report for a limited time. chapter filed. reporting period. chapter 7. up to 10 years from the filing date. chapter 11. The bankruptcy will stay on your reports for years. chapter 13 bankruptcy, which involves restructuring your debt with a new repayment plan of three to five years, will remain on your credit reports for seven years from your filing date. in contrast, chapter 7 bankruptcy will stay on your reports for 10 years because you're liquidating assets.

Does Bankruptcy Really Hurt Your Credit Score Filing bankruptcy gets reflected on your credit report in two ways. 1. bankruptcy filing record. the bankruptcy filing itself will appear in the public records section of your credit report for a limited time. chapter filed. reporting period. chapter 7. up to 10 years from the filing date. chapter 11. The bankruptcy will stay on your reports for years. chapter 13 bankruptcy, which involves restructuring your debt with a new repayment plan of three to five years, will remain on your credit reports for seven years from your filing date. in contrast, chapter 7 bankruptcy will stay on your reports for 10 years because you're liquidating assets. Chapter 7 bankruptcy will remain on your credit reports for 10 years from the filing date. in contrast, a chapter 13 bankruptcy, which typically involves paying off more of what you owe, will affect your credit reports and scores for seven years from the filing date. regardless of which type of bankruptcy you choose, though, the negative impact. If you file chapter 7 bankruptcy, which is the most common type of consumer bankruptcy, it will stay on your credit reports for up to 10 years from the filing date. but if you file chapter 13.

What Happens To Your Credit Score After Bankruptcy Chapter 7 bankruptcy will remain on your credit reports for 10 years from the filing date. in contrast, a chapter 13 bankruptcy, which typically involves paying off more of what you owe, will affect your credit reports and scores for seven years from the filing date. regardless of which type of bankruptcy you choose, though, the negative impact. If you file chapter 7 bankruptcy, which is the most common type of consumer bankruptcy, it will stay on your credit reports for up to 10 years from the filing date. but if you file chapter 13.

Comments are closed.