Overview Of Federal Income Taxation

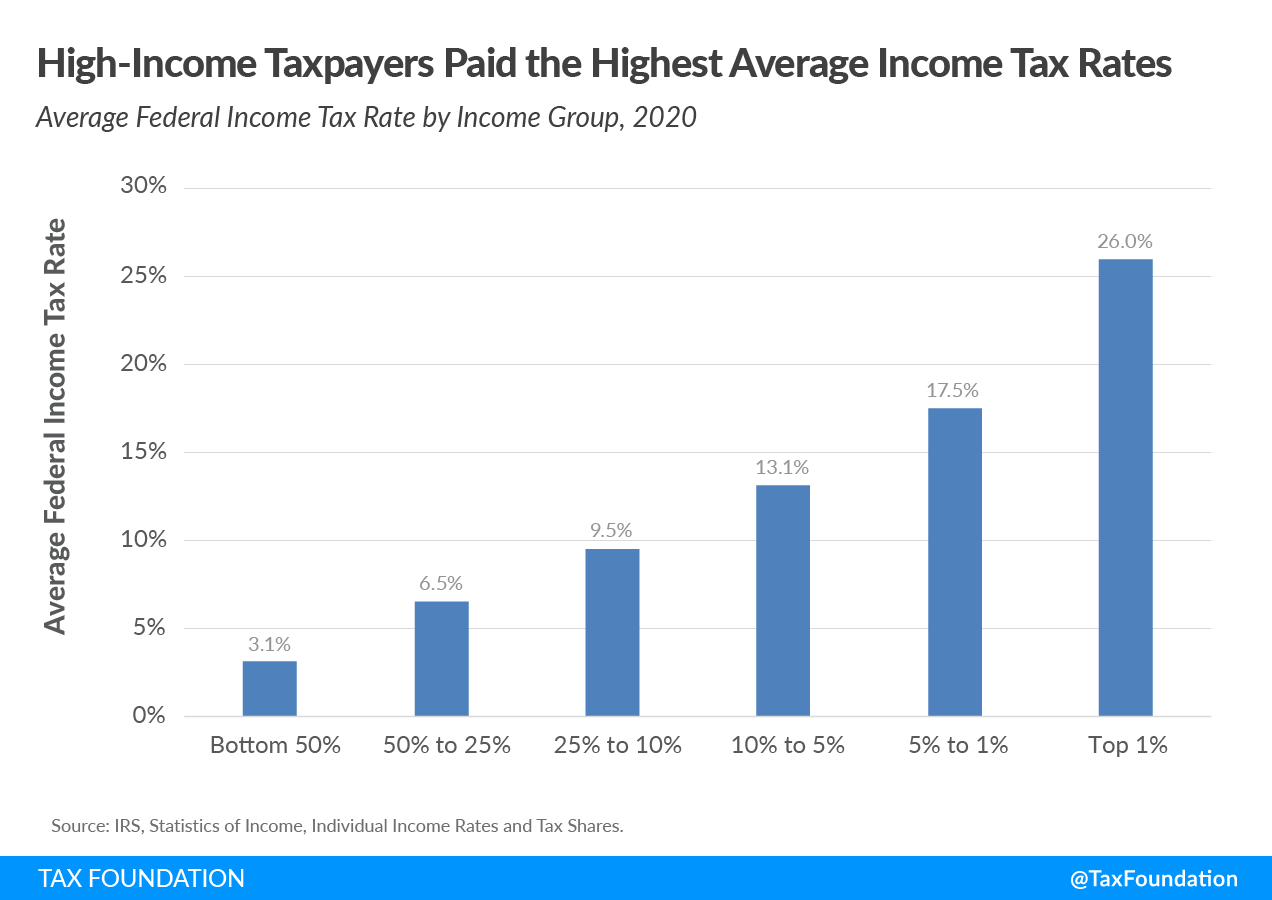

Summary Of The Latest Federal Income Tax Data 2023 Update Cashreview The average income tax rate in 2021 was 14.9 percent. the top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3 percent average rate paid by the bottom half of taxpayers. the top 1 percent’s income share rose from 22.2 percent in 2020 to 26.3 percent in 2021 and its share of federal income taxes. Federal income tax rates range from 10% to 37% as of 2024 and kick in at specific income thresholds. the income ranges to which the rates apply are called tax brackets. income that falls within.

Overview Of Federal Income Taxation For Individuals Youtube As your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer for a single taxpayer, the rates are:. E is subject to tax at a flat rate of 21%. social security and medicare tax rates are. respectively, 12.4% and 2.9% of earnings. in 2022, social security taxes. are levied on the first $147,000 of wages. medicare. axes are assessed against all wage income. federal excise taxes are levied on specific goods, such as. Social security and medicare tax rates are, respectively, 12.4% and 2.9% of earnings. in 2020, social security taxes are levied on the first $137,700 of wages. medicare taxes are assessed against all wage income. federal excise taxes are levied on specific goods, such as transportation fuels, alcohol, and tobacco. Federal individual income taxes rose by 1.6 percentage points to 40.1 percent. • since 2001, the share of federal income taxes paid by the top 1 percent increased from 33.2 percent to a new high of 40.1 percent in 2018. • in 2018, the top 50 percent of all taxpayers paid 97.1 percent of all individual.

Comments are closed.