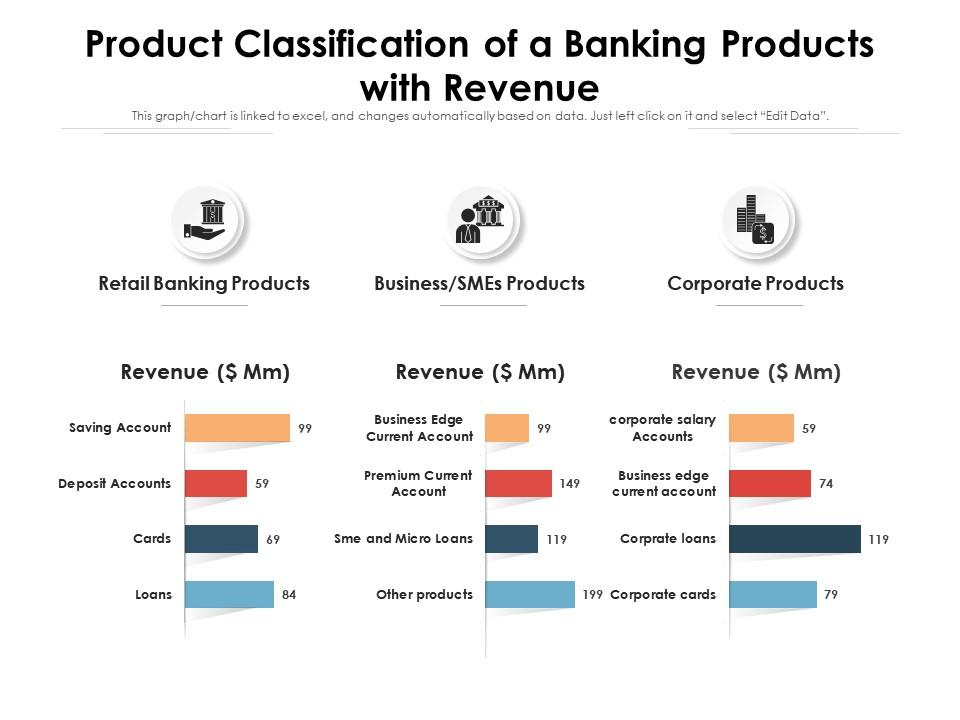

Product Classification Of A Banking Products With Revenue

Product Classification Of A Banking Products With Revenue Introducing our product classification of a banking products with revenue set of slides. the topics discussed in these slides are product classification, banking products, revenue. this is an immediately available powerpoint presentation that can be conveniently customized. download it and convince your audience. Product classification of a banking products with revenue. introducing our product classification of a banking products with revenue set of slides. the topics discussed in these slides are product classification, banking products, revenue. this is an immediately available powerpoint presentation that can be conveniently customized.

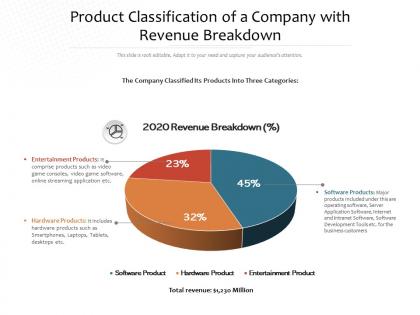

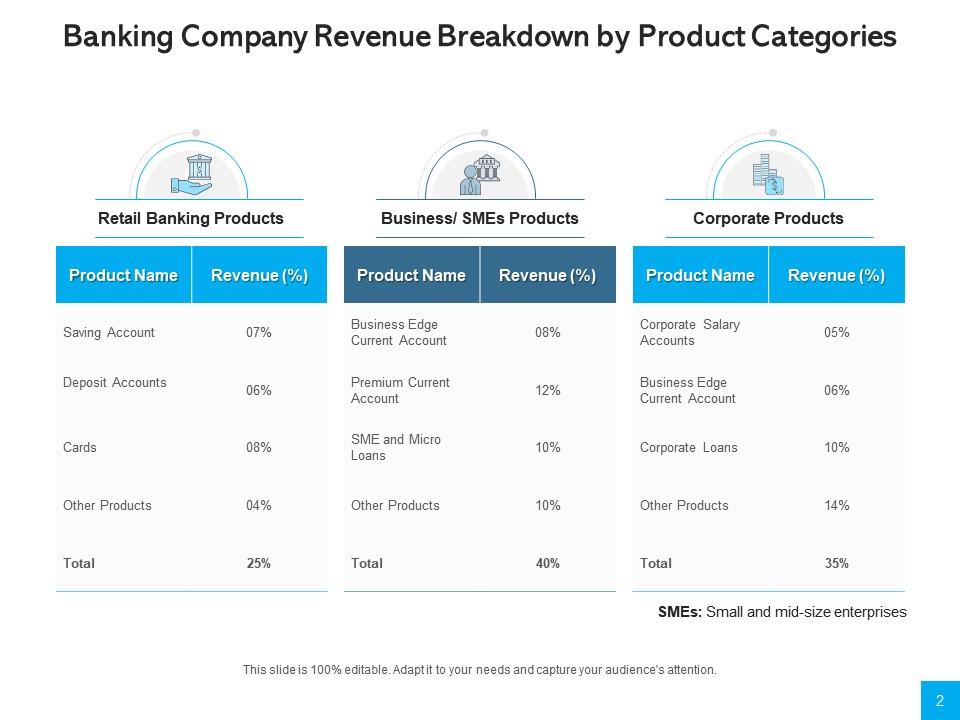

Classification Of Revenue Powerpoint Presentation And Slides Slideteam Some of common available banking products are explained below: 1) credit card: credit card is “post paid” or “pay later” card that draws from a credit line money made available by the card issuer (bank) and gives one a grace period to pay. if the amount is not paid full by the end of the period, one is charged interest. Democratization of investments. a digital platform that gives those with limited funds access to a broader range of investment products by pooling their capital. 4. green deposit account. deposit accounts for funding bank investments in sustainable initiatives at competitive interest rates. 5. sme banking platform. If a bank has to classify its product offer, banking product factory for enterprise has an inbuilt feature, accessible through the banking product classification menu item, which allows you to manage classification items. once defined, a product classification can be attached to different products, and then the contracts based on these products further inherit the same classification. Financial products are everything a bank sells to its customers, including to investment banking and commercial banking clients. a broad range of business lines necessitates an extensive systems’ landscape and involves multiple internal and external financial product classifications, including industry schemes such as isda and cfi. a fit for.

Revenue Breakdown Corporate Products Business Retail Banking Products If a bank has to classify its product offer, banking product factory for enterprise has an inbuilt feature, accessible through the banking product classification menu item, which allows you to manage classification items. once defined, a product classification can be attached to different products, and then the contracts based on these products further inherit the same classification. Financial products are everything a bank sells to its customers, including to investment banking and commercial banking clients. a broad range of business lines necessitates an extensive systems’ landscape and involves multiple internal and external financial product classifications, including industry schemes such as isda and cfi. a fit for. The three main business segments for a bank are retail banking, wholesale banking, and wealth management. retail banking or personal banking involves deposits, mortgages, loans, and credit cards. wholesale banking is related to sales and trading and mergers and acquisitions. wealth management generates revenue through retail brokerage services. Mckinsey website accessibility@mckinsey . corporate bank deposits in 2022 totaled an estimated $54.6 trillion worldwide, roughly doubling from an estimated $26.8 trillion in 2010 and accounting for 46 percent of overall deposits. 2 however, customers started withdrawing deposits in 2023 amid increasing market volatility due to rising.

Comments are closed.