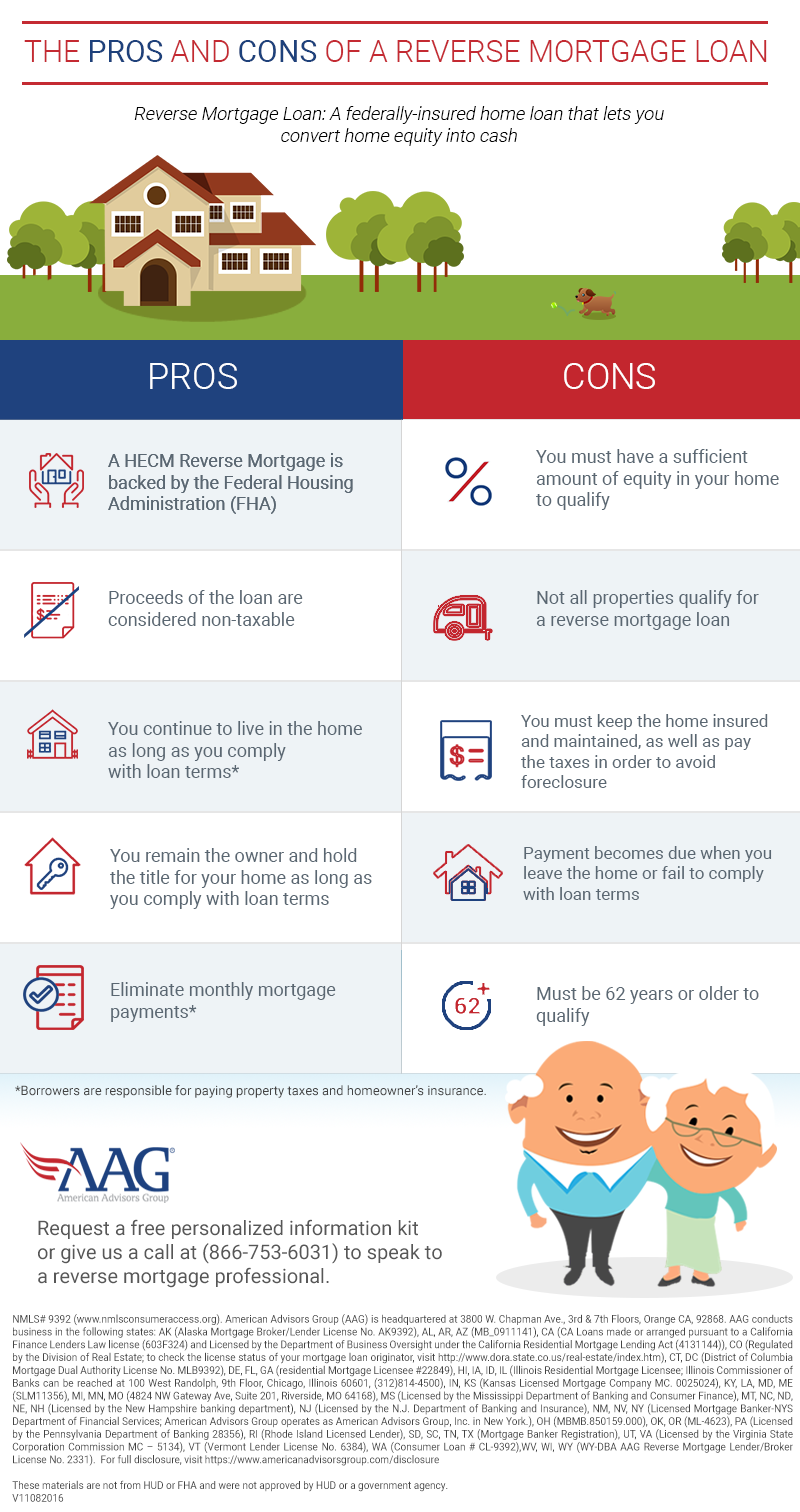

Pros And Cons Of Reverse Mortgage Loans

Is A Reverse Mortgage Right For You Trusted Choice 1. helps secure your retirement. reverse mortgages are ideal for retirees who don’t have a lot of cash savings or investments but do have a lot of wealth built up in their homes. a reverse. Pros and cons of a reverse mortgage. while a reverse mortgage may seem like a good way to access cash in your golden years, it’s important to understand the realities of this type of loan.

Reverse Mortgage вђ Pros And Cons Roofandfloor Blog Reverse mortgages: pros and cons reverse mortgages can be a good way to shore up retirement income, but costs can outweigh benefits for some. updated may 22, 2024 · 4 min read. Cons: the downsides of a reverse mortgage. your home’s equity will shrink. a big downside to reverse mortgages is the loss of home equity. because you’re not paying down your reverse mortgage balance, you’ll make less profit when you sell, or limit your borrowing power if you need a new loan. Key takeaways. if you’re a homeowner aged 62 or older, a reverse mortgage can help you obtain tax free income, allowing you to stay in your home, pay bills, supplement your income and more. a. Reverse mortgage: the pros and cons. a reverse mortgage is a loan for homeowners aged 62 and older who want to borrow against their home equity without having to make monthly payments.

Pros Cons Of A Reverse Mortgage Loan Lexleader Key takeaways. if you’re a homeowner aged 62 or older, a reverse mortgage can help you obtain tax free income, allowing you to stay in your home, pay bills, supplement your income and more. a. Reverse mortgage: the pros and cons. a reverse mortgage is a loan for homeowners aged 62 and older who want to borrow against their home equity without having to make monthly payments. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. by borrowing against their equity, seniors get access to cash to. A reverse mortgage is a type of mortgage loan that enables older homeowners to cash out some of their home equity without making monthly loan payments. learn more about the pros and cons of.

Pros And Cons Of Reverse Mortgage Loans A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. by borrowing against their equity, seniors get access to cash to. A reverse mortgage is a type of mortgage loan that enables older homeowners to cash out some of their home equity without making monthly loan payments. learn more about the pros and cons of.

63 What Are The Advantages And Disadvantages Of Reverse Mortgages

Comments are closed.