Money Market Account Vs Savings Account Vs Cd Which Is Rig

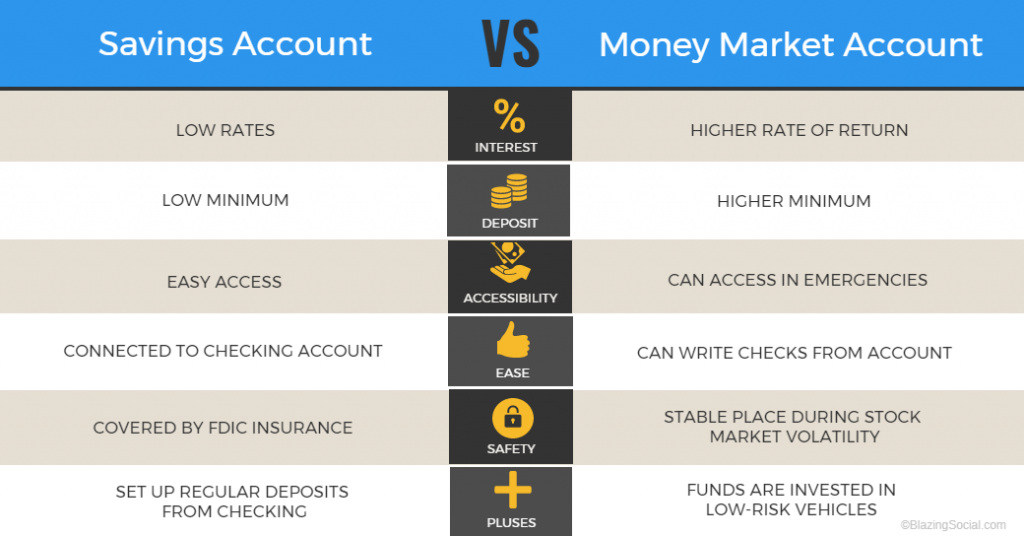

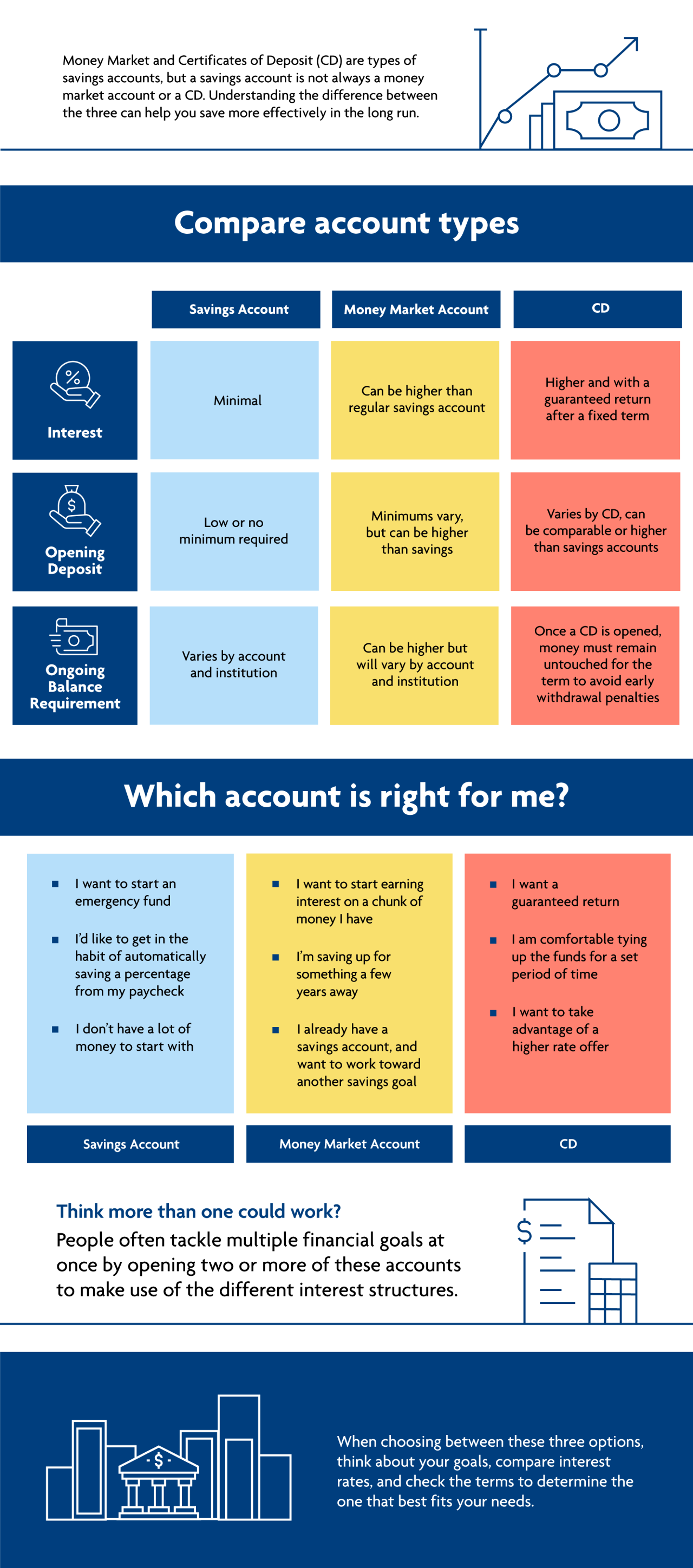

Money Market Vs Savings Account Which One Should You Pick As of november 2023, the national average savings account rate was 0.46%, according to data from the fdic. so if you were to deposit $1,000 into a savings account at that rate and leave it there. Cd accounts. best for when you want to lock in an apy and don’t need your money quickly. short for certificate of deposit, cds tend to offer higher apy’s compared to high yield savings.

Money Market Account Vs Savings Account Vs Cd Which Opening a money market account is something you can do online or in person at a branch. there may be a minimum deposit required to open a money market savings account, which can be as low as $1 or. Money market accounts, savings accounts, and certificates of deposit (cds) can give your savings a boost by earning interest, all while keeping your money safe. understanding how these interest. Mainly, money market accounts offer a level of liquidity that cds don’t. in an mma, your money is accessible, while in a cd your cash isn’t accessible until the term account matures. another. Cds generally offer higher interest rates compared with money market accounts. money market accounts provide access to funds and offer interest rates similar to regular savings accounts. cds earn.

Comments are closed.