Printable Itemized Deductions Worksheet

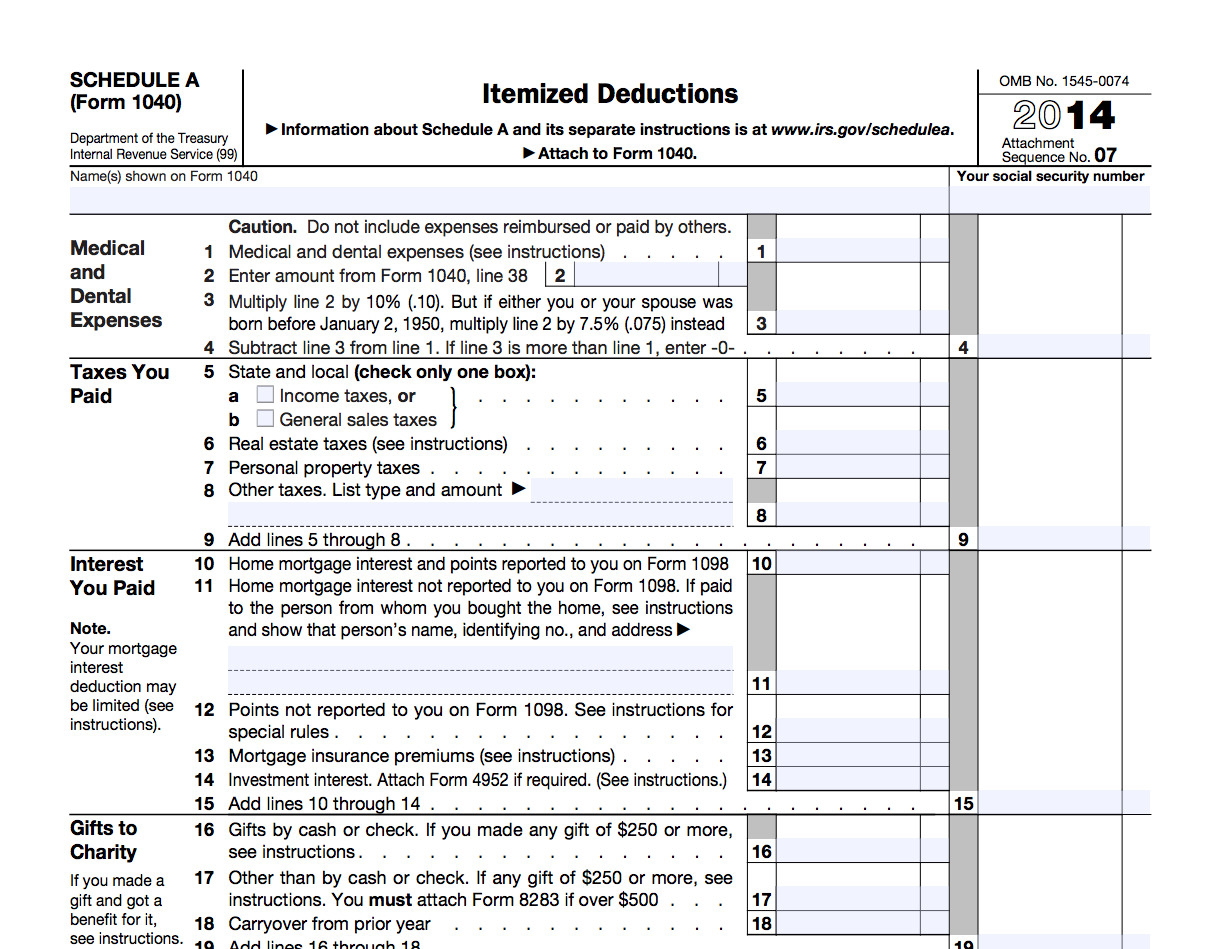

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. this schedule is used by filers to report itemized deductions. use schedule a (form 1040 or 1040 sr) to figure your itemized deductions. 2023. attachment. if you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. sequence no. 07. name(s) shown on form 1040 or 1040 sr. your social security number. medical and dental expenses. taxes you paid.

Itemized Deductions Worksheet 2017 Printable Worksheets And Gambling losses expenses. $. other (specify): $. we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): single $12,950 married $25,900 single (65 ) $14,700 married (one 65 ) $27,300 married (both 65 ) $28,700. hoh. 2023 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. if you itemize, you can deduct a part of your medical and dental expenses, and. Schedule a is a place to tally various itemized deductions you want to claim. you then enter the total deductions on your form 1040. stuff you’ll need if you want to claim any of the most. Itemized deductions 20 1 itemized deductions introduction this lesson will assist you in determining if a taxpayer should itemize deductions. generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. objectives at the end of this lesson, using your resource materials, you will be able to:.

Itemized Deductions Worksheet вђ Db Excel Schedule a is a place to tally various itemized deductions you want to claim. you then enter the total deductions on your form 1040. stuff you’ll need if you want to claim any of the most. Itemized deductions 20 1 itemized deductions introduction this lesson will assist you in determining if a taxpayer should itemize deductions. generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. objectives at the end of this lesson, using your resource materials, you will be able to:. Standard mileage rate for medical purposes is 16 cents per mile. qualified long term care premiums up to the amounts shown below can be included as medi cal expenses on sched ule a, or in calculating the self employed health insurance deduction. age 40 or under: $450. age 41 to 50: $850. age 51 to 60: $1,690. 2023 itemized deductions (sch a) worksheet (fillable) donated a vehicle worth more than $500 i made more than $5,000 of noncash donations. paid interest on borrowings for investments i repaid income (taxed in prior year) over $3,000. if you checked any of the above, please stop here and speak with one of our counselors.

Deductions Worksheet Fill Online Printable Fillable Blank Pdffiller Standard mileage rate for medical purposes is 16 cents per mile. qualified long term care premiums up to the amounts shown below can be included as medi cal expenses on sched ule a, or in calculating the self employed health insurance deduction. age 40 or under: $450. age 41 to 50: $850. age 51 to 60: $1,690. 2023 itemized deductions (sch a) worksheet (fillable) donated a vehicle worth more than $500 i made more than $5,000 of noncash donations. paid interest on borrowings for investments i repaid income (taxed in prior year) over $3,000. if you checked any of the above, please stop here and speak with one of our counselors.

Comments are closed.