Net Present Value Formula Derivation Examples

Net Present Value Formula Derivation Examples Net present value (npv) determines the total current value of all cash flows generated, including the initial capital investment, by a project. understand the net present value formula with its derivations, examples, and faqs. The npv formula can be very useful for financial analysis and financial modeling when determining the value of an investment (a company, a project, a cost saving initiative, etc.). below is an illustration of the npv formula for a single cash flow. present value = cash flow (1 i) n. where: i = discount rate; n = period number.

Net Present Value Formula And Example Toolshero What is the pv (present value)? the present value (or pv) in this context refers to the value of all the money we expect to earn in the future, expressed in today’s terms. in other words, the pv tells us how much that future cash flow is worth to us right here, right now (i.e. the present value). put differently, it’s telling us the future. Net present value (npv) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. in the example above, the formula entered into. Net present value (npv) reflects a company’s estimate of the possible profit (or loss) from an investment in a project. companies must weigh the benefits of adding projects versus the benefits of holding onto capital. investors often use npv to calculate the pros and cons of investments. for example, you may wish to invest $100,000 in a bond. Net present value example for a simple net present value example, let's say someone buys 1000 shares of stock at $10, for a cost of $10,000. the stock pays a 50c dividend annually, or a $500 total.

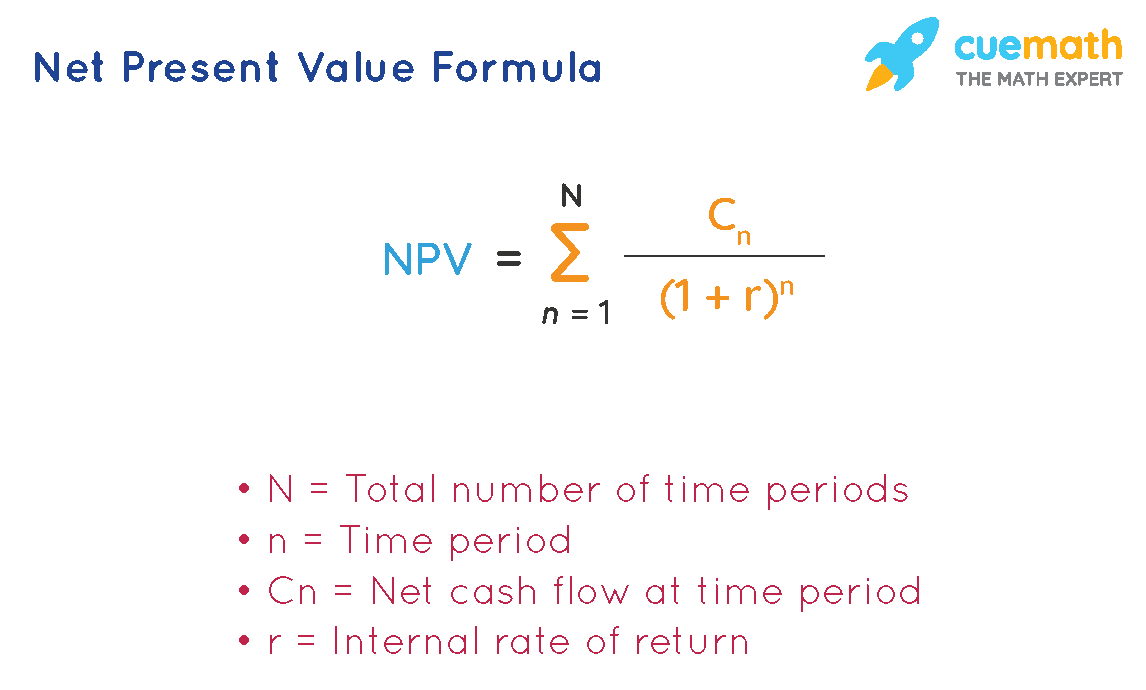

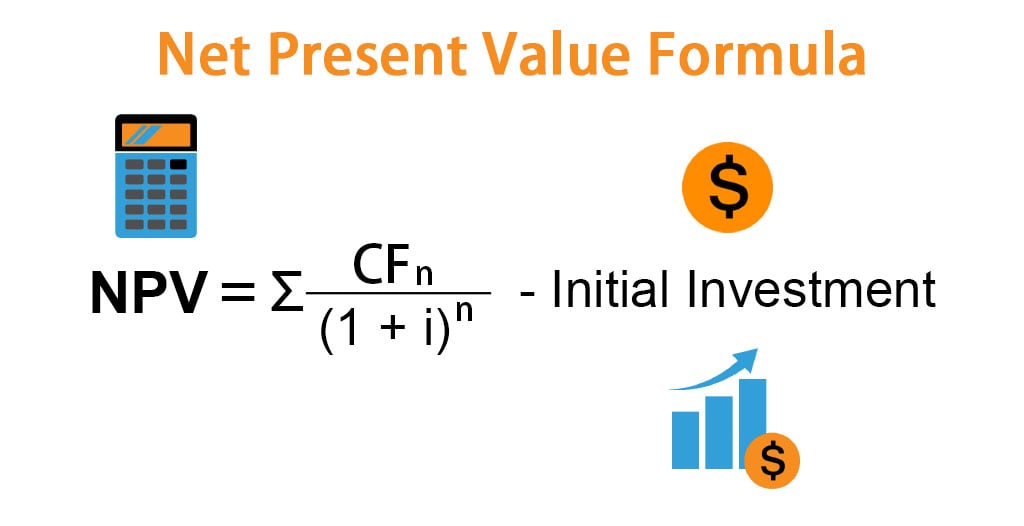

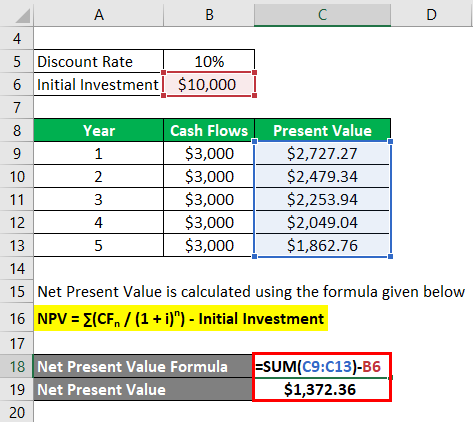

Net Present Value Formula Examples With Excel Template Net present value (npv) reflects a company’s estimate of the possible profit (or loss) from an investment in a project. companies must weigh the benefits of adding projects versus the benefits of holding onto capital. investors often use npv to calculate the pros and cons of investments. for example, you may wish to invest $100,000 in a bond. Net present value example for a simple net present value example, let's say someone buys 1000 shares of stock at $10, for a cost of $10,000. the stock pays a 50c dividend annually, or a $500 total. Definition: net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows of a project or potential investment. in other words, it’s used to evaluate the amount of money that an investment will generate compared with the cost adjusted for the time value of money. Npv formula. in practice, the xnpv excel function is used to calculate the net present value (npv). =xnpv (rate, values, dates) where: rate → the appropriate discount rate based on the riskiness and potential returns of the cash flows. values → the array of cash flows, with all cash outflows and inflows accounted for.

Net Present Value Formula Examples With Excel Template Definition: net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows of a project or potential investment. in other words, it’s used to evaluate the amount of money that an investment will generate compared with the cost adjusted for the time value of money. Npv formula. in practice, the xnpv excel function is used to calculate the net present value (npv). =xnpv (rate, values, dates) where: rate → the appropriate discount rate based on the riskiness and potential returns of the cash flows. values → the array of cash flows, with all cash outflows and inflows accounted for.

Net Present Value Formula With Calculator

Comments are closed.