Non Us Employees And Equity Compensation Taxation Eqvista

Non Us Employees And Equity Compensation Taxation Eqvista Equity compensation taxation and non us employees equity compensation enables cash strapped businesses to get highly qualified people to join their staff and board of directors. with increasing globalization, migration to more developed countries, particularly the u.s., has increased tremendously in the past few decades (although the pandemic. Equity compensation is a kind of non monetary remuneration that may be offered to employees. wages and salaries are common forms of compensation for work. however, if you choose this approach, you might potentially get equity remuneration in the form of a stake in the company. this equity is often linked to the stock price of the firm.

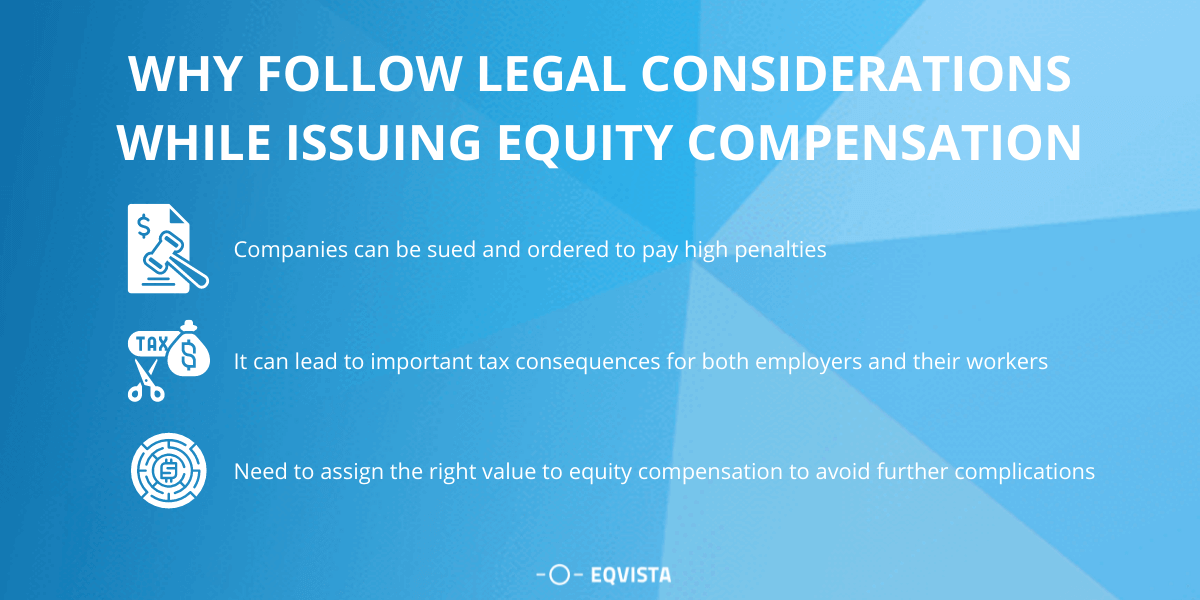

Taxation Of Equity Compensation For Employees Eqvista Tax compliance: non us companies must comply with 409a regulations when providing equity compensation to employees in the us. failure to do so might result in immediate taxation on deferred salary, interest, and extra employee taxes. consequently, a valuation is an initial measure to guarantee that stock options or other equity based. Keep an eye out for extra tax forms. once you start receiving equity based compensation, your taxes may get a bit more complicated. if you sell any equity compensation throughout the year, you’ll likely receive a form 1099 b. you will also need to complete form 8949 and schedule d (form 1040) to report capital gain and loss transactions. Stock based 115 97 stock based laws. the most common forms of stock based compensation are restricted stock awards (rsas), restricted stock units (rsus), nonqualified stock options (nqsos), and incentive stock options (isos). each type is treated differently for tax purposes, and each has its advantages and disadvantages. Questions to consider before granting equity to non employees. 1. does the plan allow for making grants to service providers who are not employees of the company? while this is more of a u.s. plan issue, first confirm whether the equity plan allows the company to grant equity to service providers. if not, then the company may need to restate.

