Mgr Accountants Group Reduction Of Company Tax Rates And Imputation

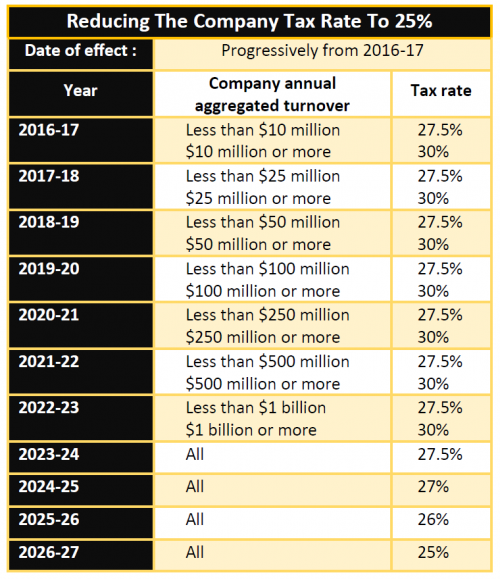

Mgr Accountants Group Reduction Of Company Tax Rates And Imputation Reduction of company tax rates and imputation credits. currently two company tax rates can apply to companies (that are carrying on a business): for the year ended 30 june 2017, companies with turnover of less than $10 million will be subject to company tax at a rate of 27.5% (i.e. company tax will only be 30% if turnover is $10 million or more); and. Reduction of company tax rates & imputation credits; 6 mar '23 fbt 2023 and hybrid workforces with mgr accountants group for business owners, fbt 2023 might.

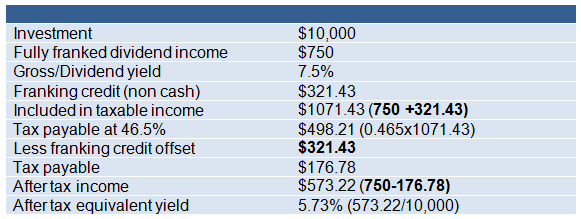

Mgr Accountants Group Reductions In The Corporate Tax Rate Reduction of company tax rates and imputation credits. currently two company tax rates can apply to companies (that are carrying on a business): for the year ending 30 june 2018, companies with turnover of less than $25 million will be subject to company tax at a rate of 27.5% (i.e. company tax will only be 30% if turnover is $25 million or more). As a result of the change in the company tax rate to 30%, the imputation credit that arises under the section has been reduced to 42.86%, consistent with the new maximum imputation credit ratio of 30 70. the reduction to 42.86% increases the potential for double taxation to arise. The flat rate of tax can be attractive to a highly profitable business for example, if the taxable income was $500k the company would pay tax of $137,500 based on a 27.5% tax rate. a sole trader would pay tax of $198,097 on a $500k taxable income. a company is a separate legal entity that can sue and be sued and as such, they can provide. This is $12,960 cash and $2,520 of imputation credits. this dividend is not fully imputed so lossco has to pay extra tax of $1,814. lossco pays its $10,000 interest bill and distributes its remaining $3,946 [2] as a cash dividend with $1,534 of imputation credits attached. this can be shown in a diagram as: 10.

Arbor Cpa 401k Roth Ira Pensions Individual Federal Taxation The flat rate of tax can be attractive to a highly profitable business for example, if the taxable income was $500k the company would pay tax of $137,500 based on a 27.5% tax rate. a sole trader would pay tax of $198,097 on a $500k taxable income. a company is a separate legal entity that can sue and be sued and as such, they can provide. This is $12,960 cash and $2,520 of imputation credits. this dividend is not fully imputed so lossco has to pay extra tax of $1,814. lossco pays its $10,000 interest bill and distributes its remaining $3,946 [2] as a cash dividend with $1,534 of imputation credits attached. this can be shown in a diagram as: 10. The imputation credit regime helped remove double taxation from the nz tax system. fast forward to 2021. as at august 2021 nz has 15% gst on expenditure and company income tax of 28%. nz trust’s pay 33% income tax, and individuals pay income tax at variable (marginal) tax rates based on their level of net taxable income. For the 2016–17 income year, your corporate tax rate for imputation purposes is 27.5% if either of the following apply: your 2015–16 aggregated turnover was less than $10 million, and you are carrying on a business; this is the first year you are in business. otherwise, your corporate tax rate for imputation purposes is 30%.

Dividend Imputation System Franking Credits Explained Calculations The imputation credit regime helped remove double taxation from the nz tax system. fast forward to 2021. as at august 2021 nz has 15% gst on expenditure and company income tax of 28%. nz trust’s pay 33% income tax, and individuals pay income tax at variable (marginal) tax rates based on their level of net taxable income. For the 2016–17 income year, your corporate tax rate for imputation purposes is 27.5% if either of the following apply: your 2015–16 aggregated turnover was less than $10 million, and you are carrying on a business; this is the first year you are in business. otherwise, your corporate tax rate for imputation purposes is 30%.

Staged Reduction Of The Company Tax Rate Taxassist Accountants

Comments are closed.