Ppt Sales Tax Vs Use Tax Powerpoint Presentation Id 1295294

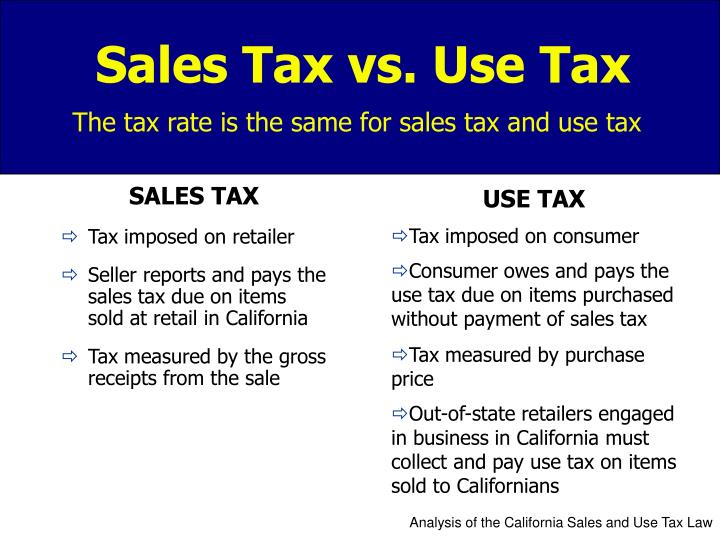

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Id 1295294 Sales tax tax imposed on retailer seller reports and pays the sales tax due on items sold at retail in california tax measured by the gross receipts from the sale. sales tax vs. use tax. the tax rate is the same for sales tax and use tax. use tax tax imposed on consumer slideshow 1295294 by. A tax on the sale, transfer, or exchange of a taxable item or service. applies on the sale to the end user or consumer. added to sales price and charged to purchaser. applies to intrastate sales. trust tax the storage, use or consumption of taxable property or services and includes the exercise of any right or power incident to the ownership of.

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Fre The total non taxable amount (before shipping and handling) would be $1,000. no tax would be due. sales and use tax. erica fernandez uc merced tax manager. sales vs. use tax. sales tax imposed on every retailer (seller merchant) for the privilege of making retail sales of tangible personal property (tpp) in california use tax slideshow 3385831. The differences. sales tax and use tax are both types of taxes that are imposed on the sale of goods and services. the main difference between the two is that sales tax is a tax on the sale of tangible personal property, while use tax is a tax on the use of that property within a state. Presentation transcript. sales tax brave new world. 3 things about sales tax (mostly) • compliance environment is getting tougher • exemption certificates – protect against private use • business activities – plans to improve our understanding. compliance environment • interested persons • governmental audits • new aggressive. Florida sales and use tax rates typically range from 6% to 8%; illinois sales and use tax rates range from 6.25% to 11%. if you buy something taxable for $10 and the seller doesn’t collect sales tax, you would owe the state 50 cents in consumer use tax. sales tax rates, rules, and regulations change frequently.

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Fre Presentation transcript. sales tax brave new world. 3 things about sales tax (mostly) • compliance environment is getting tougher • exemption certificates – protect against private use • business activities – plans to improve our understanding. compliance environment • interested persons • governmental audits • new aggressive. Florida sales and use tax rates typically range from 6% to 8%; illinois sales and use tax rates range from 6.25% to 11%. if you buy something taxable for $10 and the seller doesn’t collect sales tax, you would owe the state 50 cents in consumer use tax. sales tax rates, rules, and regulations change frequently. The privilege of making retail sales of tangible. personal property (tpp) in california. use tax. imposed on the purchaser for the storage, use or. consumption of tpp in california. 3. tangible personal property. tpp is personal property which can be. seen, weighed, measured, felt, touched etc. Course objectives. after completing this course you will be able to: apply the basic sales and use tax concepts for minnesota and its local taxing jurisdictions to your business. recognize the exceptions to the rule and the exemptions available. distinguish how sales and use tax law applies to different types of businesses and their business.

Comments are closed.