Mileage Log Excel Template Mileage Logbook Spreadsheet

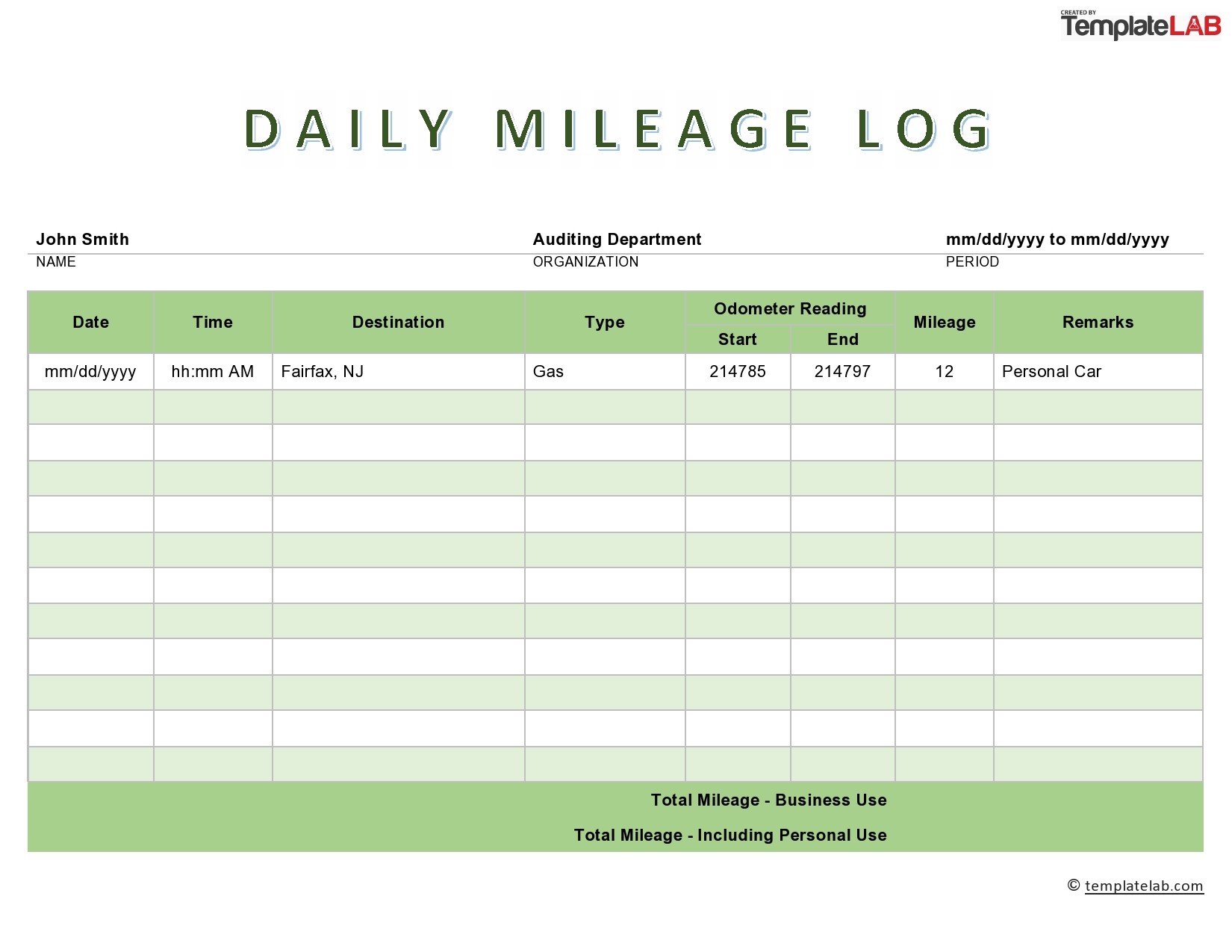

20 Printable Mileage Log Templates Free бђ Templatelab Free mileage log templates. following are free mileage log templates that can be edited as per needs: mileage log (word) 01. mileage log form 02. mileage sheet fillable 03. mileage log form 04. mileage log sheet 05. mileage log template 06. mileage log (word) 07. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. this spreadsheet report can be customized to include whatever details are relevant to your business, including mileage rates. it’s available as an excel, word, or pdf file.

31 Printable Mileage Log Templates Free бђ Templatelab Download the free 2024 mileage log template as a pdf, sheets or excel version and keep track of your trips. free irs printable mileage log form to download. The percentage of mileage on the vehicle for business is then deducted from the costs on your taxes. for example, a vehicle with $6,000 of expenses and 50 percent of total mileage as business would deduct $3,000 from their taxes. it doesn’t matter what type of deduction you’re taking at the end of the year. By addressing these common issues proactively, you can overcome potential hurdles in mileage tracking and maintain compliance with irs regulations. in conclusion, a mileage log template can simplify your record keeping. it can also ensure irs compliance. our free 2024 mileage log template provides a simple tool. The mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. for 2023, that’s $0.655. for 2024, it'll be $0.67. this rate is adjusted for inflation each year. it’s designed to reflect the average costs of car related expenses, such as:.

Comments are closed.