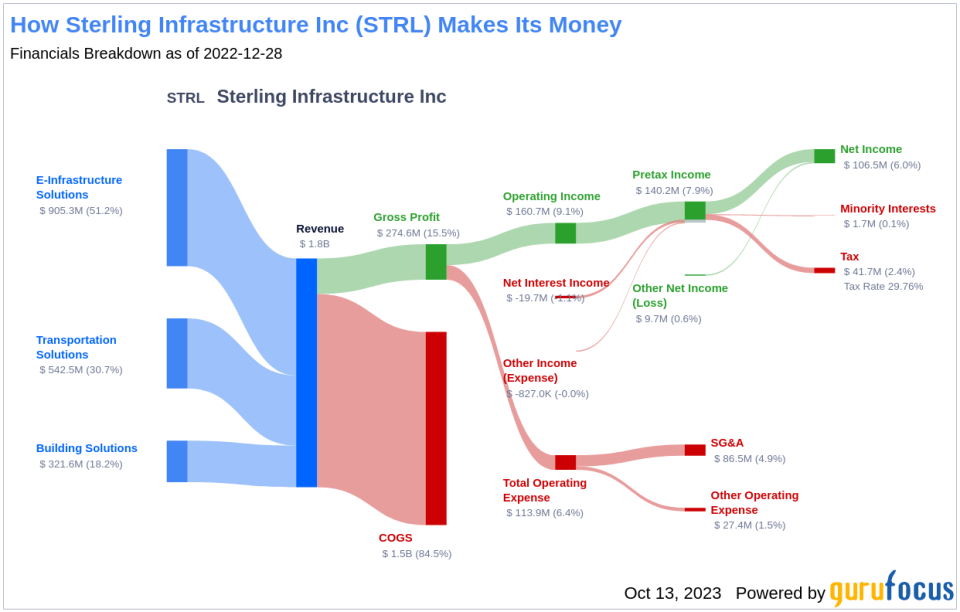

Present Value Of Strl

Total Present Value Of The Strategy Download Table Present value. present value, or pv, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. net present value. a popular concept in finance is the idea of net present value, more commonly known as npv. After calculating the present value of future cash flows in the initial 10 year period, we need to calculate the terminal value, which accounts for all future cash flows beyond the first stage. the gordon growth formula is used to calculate terminal value at a future annual growth rate equal to the 5 year average of the 10 year government bond.

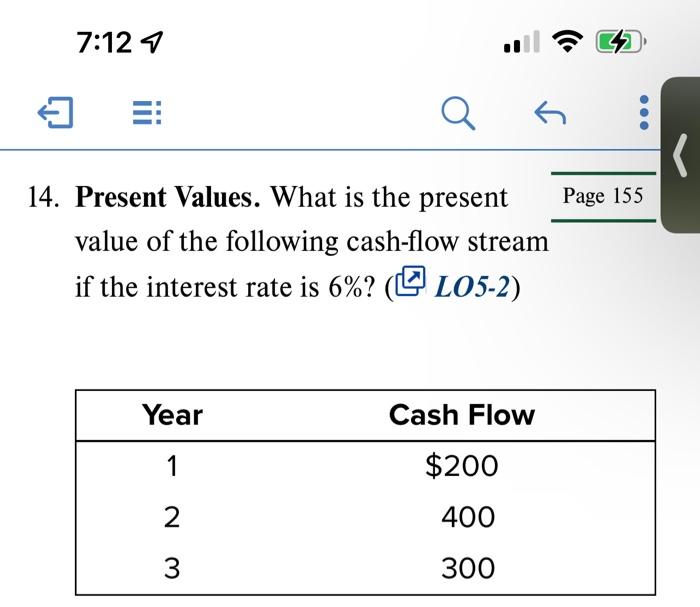

Solved 4 Present Values What Is The Present Value Of The Chegg Sterling infrastructure (strl) has been one of the stocks most watched by zacks users lately. this is because we believe the fair value for its stock is determined by the present value of. The present value formula is pv=fv (1 i) n, where you divide the future value fv by a factor of 1 i for each period between present and future dates. input these numbers in the present value calculator for the pv calculation: the future value sum fv. number of time periods (years) t, which is n in the formula. Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an. Pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one period of time, you need to raise the (1 r) by the number of periods.

Unveiling Sterling Infrastructure Strl S Value Is It Really Priced Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an. Pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one period of time, you need to raise the (1 r) by the number of periods. Present value of the annuity (pva) is the present value of any future cash flows (payments). in the section labeled growth rate and additional information, you can reach the following specifications: growth rate of the annuity (g) is the percentage increase of the annuity in the case of a growing annuity. The present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. this is also called discounting. the present value of a future cash flow represents the amount of money today, which, if invested at a particular interest rate, will grow.

Comments are closed.