Market Segmentation Competitive Analysis Of Banking Products

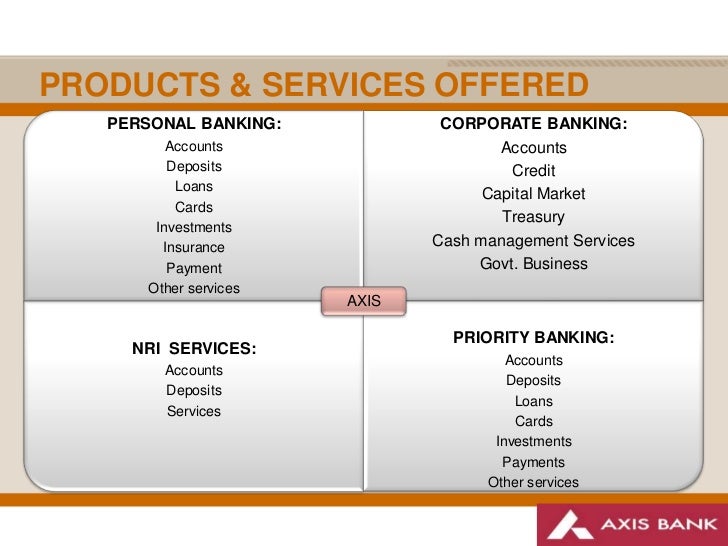

Market Segmentation Competitive Analysis Of Banking Products Marketing and retention strategies: from the initial account opening process through periodic cross sell initiatives, promote the range of available benefits across products and services to establish and maintain a solid relationship. share proof points about your bank’s commitment to service. There are five broad market segments within the banking sector (using this style of market segmentation), most of which could be broken down into two groups, thereby representing 9 potential market segments in total as follows: non customers. customers of other banks. younger consumers. low value customers. limited income financial needs.

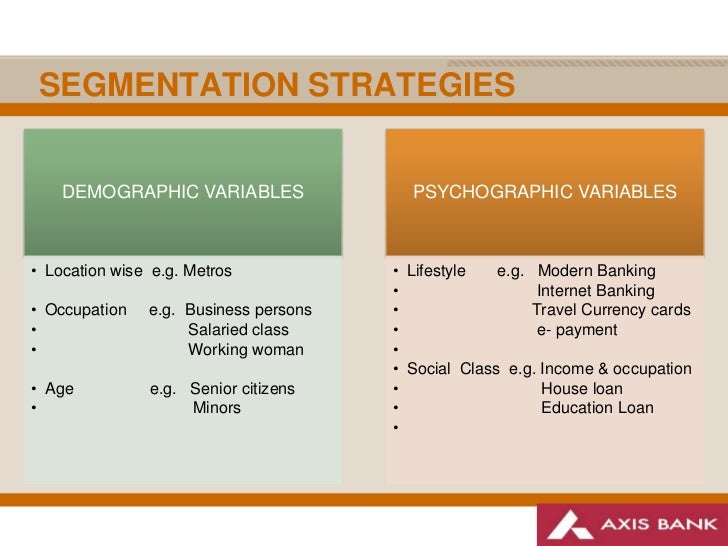

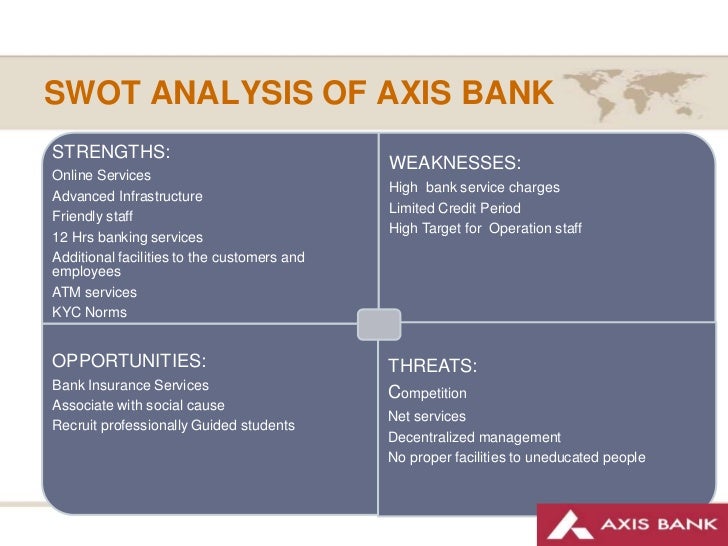

Market Segmentation Competitive Analysis Of Banking Products The adoption of market segmentation strategies in the banking industry offers several benefits for both banks and customers: customized products and services: customer segmentation allows banks to create personalized offerings that meet the specific needs and preferences of each segment. by tailoring products and services, banks can provide. Rfm customer segmentation is a data driven customer classification technique more robust than categorizing by profitability alone. the methodology allows bank marketers and executives to segment customers using a proxy for propensity to convert. in this manner, bankers can have a homogenous data set to take tactical action to achieve strategic. Go to market strategy is essentially the plan and tactics a company uses to bring their products or services to market. in the case of banking, a go to market strategy outlines how a bank will attract and retain customers and make its offerings stand out amongst competitors. it is important to note that a go to market strategy is not a one time. Segmentation is the process of dividing a broad market into distinct consumer groups with everyday needs, preferences, or characteristics.segments can be defined in many ways, such as demographic (age, gender, income), geographic (location, climate), psychographic (lifestyle, values), and behavioral (usage rate, loyalty) factors.

Market Segmentation Competitive Analysis Of Banking Products Go to market strategy is essentially the plan and tactics a company uses to bring their products or services to market. in the case of banking, a go to market strategy outlines how a bank will attract and retain customers and make its offerings stand out amongst competitors. it is important to note that a go to market strategy is not a one time. Segmentation is the process of dividing a broad market into distinct consumer groups with everyday needs, preferences, or characteristics.segments can be defined in many ways, such as demographic (age, gender, income), geographic (location, climate), psychographic (lifestyle, values), and behavioral (usage rate, loyalty) factors. 4. market segmentation: in a perceptual map different market segments can be illustrated based on the desired combinations of product attributes. 5. identification of gaps in the market new product opportunities: a gap in the market is identified when there is no brand with the desired combination of product attributes. Section 1: understanding customer segmentation in banking customer segmentation is a fundamental strategy in the banking industry that involves dividing a customer base into distinct groups based on various shared characteristics. this approach enables financial institutions to tailor their . paper id: sr24522131706.

Market Segmentation Competitive Analysis Of Banking Products 4. market segmentation: in a perceptual map different market segments can be illustrated based on the desired combinations of product attributes. 5. identification of gaps in the market new product opportunities: a gap in the market is identified when there is no brand with the desired combination of product attributes. Section 1: understanding customer segmentation in banking customer segmentation is a fundamental strategy in the banking industry that involves dividing a customer base into distinct groups based on various shared characteristics. this approach enables financial institutions to tailor their . paper id: sr24522131706.

Market Segmentation Competitive Analysis Of Banking Products

Comments are closed.