Leveraging Insurance To Ensure Financial Security

Leveraging Life Insurance For Financial Freedom And Legacy With Jim Lifetime annuities offer a reliable income stream for retirees, leveraging mortality credits to provide financial peace of mind and longevity insurance. author: ken nuss. Leveraging insurance to ensure financial security. january 15, 2024. play pause. 00:00 to talk about leveraging insurance solutions to get clients to where they.

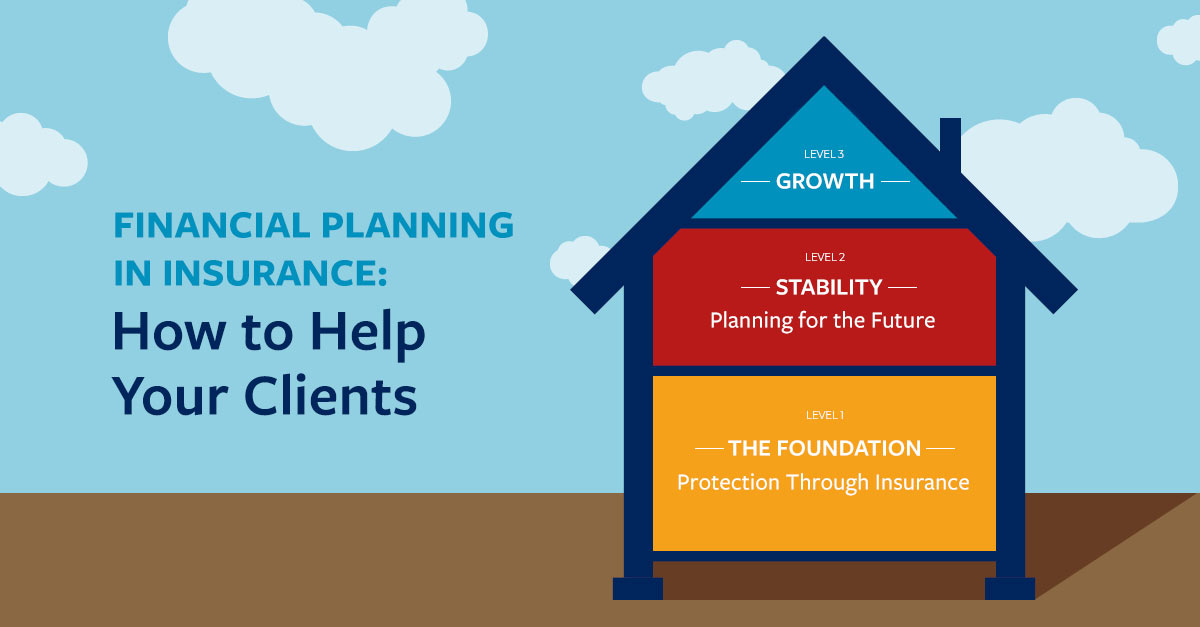

Financial Planning In Insurance How To Help Your Clients 1. life insurance provides financial security to your loved ones. the primary purpose of life insurance is to protect those who matter most to you following your death. while it’s emotional to. Introduction. welcome to our comprehensive guide on how to leverage life insurance. life insurance is a crucial financial tool that provides a safety net for your loved ones in the event of your passing. it offers financial protection and peace of mind, ensuring that your family can maintain their standard of living and cover essential expenses. Retirement planning is a journey filled with complexities and uncertainties, but amidst the myriad of options available, life insurance emerges as a powerful tool for securing financial freedom in retirement. in this article, we'll delve into the transformative role that certain types of life insurance, particularly indexed universal life (iul) policies, can play in retirement planning. by. 9. consider your spouse. if you are married, consider whether your spouse is also saving and whether certain expenses can be shared during your retirement years. if your spouse hasn't been saving.

Your Money Ensuring Financial Security Through Life Insurance Retirement planning is a journey filled with complexities and uncertainties, but amidst the myriad of options available, life insurance emerges as a powerful tool for securing financial freedom in retirement. in this article, we'll delve into the transformative role that certain types of life insurance, particularly indexed universal life (iul) policies, can play in retirement planning. by. 9. consider your spouse. if you are married, consider whether your spouse is also saving and whether certain expenses can be shared during your retirement years. if your spouse hasn't been saving. Accordingly, leveraging life insurance, particularly through a permanent life insurance policy, is a powerful and versatile strategy for financial planning and investing. this approach improves upon traditional investment methods, offering a unique blend of benefits that significantly amplifies overall returns, and allows you options to go at. Using life insurance as an investment provides several financial advantages that you can leverage during your lifetime. here are some of the key benefits: tax benefits : one of the most attractive features of investment life insurance is the tax deferred cash value growth, making it a good option for those considering using life insurance to.

Empowering Clients Life Insurance To Secure Their Futures Accordingly, leveraging life insurance, particularly through a permanent life insurance policy, is a powerful and versatile strategy for financial planning and investing. this approach improves upon traditional investment methods, offering a unique blend of benefits that significantly amplifies overall returns, and allows you options to go at. Using life insurance as an investment provides several financial advantages that you can leverage during your lifetime. here are some of the key benefits: tax benefits : one of the most attractive features of investment life insurance is the tax deferred cash value growth, making it a good option for those considering using life insurance to.

Comments are closed.