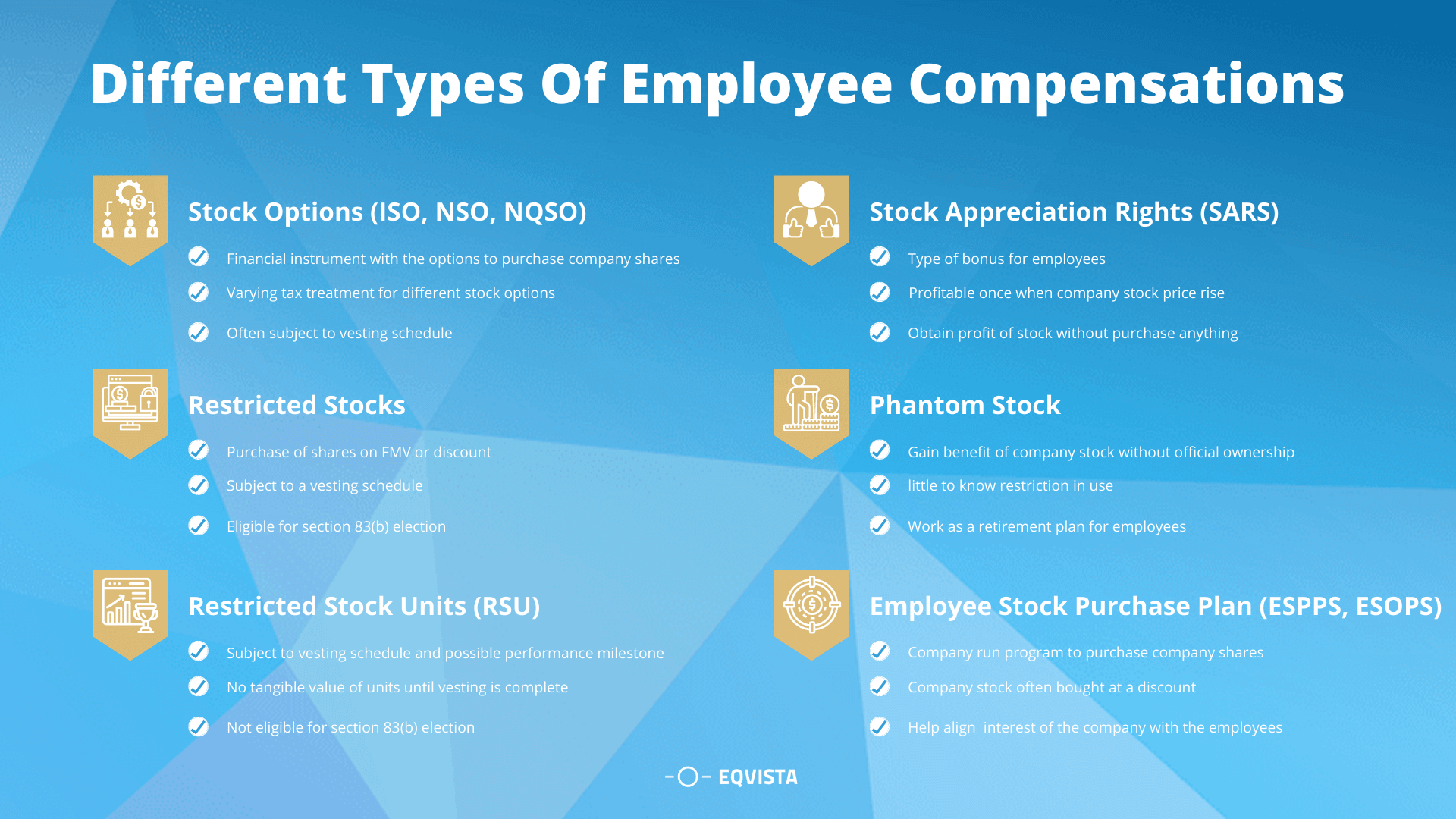

Different Types Of Employee Compensation Eqvista Stock based 115 97 stock based laws. the most common forms of stock based compensation are restricted stock awards (rsas), restricted stock units (rsus), nonqualified stock options (nqsos), and incentive stock options (isos). each type is treated differently for tax purposes, and each has its advantages and disadvantages. Questions to consider before granting equity to non employees. 1. does the plan allow for making grants to service providers who are not employees of the company? while this is more of a u.s. plan issue, first confirm whether the equity plan allows the company to grant equity to service providers. if not, then the company may need to restate. Equity compensation is supplemental wages for income tax withholding purposes so employers may choose to use flat rates for federal income tax (if the equity compensation is separately identifiable from regular wages that have tax withholding) or the aggregate method of withholding (refer to reg. sec. 31.3402 (g) 1. Qualified equity grants. the law known as the tax cuts and jobs act, p.l. 115 97, made a notable change to taxation of stock options and rsus. the tcja created an election that permits qualified employees to defer income taxation for up to five years from the vesting date (sec. 83(i)). the corporation must have a written plan providing stock.

Types Of Employee Equity Compensation Plans Eqvista Equity compensation is supplemental wages for income tax withholding purposes so employers may choose to use flat rates for federal income tax (if the equity compensation is separately identifiable from regular wages that have tax withholding) or the aggregate method of withholding (refer to reg. sec. 31.3402 (g) 1. Qualified equity grants. the law known as the tax cuts and jobs act, p.l. 115 97, made a notable change to taxation of stock options and rsus. the tcja created an election that permits qualified employees to defer income taxation for up to five years from the vesting date (sec. 83(i)). the corporation must have a written plan providing stock.

Legal Requirements For Equity Compensation Eqvista

Comments are closed.