Old Vs New Tax Regime Calculator Ay 2024 25 Olva Tommie

Old Vs New Tax Regime Calculator Ay 2024 25 Olva Tommie Following are the steps to use the tax calculator: 1. choose the financial year for which you want your taxes to be calculated. 2. select your age accordingly. tax liability in india differs based on the age groups. 3. click on 'go to next step'. 4. New tax regime. the following deductions are available under the new tax regime 2024: section 24(b) allows for a deduction on interest paid on a home loan for a rented out property. employer contribution to nps under 80ccd (1b) is available upto 14% of salary. similarly, ppf and sukanya samriddhi yojana maturity proceeds and interest remain tax.

Old Vs New Tax Regime Calculator Ay 2024 25 Olva Tommie This service also provides a calculation of tax under the old or new tax regime with a comparison of tax as per the old and new regime. prerequisites to avail this service • access to the e filing portal step by step guide. step 1: go to the e filing portal homepage. step 2: select quick links > income and tax calculator. (select the quick. Free excel income tax calculator for fy 24 25 (ay 25 26) with 2 case studies. on 22nd july 2024, fm introduced new income tax slab for individuals for fy 2024 25. below, all the details have been given and compared with old income tax regime as well. there are currently 2 income tax regimes for fy 24 25 (ay 25 26) in india. the old tax regime. This income tax calculator aims to simplify the comparison between the new and old income tax regimes for fy 2024 25 ay 2025 26. by breaking down key components and providing an easy to use calculator, employees can make informed decisions regarding their tax planning. income from salary is the sum of basic salary hra special allowance. Follow the below steps to compute the income tax and make a comparative analysis under both the tax regime: free download the old vs new tax regime calculator in excel on your device. provide all the details in cells marked in yellow color. the final tax payable will be calculated based on the details provided.

