Promissory Notes And Bills Of Exchange

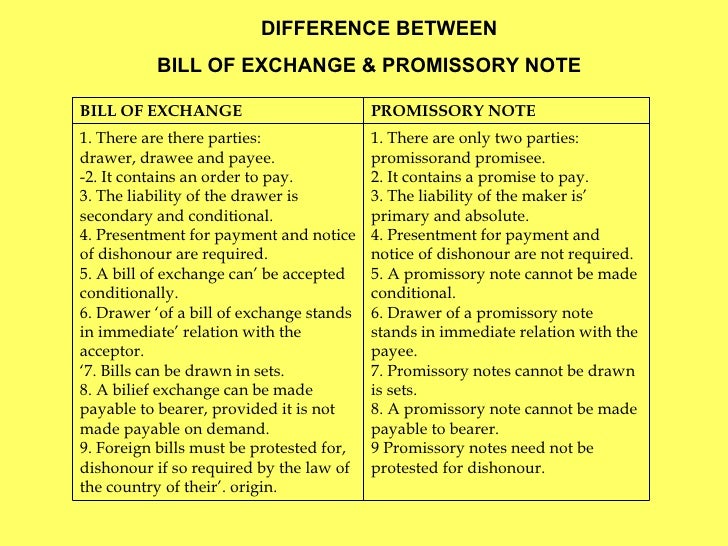

7 Key Difference Between Bill Of Exchange And Promissory Note Bills of exchange vs. promissory notes: an overview. bills of exchange and promissory notes are written commitments between two parties that confirm a financial transaction has been agreed upon. There are three types of negotiable instruments, namely bill of exchange, cheques and promissory note. meaning of bill of exchange bill of exchange is a negotiable instrument which is a legally binding document containing an order to pay a certain sum of money to a person within a pre determined time frame or on demand by the bearer of the.

ёяой юааbillюаб юааof Exchangeюаб And юааpromissoryюаб юааnoteюаб Financial Accounting юааbillsюаб O While, a promissory note involves just two parties: the maker (who promises to pay) and the payee. 6. a bill of exchange is an order made by one person to another to pay money to a third person. conversely, promissory note is a promise made by one person to another to pay a certain sum of money. 10. in a bill of exchange, the liability is. A directive that the drawee is to pay the payee. the signature of the drawer and date it is signed. a bill of exchange is transferable (much in the same way you can endorse a check to someone else). bills of exchange are enforceable in court in the event of nonpayment. bills of exchange and promissory notes both create an obligation to pay. Promissory note is a written document in which the debtor promises the creditor that the amount due will be paid at a future specified date. bill of exchange is defined in section 5 of the negotiable instrument act, 1881 whereas promissory note is defined in section 4. in a bill of exchange, there are three parties while in the case of a. Banknotes are common forms of promissory notes. a bill of exchange is issued by the creditor and orders a debtor to pay a particular amount within a given period of time. the promissory note, on.

Difference Between Bills Of Exchange And Promissory Note Promissory note is a written document in which the debtor promises the creditor that the amount due will be paid at a future specified date. bill of exchange is defined in section 5 of the negotiable instrument act, 1881 whereas promissory note is defined in section 4. in a bill of exchange, there are three parties while in the case of a. Banknotes are common forms of promissory notes. a bill of exchange is issued by the creditor and orders a debtor to pay a particular amount within a given period of time. the promissory note, on. Bills of exchange are more typically utilized in overseas business than promissory notes are in domestic trade. the major difference between a promissory note and bill of exchange is that a promissory note is a simple written promise between two parties. in contrast, a bill of exchange is a formal written commitment between two parties. 1. draft the bill of exchange: as the creditor (drawer), draft a bill of exchange outlining the payment terms, including the amount, due date, and any credit terms if applicable. ensure all parties’ details are accurate. 2. present to the debtor: provide the bill of exchange to the debtor (drawee) for acceptance.

Comments are closed.