Monetary Policy Update January 2022 Transitory Vs Permanent Inflation

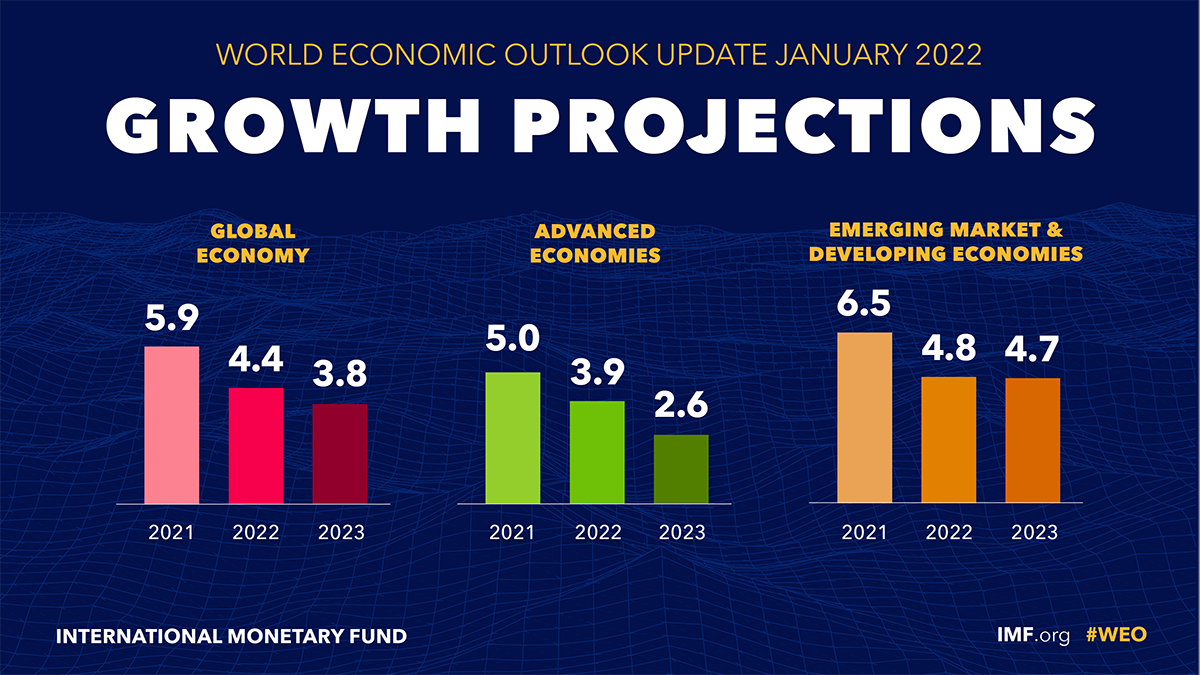

World Economic Outlook Update January 2022 Rising Caseloads A How much persistent versus transitory forces contribute to inflation influences the federal reserve’s ability to achieve its goal of 2% average inflation over time. if elevated inflation is driven mainly by persistent shocks, then a stronger and longer lasting policy response is likely to be needed to bring inflation back down. recent data show that consecutive changes in monthly inflation. This video discusses the fed's monetary policy actions at their november and december 2021 fomc meetings. the rest of the video analyzes recent data to exami.

