Net Present Value Npv

Net Present Value Npv Definition And How To Use It In Investing Net present value (npv) is used to calculate the current value of a future stream of payments from a company, project, or investment. to calculate npv, you need to estimate the timing. Learn how to calculate the net present value (npv) of an investment, project, or business using a formula, excel functions, and examples. npv is the value of all future cash flows discounted to the present and used for intrinsic valuation.

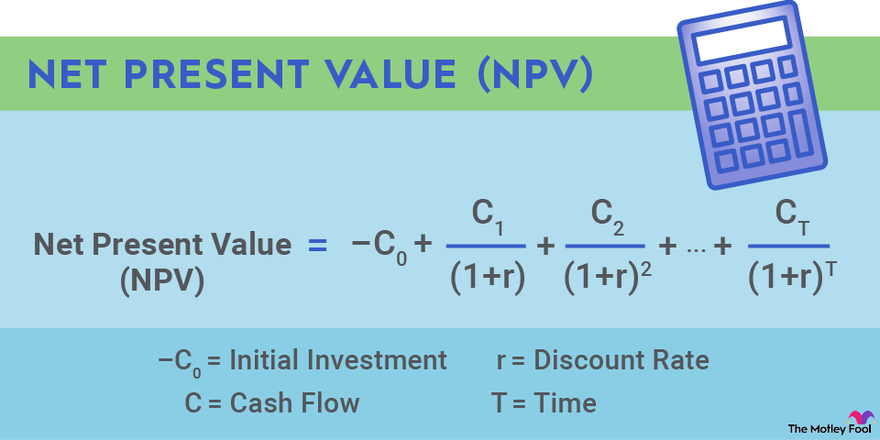

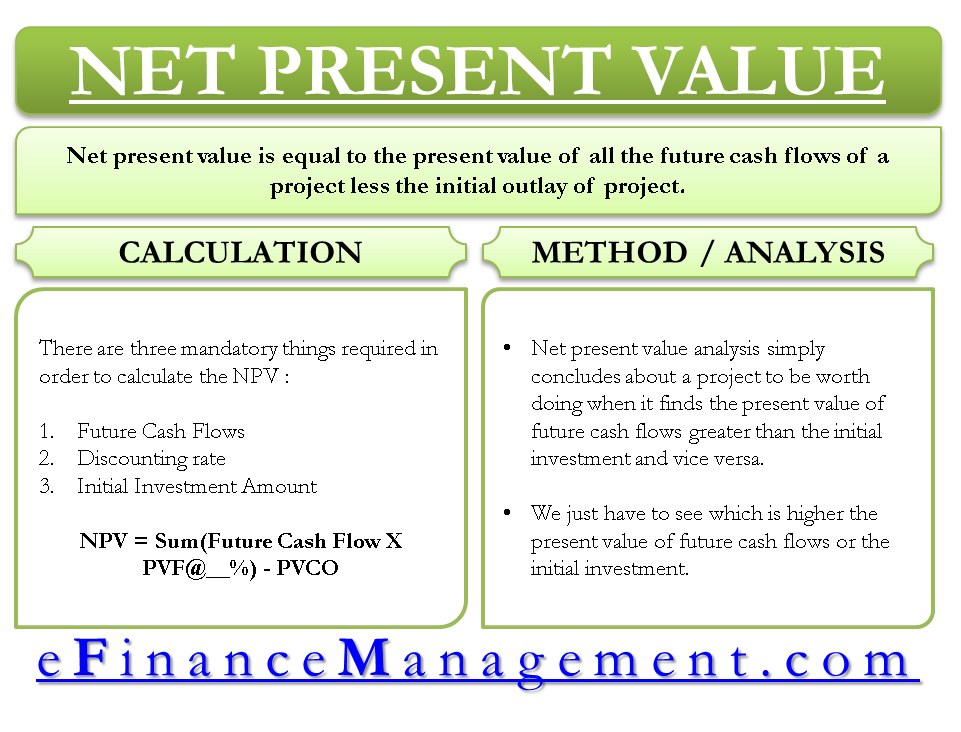

Net Present Value Npv Meaning Formula Calculate Example Analysis The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. in practice, npv is widely used to determine the perceived profitability of a potential investment or project to help guide critical capital budgeting and allocation decisions. how to calculate net present value (npv). Learn how to use npv to determine the value of an investment by calculating the difference between the present value of cash inflows and outflows. find out the advantages, limitations, and alternative methods of npv for financial decision making. By definition, net present value is the difference between the present value of cash inflows and the present value of cash outflows for a given project. to understand this definition, you first need to know what is the present value. imagine that you want to have $2200 in your account next year. Learn how to calculate npv, a capital budgeting formula that compares the present value of cash inflows and outflows of an investment. see how npv is used to evaluate investment decisions and compare different options.

Comments are closed.