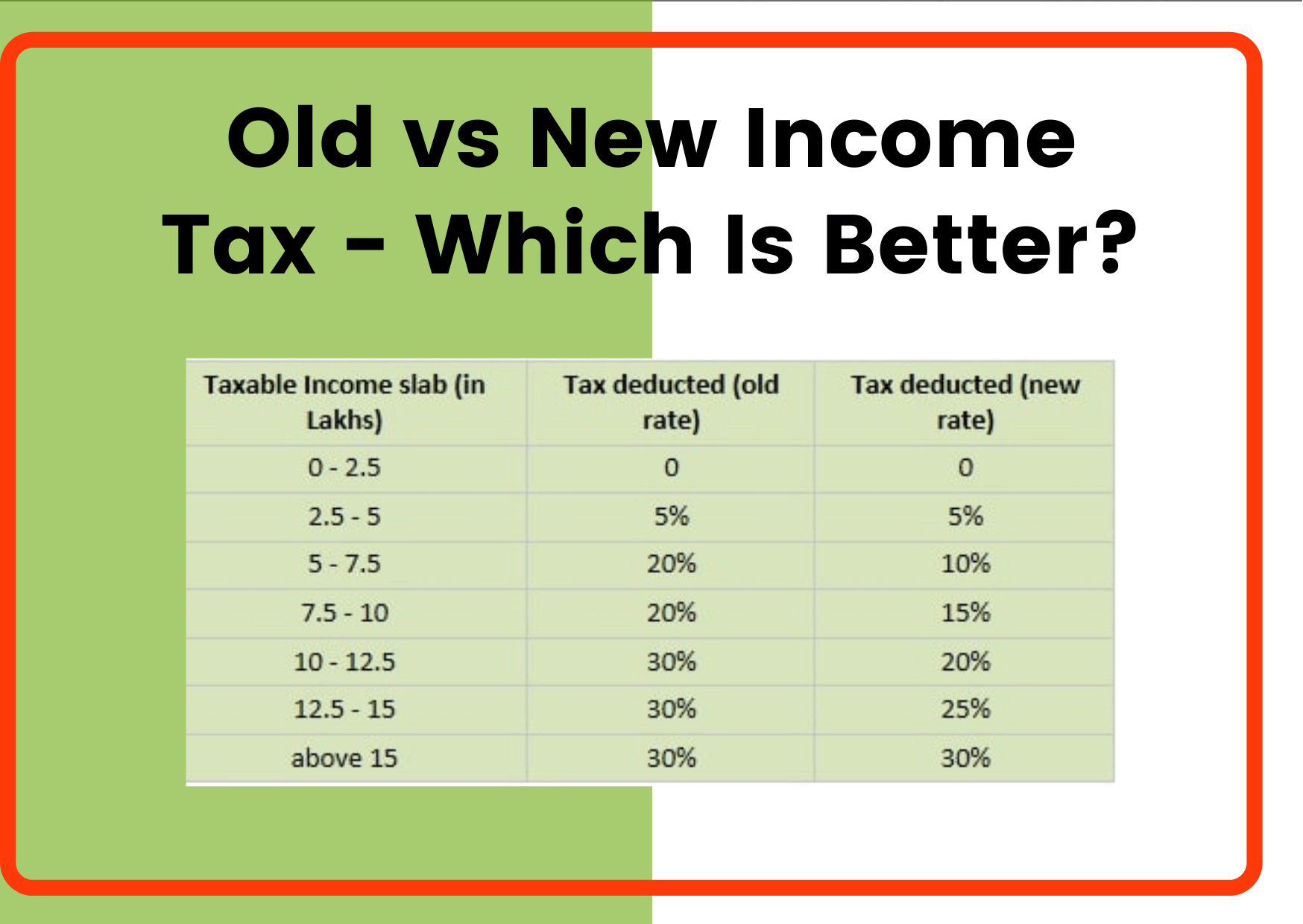

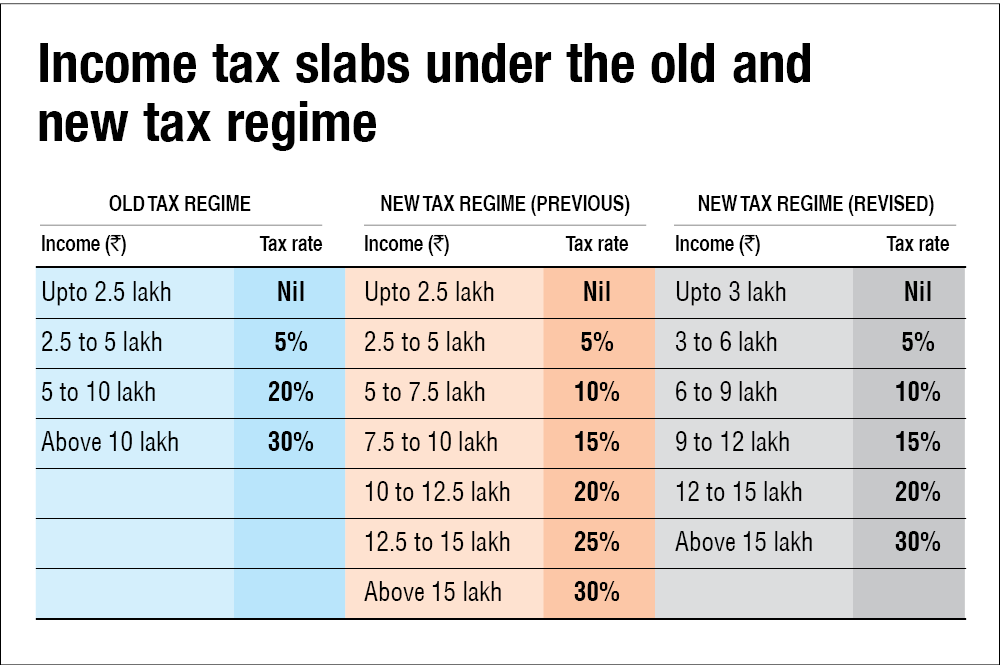

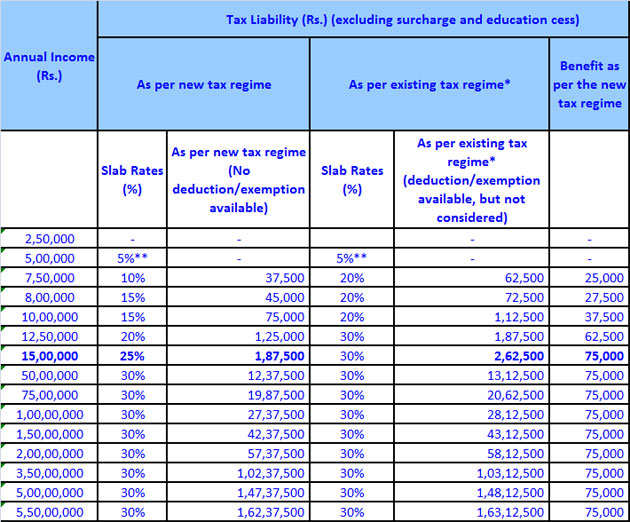

Old Vs New Tax Regime Calculator Ay 2024 25 Fa This income tax calculator aims to simplify the comparison between the new and old income tax regimes for fy 2024 25 ay 2025 26. by breaking down key components and providing an easy to use calculator, employees can make informed decisions regarding their tax planning. income from salary is the sum of basic salary hra special allowance. Follow the below steps to compute the income tax and make a comparative analysis under both the tax regime: free download the old vs new tax regime calculator in excel on your device. provide all the details in cells marked in yellow color. the final tax payable will be calculated based on the details provided. E tax subject to a maximum of rs. 12,500 . in the new tax regime, the rebate is increased to rs. 25,000 or 100 percent of income tax where the. otal income does not exceed rs. 7,00,000 .10) while filing itr for fy 2023 24 (ay 2024 25), i want to opt for the old tax regime instead of the default new tax regime, should i file form 10 ie. Rs 12,50,001 rs 15,00,000. 25%. rs 15,00,001 and above. 30%. * tax rebate up to rs.12,500 is applicable if the total income does not exceed rs 5,00,000 (not applicable for nris) refer to the above image for the rates applicable to fy 2023 24 (ay 2024 25) for the upcoming tax filing season. b.

Old Vs New Tax Regime Calculator Ay 2024 25 El E tax subject to a maximum of rs. 12,500 . in the new tax regime, the rebate is increased to rs. 25,000 or 100 percent of income tax where the. otal income does not exceed rs. 7,00,000 .10) while filing itr for fy 2023 24 (ay 2024 25), i want to opt for the old tax regime instead of the default new tax regime, should i file form 10 ie. Rs 12,50,001 rs 15,00,000. 25%. rs 15,00,001 and above. 30%. * tax rebate up to rs.12,500 is applicable if the total income does not exceed rs 5,00,000 (not applicable for nris) refer to the above image for the rates applicable to fy 2023 24 (ay 2024 25) for the upcoming tax filing season. b.

Old Vs New Tax Regime Calculator Ay 2024 25 Ri

Comments are closed.