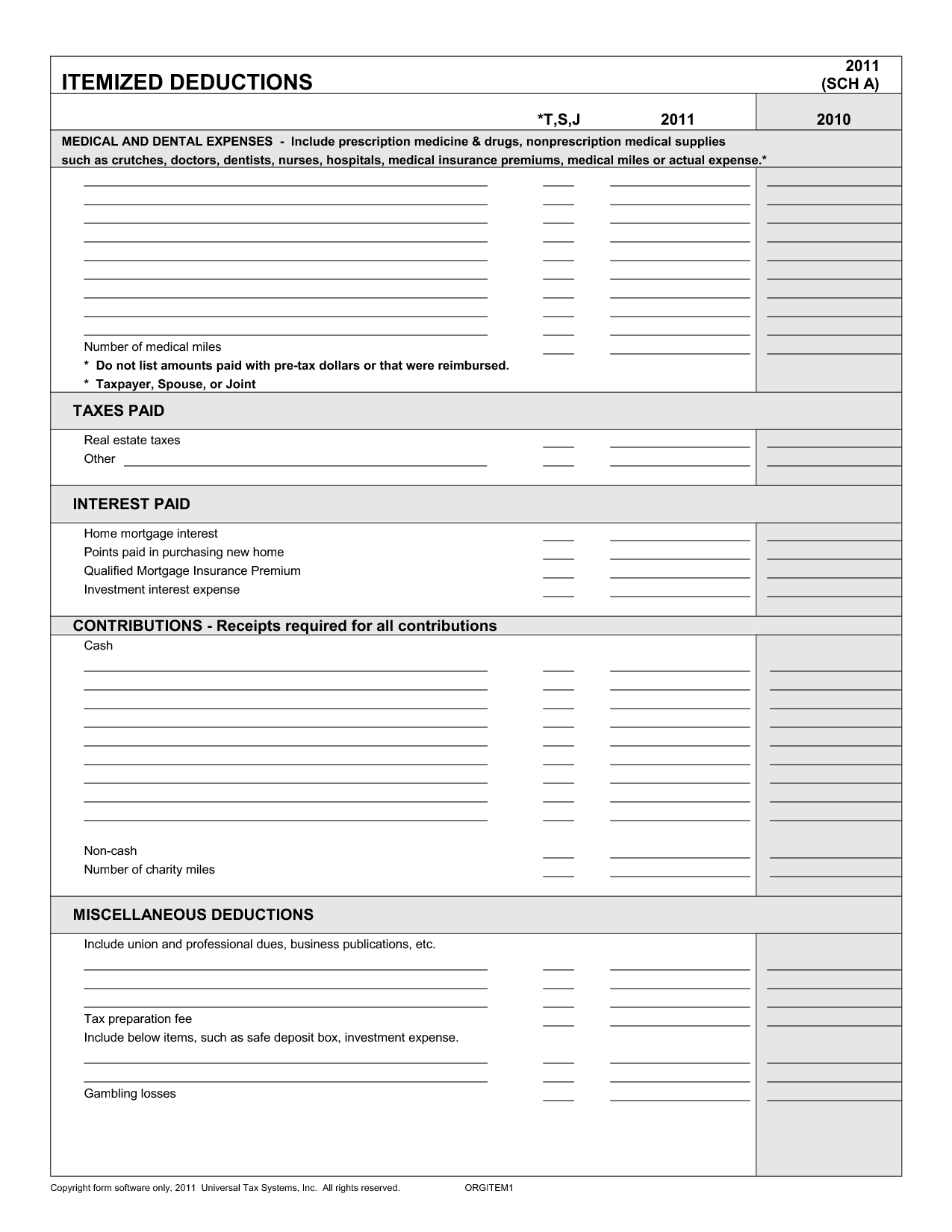

List Of Itemized Deductions Worksheet

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign Consult a CPA or tax professional to ensure you're submitting truthful returns, but taking advantage of itemized deductions can save you thousands of dollars annually Consider this list of more Your home office, car, insurance, retirement savings, and a lot more could get you a tax break Here are the tax write-offs that you may be missing out on as a self-employed individual

List Of Itemized Deductions Worksheet Here is a list of our partners Tax deductions for homeowners can add up to thousands of dollars, but claiming them is worth the trouble only if all your itemized deductions exceed the IRS As you might expect, those with more income are more likely to choose to itemize their deductions, while those earning less favor the standard deduction Taxpayers earning $1 million or more filed 168 Remember that these deductions are not the same as the deductions that you itemize Itemized deductions (and the standard deduction) are dollar amounts that are deducted from your AGI Use Itemized deductions work a bit differently because they “require you to list eligible expenses that you can deduct from your income,” Kovar said Again, itemized deductions can include

List Of Itemized Deductions Worksheets Read more: we researched free tax software and put together a list of the best options here the best thing you can do to optimize your itemized deductions Not every type of tax deduction use the Deductions Worksheet on page 3 and enter the result here" See the W-4 form to complete the worksheet on page 3 This is an amount that the employee has elected to withhold EACH PAYCHECK Nearly 90% of taxpayers claim the standard deduction vs itemized deductions As you prepare to file your next tax return, should you do the same? Claiming the standard deduction is certainly easier The IRS has compiled a long list of deductible items that covers That's because a person's total itemized deductions – which can also include state and local taxes, mortgage interest and

Comments are closed.