Navigate The Pre Approval Process

How To Navigate The Mortgage Pre Approval Process What Documents You 3 steps to get a mortgage preapproval. here are three steps to follow to get preapproved for a home loan. 1. get a mortgage preapproval letter. if you’re ready to begin house hunting, your first. How to get preapproved for a mortgage in 5 steps. obtaining mortgage preapproval can be a complex process with a lot of interdependencies. the following section will simplify the mortgage preapproval process into five crucial steps, providing you with a clear and actionable guide on how to navigate the complexities of securing preapproval for your mortgage.

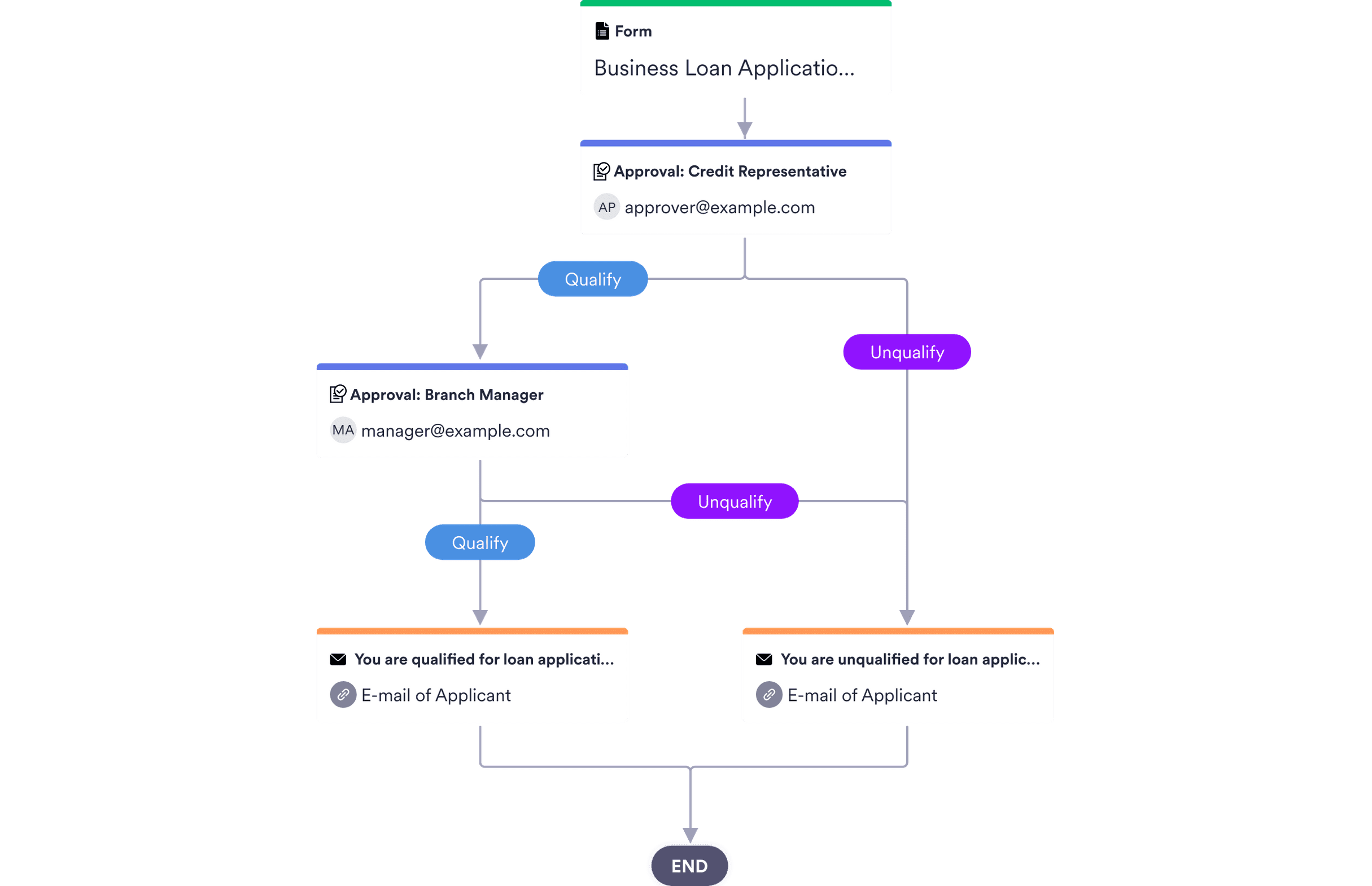

Business Loan Pre Approval Process Template Jotform We’ll also recommend types of home loans, down payments, monthly payments and mortgage rates. 3. get your approval letter. once you’ve chosen your mortgage option, you can see if you’re approved for it. from there, we’ll give you a prequalified approval letter that you can use to shop for homes. Step by step mortgage pre approval process. getting pre qualified and pre approved for a mortgage loan lays the groundwork for turning your homeownership dreams into reality. here is a step by step overview of the process so you know what to expect. step 1: understanding your credit score and financial health. A mortgage pre approval is documentation that shows you’re a good candidate for receiving a home loan. to get pre approved, you’ll complete an application and the lender will review your financial information, which includes pulling your credit. once pre approved, you’ll receive a pre approval letter with an estimate of how much money you. By understanding these top considerations and tips, you can navigate the home loan pre approval process with greater confidence and success. remember, pre approval is a crucial step in the home buying journey that can help you stand out in a competitive market, secure your dream home, and achieve your long term homeownership goals.

Navigate The Pre Approval Process A mortgage pre approval is documentation that shows you’re a good candidate for receiving a home loan. to get pre approved, you’ll complete an application and the lender will review your financial information, which includes pulling your credit. once pre approved, you’ll receive a pre approval letter with an estimate of how much money you. By understanding these top considerations and tips, you can navigate the home loan pre approval process with greater confidence and success. remember, pre approval is a crucial step in the home buying journey that can help you stand out in a competitive market, secure your dream home, and achieve your long term homeownership goals. Navigating the mortgage loan process can be daunting, but breaking it down into manageable steps can help. this guide will walk you through each phase of the mortgage loan process, from pre approval to post closing, with examples to illustrate key points. 5. get your pre approval letter. if you meet the lender's criteria, you will receive a pre approval letter. this letter outlines the loan amount you're approved for, along with other relevant details such as the loan term, interest rate, and any conditions or contingencies that need to be met.

Mortgage Preapprovals Navigating the mortgage loan process can be daunting, but breaking it down into manageable steps can help. this guide will walk you through each phase of the mortgage loan process, from pre approval to post closing, with examples to illustrate key points. 5. get your pre approval letter. if you meet the lender's criteria, you will receive a pre approval letter. this letter outlines the loan amount you're approved for, along with other relevant details such as the loan term, interest rate, and any conditions or contingencies that need to be met.

Your Guide To First Time Homebuyer Preapproval What To Expect And How

Comments are closed.