Ppp Loan Forgiveness The Complete Guide

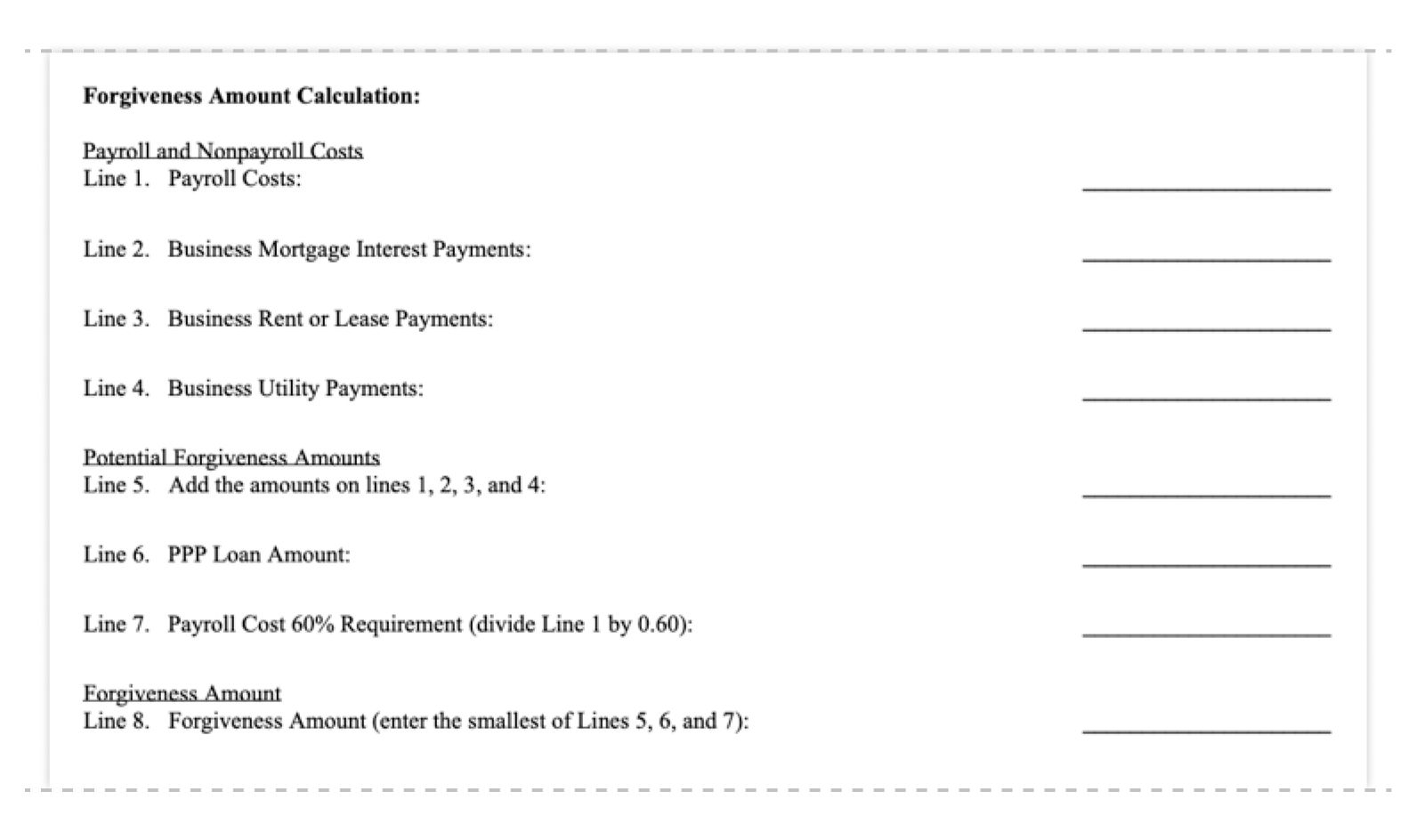

A Complete Guide To Ppp Loan Forgiveness Boosted Crm This is 75% of the minimum payroll cost required for full forgiveness so their forgiveness amount is 75% of the loan. this means $15,000 of the $20,000 loan is forgiven, and they have to pay back the remaining $5,000. you can also find your maximum forgiveness amount from your payroll costs. To calculate how that affects your forgiveness, use this calculation: your maximum forgivable amount will be what you spend on payroll costs, divided by 0.60. for example, on a $100,000 ppp loan, spending just $45,000 on payroll during your covered period means you can have $75,000 of the loan forgiven.

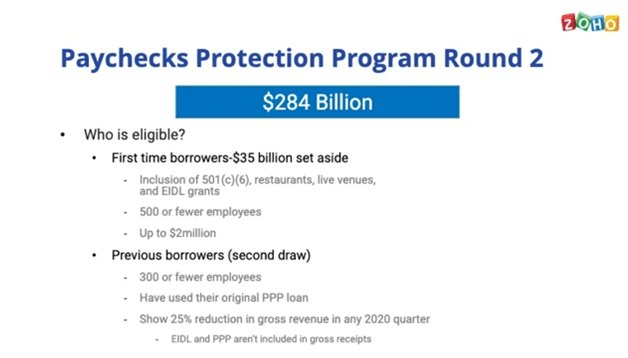

Ppp Loan Forgiveness The Complete Guide How to apply for forgiveness. each forgiveness form has unique instructions for documentation that must be submitted with your loan forgiveness application. for detailed instructions, refer to your chosen forgiveness form for clear guidance. for loans of $150,000 and below: sba form 3508s ppp loan forgiveness application instructions. Ppp loan forgiveness through the sba. if your business received a ppp loan before the program ended on may 31, 2021, you can apply for ppp loan forgiveness until the date when your loan matures. You can find a list of participating lenders here. if your ppp lender has not opted into the sba direct forgiveness portal or you've borrowed more than $150,000, you will still need to apply for forgiveness through your lender. here is a complete guide on ppp loan forgiveness from the u.s. chamber of commerce. 1a. amount of possible loan forgiveness for ppp loans of $150,000 or less: in august 2021, sba created a “covid revenue reduction score” for use with the agency’s online ppp direct forgiveness portal. borrowers must first determine whether their lender has opted in to sba’s online ppp direct forgiveness portal.

A Complete Guide To Ppp Loan Forgiveness For The Self Printable Form 2 You can find a list of participating lenders here. if your ppp lender has not opted into the sba direct forgiveness portal or you've borrowed more than $150,000, you will still need to apply for forgiveness through your lender. here is a complete guide on ppp loan forgiveness from the u.s. chamber of commerce. 1a. amount of possible loan forgiveness for ppp loans of $150,000 or less: in august 2021, sba created a “covid revenue reduction score” for use with the agency’s online ppp direct forgiveness portal. borrowers must first determine whether their lender has opted in to sba’s online ppp direct forgiveness portal. Application form automatically qualify to use the loan forgiveness application form 3508ez or lender equivalent and should complete that application. 2. question: can ppp lenders use scanned copies of documents, e signatures, or e consents for loan forgiveness applications and loan forgiveness documentation? answer: yes. Ppp borrowers must apply for loan forgiveness with the lender that processed the loan or use sba’s online direct forgiveness portal for loans of $150,000 or less. this guide is designed to help borrowers understand the process by which their loan forgiveness amount will be calculated and the overall approach of the loan forgiveness process.

Comments are closed.