Max Ira Contribution 2022 Over 50 Choosing Your Gold Ira

Max Ira Contribution 2022 Over 50 Choosing Your Gold Ira The limit on annual contributions for a traditional ira in 2022 was $6,000. in 2023, this will increase to $6,500, an 8% rise reflecting a cost of living increase. did the precious metals ira contribution limit for individuals over age 50 change? if you were 50 years of age or older by december 31, 2022, you would have been able to contribute. The maximum amount you can contribute to a traditional ira for 2022 is $6,000 if you're younger than age 50. workers aged 50 and older can add an extra $1,000 per year as a "catch up" contribution.

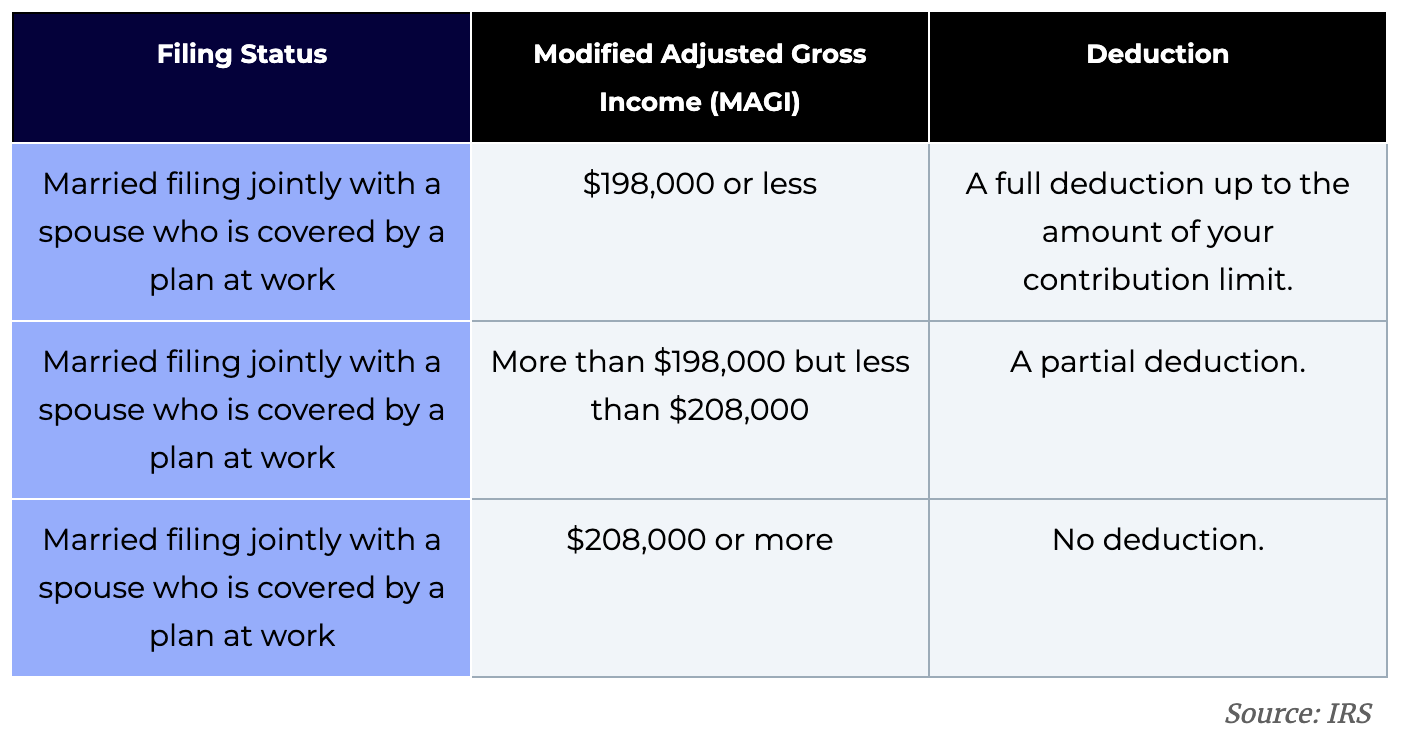

Simple Ira Contribution Limits 2022 Choosing Your Gold Ira For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or. if less, your taxable compensation for the year. the ira contribution limit does not apply to: rollover contributions. qualified reservist repayments. Allows you to invest in select physical gold or other irs approved precious metals. provides tax sheltered gains because gold iras can be set up as traditional or roth iras. requires a custodian to help manage the account. has an annual contribution cap of $6,500 (or $7,500 if you’re over 50). If it’s $228,000 to $240,000, they can make a reduced contribution. if their magi exceeds $240,000, they aren’t eligible to contribute. the maximum roth ira contribution for 2024 is $8,000 if. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income.

Max Roth Ira Contribution 2022 Choosing Your Gold Iraођ If it’s $228,000 to $240,000, they can make a reduced contribution. if their magi exceeds $240,000, they aren’t eligible to contribute. the maximum roth ira contribution for 2024 is $8,000 if. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income. The maximum elective deferral for a one participant 401(k) plan for 2023 is $22,500 ($30,000 for people 50 and over with the catch up contribution). it's $23,000 ($30,500) for 2024. the catch up. There is an aggregate limit on the amount you can contribute to a traditional and roth ira. for 2023, it is $6,500 for those younger than 50, while catch up contributions bring the limit up to.

Self Directed Ira Contribution Limits 2022 Choosing Your Gold ођ The maximum elective deferral for a one participant 401(k) plan for 2023 is $22,500 ($30,000 for people 50 and over with the catch up contribution). it's $23,000 ($30,500) for 2024. the catch up. There is an aggregate limit on the amount you can contribute to a traditional and roth ira. for 2023, it is $6,500 for those younger than 50, while catch up contributions bring the limit up to.

Ira Contribution Deadline 2022 Choosing Your Gold Ira

Comments are closed.