Nhs Pension Increase 2023 2024

Nhs Pension Increase 2023 2024 Nhs pension payments received in the 2023 24 tax year and the tax deducted from all taxable payments. in previous employment – hmrc lets us know of any pay you have earned, and tax paid in previous employment in the 2023 24 tax year. final tax code – this is the code that was used for your final nhs pension payment in the 2023 24 tax year. Public service pensions which have been in payment for a year will be increased by 10.1% from 10 april 2023 in line with the september to september increase in the consumer price index (cpi). any.

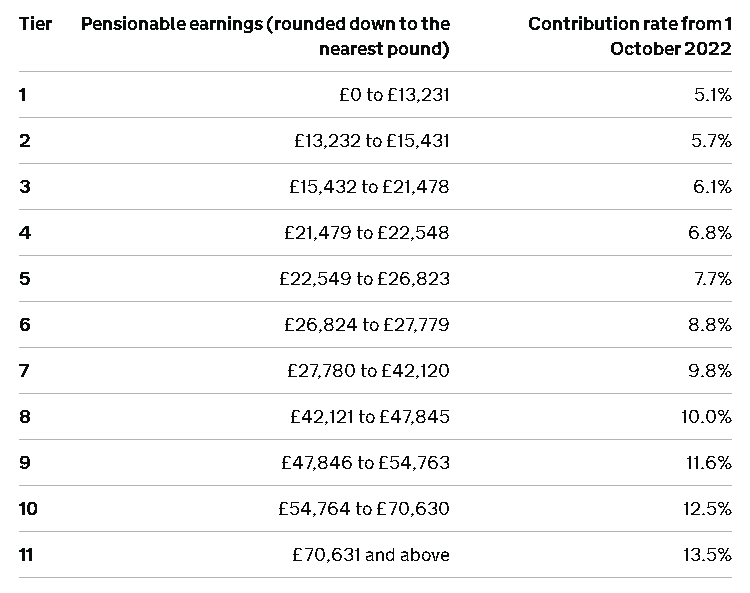

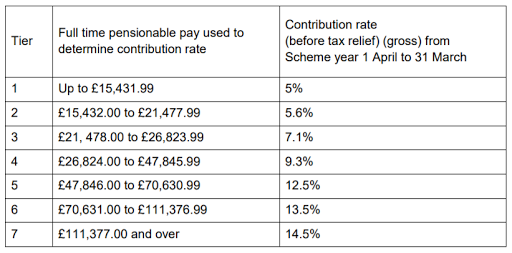

Nhs Pension Increase 2023 2024 Learn about the changes to the member contribution structure and the employer contribution rate from april 2024, as confirmed by the department of health and social care. find out how the changes affect your pensionable earnings, partial retirement eligibility and salary sacrifice arrangements. Your nhs pension is paid into your nominated bank account in equal amounts on the same day each month. your payment date is on your award letter. pensions increase. nhs pensions are subject to an annual increase which is based upon the consumer price index (cpi) as laid down by hm treasury every year. the increase for 2023 24 will be 6.7%. Nhs pension – this is the gross amount of your nhs pension payments received in the 2022 23 tax year and the tax deducted from all taxable payments. in previous employment – hmrc lets us know of any pay you have earned, and tax paid in previous employment in the 2022 23 tax year. final tax code – this is the code that was used for your. An increase to your pension is payable if you’re over age 55 or are receiving: injury benefits. the annual increase is based on the consumer price index (cpi). this is set by hm treasury every year. visit the gov.uk website for information on the yearly increases. pension increases will be applied on the first monday on or after 6 april each.

Nhs Pension Increase 2023 2024 Nhs pension – this is the gross amount of your nhs pension payments received in the 2022 23 tax year and the tax deducted from all taxable payments. in previous employment – hmrc lets us know of any pay you have earned, and tax paid in previous employment in the 2022 23 tax year. final tax code – this is the code that was used for your. An increase to your pension is payable if you’re over age 55 or are receiving: injury benefits. the annual increase is based on the consumer price index (cpi). this is set by hm treasury every year. visit the gov.uk website for information on the yearly increases. pension increases will be applied on the first monday on or after 6 april each. The consultation outlines the proposed changes to the member contribution structure for the nhs pension scheme, linked to the agenda for change pay award in england. the new structure increases most thresholds by 5%, with backdated effect from 1 april 2023. 2 february 2024. updated with: public service pensions increase: 2024. 9 march 2023. public service pensions increase: 2023 added. 20 january 2022. public service pensions increase: 2022 added. 12.

Nhs Pension Increase 2023 2024 The consultation outlines the proposed changes to the member contribution structure for the nhs pension scheme, linked to the agenda for change pay award in england. the new structure increases most thresholds by 5%, with backdated effect from 1 april 2023. 2 february 2024. updated with: public service pensions increase: 2024. 9 march 2023. public service pensions increase: 2023 added. 20 january 2022. public service pensions increase: 2022 added. 12.

Nhs Pension Contribution Rates 2023 2024

Comments are closed.