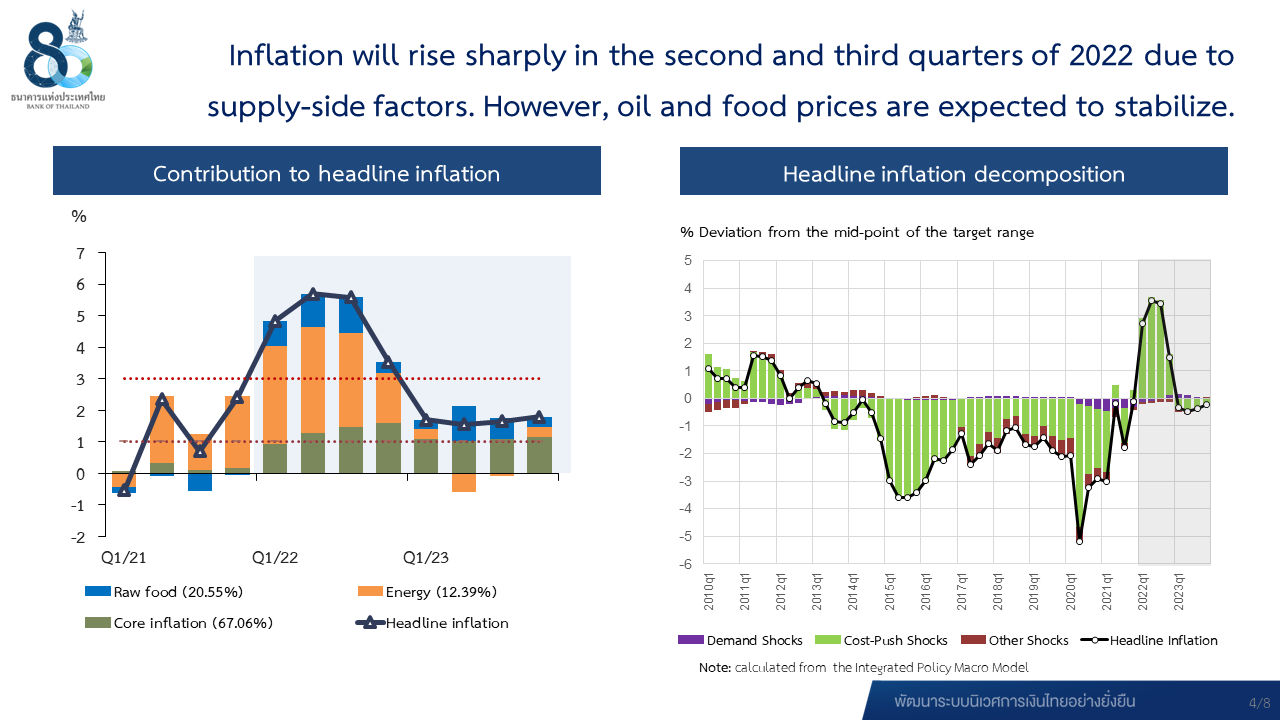

The Case For Transitory Inflation The federal reserve is in the early stages of tightening monetary policy to fight inflation. most fed watchers expect 50 basis point interest rate hikes in june and july and more after that. This approach to inflation therefore downplays the role played by demand, and rejects specifically the phillips curve, on which monetary policy is based. without the phillips curve, there is no. The transitory versus permanent inflation debate has suffered from vague definitions. with price growth in the us and europe now tumbling, those on “team transitory” are somewhat smug. but of. In the summer of 2021, believing inflation to be transitory, the fed projected that interest rates would not need to rise until 2023, and even then to only 0.5 0.75%—a path that would have been.

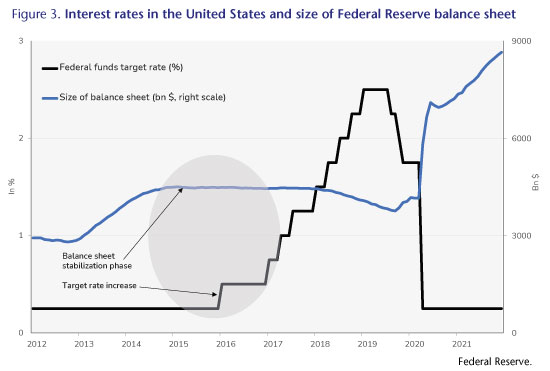

What Direction For Monetary Policy In 2022 Le Blog The transitory versus permanent inflation debate has suffered from vague definitions. with price growth in the us and europe now tumbling, those on “team transitory” are somewhat smug. but of. In the summer of 2021, believing inflation to be transitory, the fed projected that interest rates would not need to rise until 2023, and even then to only 0.5 0.75%—a path that would have been. The committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the committee's goals. the committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation. The federal reserve conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long term interest rates in the u.s. economy. this section reviews u.s. monetary policy and economic developments in 2022, with excerpts and select figures from the monetary policy report published in march 2023 and june 2022. 1.

юааmonetaryюаб юааpolicyюаб Committeeтащs Decision 2 юаа2022юаб The committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the committee's goals. the committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation. The federal reserve conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long term interest rates in the u.s. economy. this section reviews u.s. monetary policy and economic developments in 2022, with excerpts and select figures from the monetary policy report published in march 2023 and june 2022. 1.

Comments are closed.