Michigan Gas Tax Increase History Narcisa Dominguez

Michigan Gas Tax Increase History Narcisa Dominguez Diesel fuel tax established at 5 cents per gallon. d: 1951: pa 54: increased gas tax rate to 4.5 cents per gallon; added chapter 2 (diesel fuel tax) to 150 pa 1927 at 6 cents per gallon; repealed 1947 pa 319. e: 1953: pa 147: added chapter 3 (liquefied petroleum gas tax) to 150 pa 1927 at 4.5 cents per gallon. f: 1967 (es) pa 5. A law signed under former michigan governor rick snyder increased michigan's gas tax from 27.2 cents a gallon to 28.6 cents. the rate increase is either 5% each year or the rate of inflation.

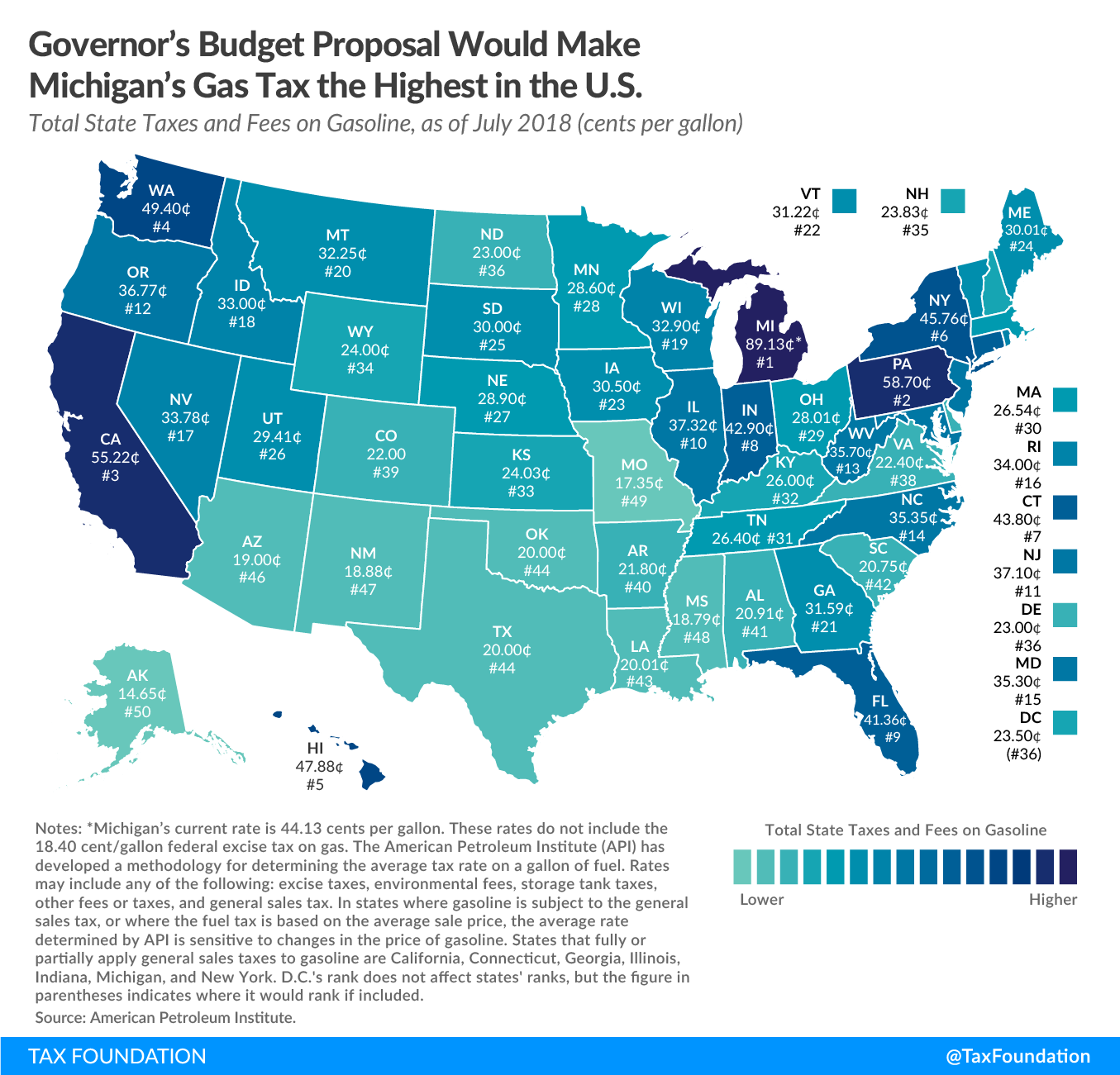

Michigan Governor Gretchen Whitmer Proposes Gas Tax Increase Michigan drivers were taxed 64.1 cents per gallon of gasoline in january 2022, the sixth highest gas tax in the nation. that includes a roughly 1 cent automatic increase to the state gas tax on. As required by 2015 pa 176, the department issues this notice to announce the inflation adjusted tax rates imposed on each gallon (or gallon equivalent) of motor fuel and alternative fuel under the motor fuel tax act ("mfta"), mcl 207.1001 et seq, and the motor carrier fuel tax act ("mcfta"), mcl 207.211 et seq, that will be effective january 1. 0.286 |. 0.300 |. fuel tax rates indexed to cpi beginning in 2022, 5% maximum. electric cars surtaxed. compressed natural gas is taxed at gasoline gallon equivalent rate. half of aviation fuel tax is refunded to air carriers. gasoline values before 1983 are not corrected by 3% allowance for evaporation and loss. The increase will move the state gas tax from 27.2 cents per gallon to 28.6 cents per gallon, according to a notice from the michigan treasury on thursday, dec. 1. when combining state gas and.

Comments are closed.