Low Interest Rates Have A High Impact On Your Purchasing Power

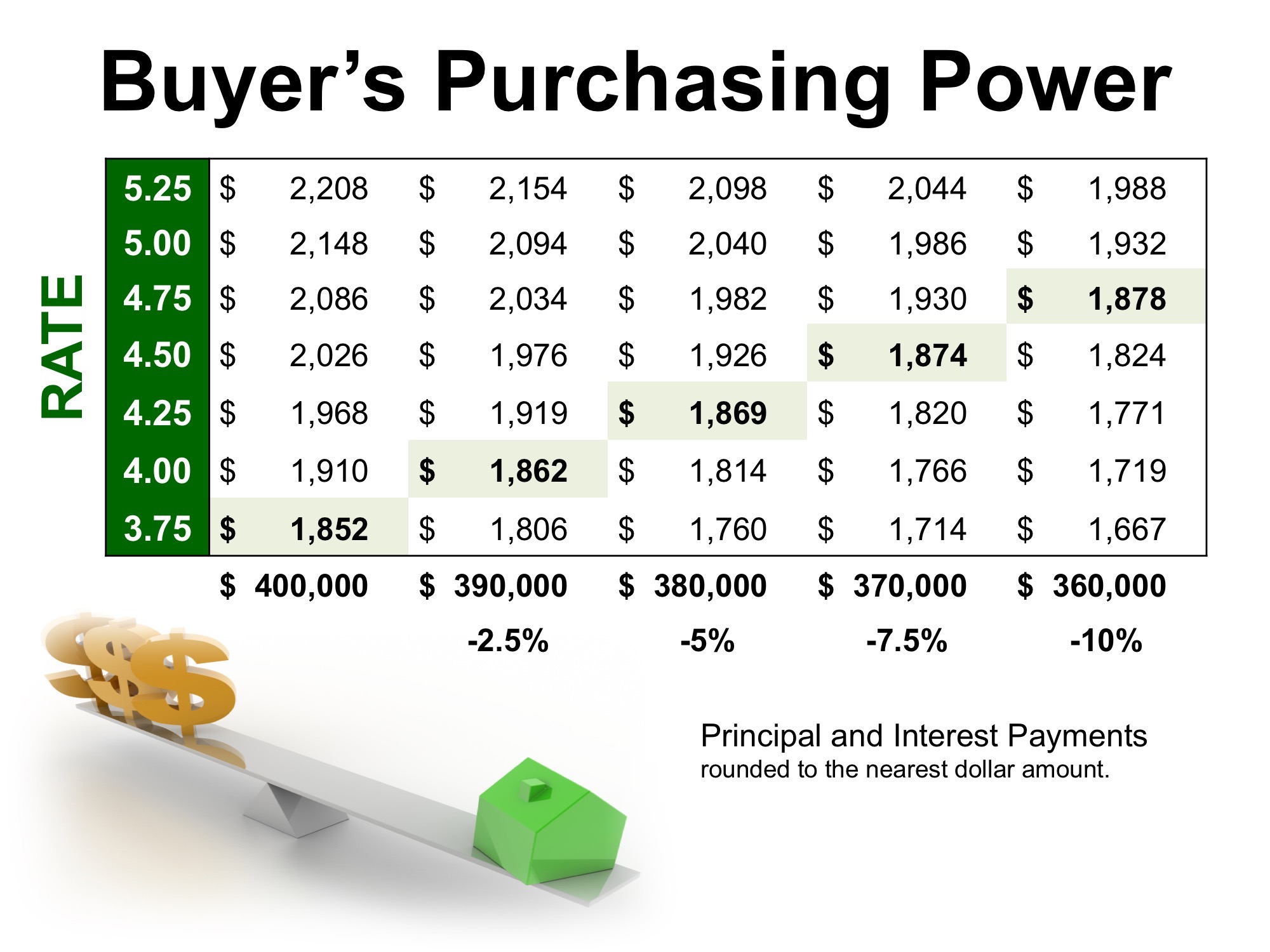

Low Interest Rates Have A High Impact On Your Purchasing Power Increased internal efficiency: High interest environments often pressure business efficiency Buyers may benefit from already optimized operations, which reduce costs and maximize revenues That's because lower interest rates confer more buying power If your Low mortgage rates can be good news for home sellers, too Sellers can often command a higher price when buyers have

The High Impact Of Low Interest Rates On Your Purchasing о The Federal Reserve's expected to cut rates this week, but will it make a difference to Americans? Here's what you need to know about a Fed rate cut NerdWallet writers spell out what a cut in the Federal Funds Rate might mean for mortgages, credit cards, savings accounts and more The Federal Reserve on Wednesday announced it was lowering its benchmark interest rate by 050 percentage points, the first cut since March of 2020 CBS News business analyst Jill Schlesinger explains The Mortgage Bankers Association currently predicts the average 30-year rate to finish out 2024 at 65% and 2025 at 59%, while Fannie Mae forecasts 64% and 59%, respectively While those mortgage

Low Interest Rates Have A High Impact On Your Purchasing Power Steve The Federal Reserve on Wednesday announced it was lowering its benchmark interest rate by 050 percentage points, the first cut since March of 2020 CBS News business analyst Jill Schlesinger explains The Mortgage Bankers Association currently predicts the average 30-year rate to finish out 2024 at 65% and 2025 at 59%, while Fannie Mae forecasts 64% and 59%, respectively While those mortgage They also have a major impact on the total cost of borrowing Higher interest rates will increase your monthly times of high inflation Inflation decreases the purchasing power of the dollar As a result, institutions have been paying considerably higher deposit yields You can still take advantage of high rates by buying CDs penalties can eat up your interest However, if your scores are below 500, you may receive a rate of 20% or higher, if you qualify at all We’ll examine how your credit scores impact have a car loan with a high interest For example, let’s compare three interest rates on a 36-month, $10,000 loan to understand how rates impact the cost of a loan A low that you have a high enough income to repay your loan

Comments are closed.