Private Equity Vs Venture Capital The Fundamentals

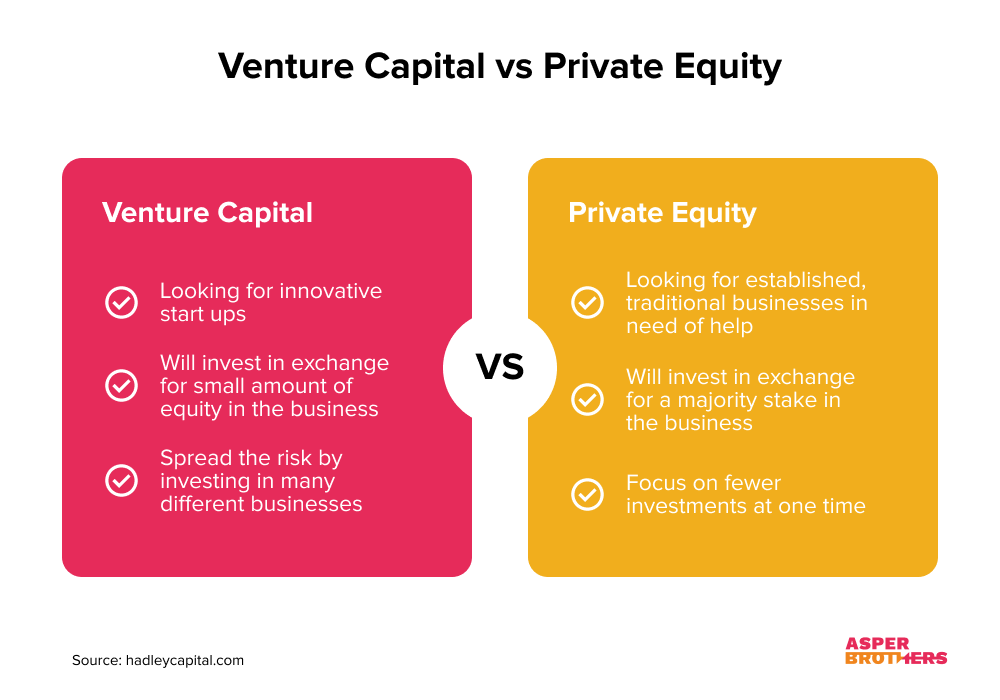

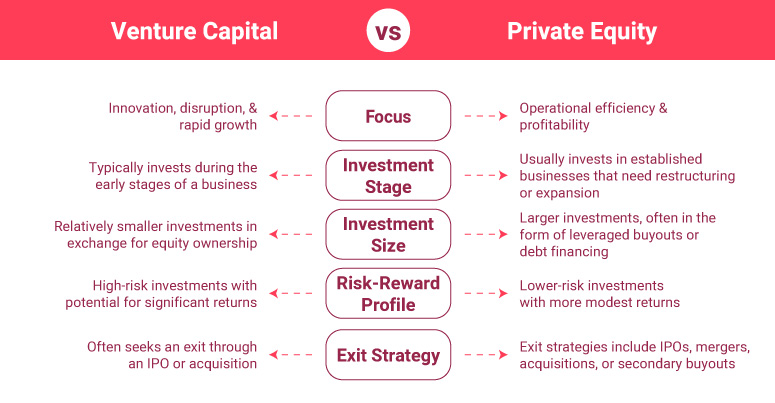

Venture Capital Vs Private Equity Which Is Right For You Asper Brother Private equity investing usually involves buying and managing non-public distressed companies, with the goal of increasing their value Venture capital (VC) funds early-stage start-ups with high With investing being more popular than ever, starting an investment journey has become one of the top discussion topics Making things even more difficult, there are different investment vehicles with

Private Equity Vs Venture Capital Truic Professor Josh Lerner started the Venture Capital and Private Equity (VCPE) course in 1996, and it today is one of the longest-running and largest offerings in the second-year curriculum Through case Lerner, Josh, Felda Hardymon, and Ann Leamon Venture Capital & Private Equity: A Casebook (5th Edition) New York: John Wiley & Sons, 2012 (New York: John Wiley & Sons, 2001 (second edition) (with When advisors invest in public equity funds, they expect high volatility and high-level liquidity On the private side, they anticipate “The nature of venture capital is to spread your risk across As a result, it is no surprise that both institutional and individual investors are increasingly turning to private equity, venture capital and other private market investments to seek growth

Comments are closed.