Purchase Price Allocation Ppa Valuation Eqvista

Purchase Price Allocation Ppa Valuation Eqvista Atlas incorporated acquired bashirian llc for $12 billion. after the acquisition, atlas incorporated must perform purchase price allocation according to existing accounting standards. the book value of bashirian llc’s assets is $9 billion, while the book value of the firm’s liabilities is $6 billion. hence, the value of the net identifiable. A purchase price allocation (ppa) is a powerful tool for preparing the firm for sale. it helps create a pitch book to attract potential buyers. identifies and evaluates the company’s primary tangible and intangible assets. an impartial third party can evaluate the firm’s parts and provide an unbiased ppa valuation.

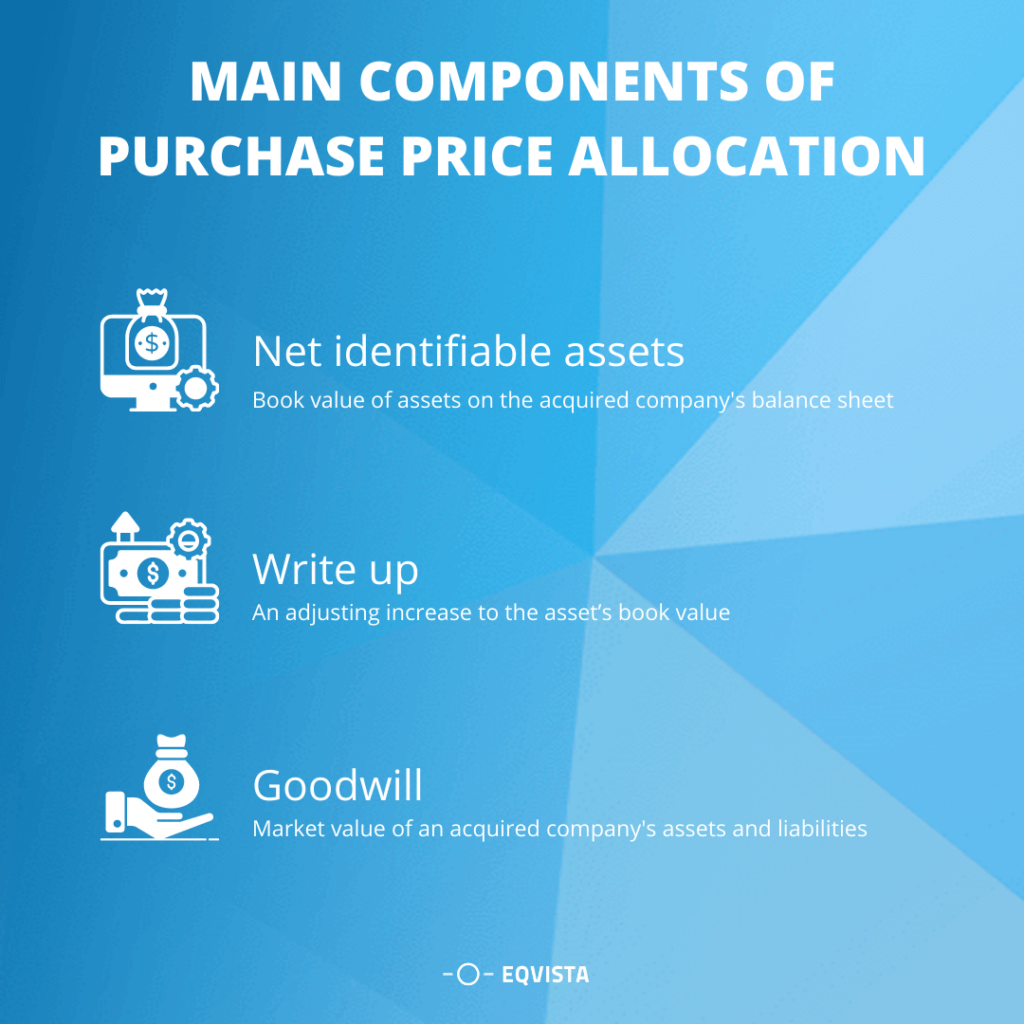

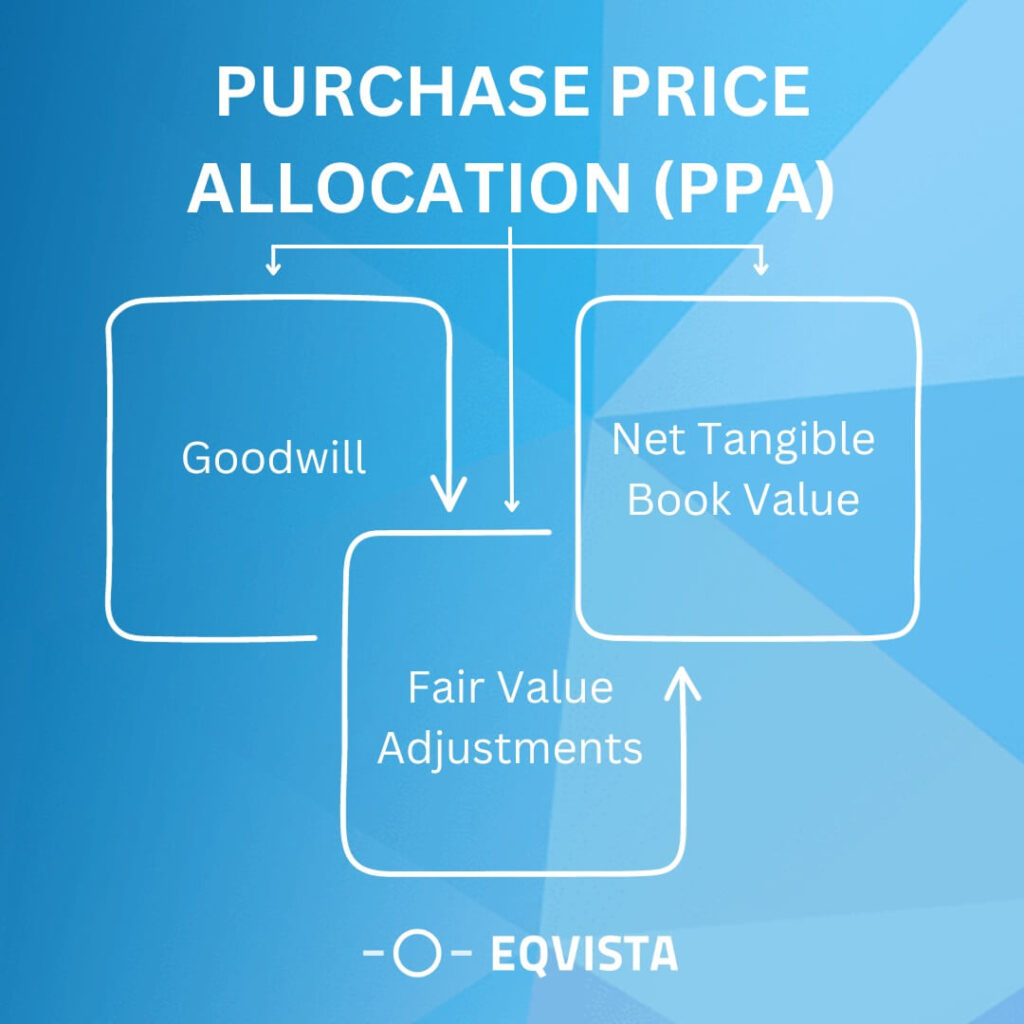

Purchase Price Allocation Ppa Valuation Eqvista Category: purchase price allocation. we help business owners realize their dreams by providing full company incorporation, share management and valuation services to startup companies. our blog is the best place to learn about valuation, equity, and the eqvista product. Purchase price allocation (ppa) is an acquisition accounting process of assigning a fair value to all of the acquired assets and liabilities assumed by the target company. in practice, purchase price allocation is an integral part of m&a accounting with broad implications on the financial statements of the parties involved in the transaction. Purchase price allocation (ppa) is a process in accounting in which the acquirer assigns the assets and liabilities of the company targeted. ppa is performed using three main components: net identifiable assets, goodwill, and fair value adjustments (write up). net identifiable assets are the total value of the acquired company's assets minus. Example of purchase price allocation. company a recently acquired company b for $10 billion. following the completion of the deal, company a, as the acquirer, must perform purchase price allocation according to existing accounting standards. the book value of company b’s assets is $7 billion, while the book value of the company’s.

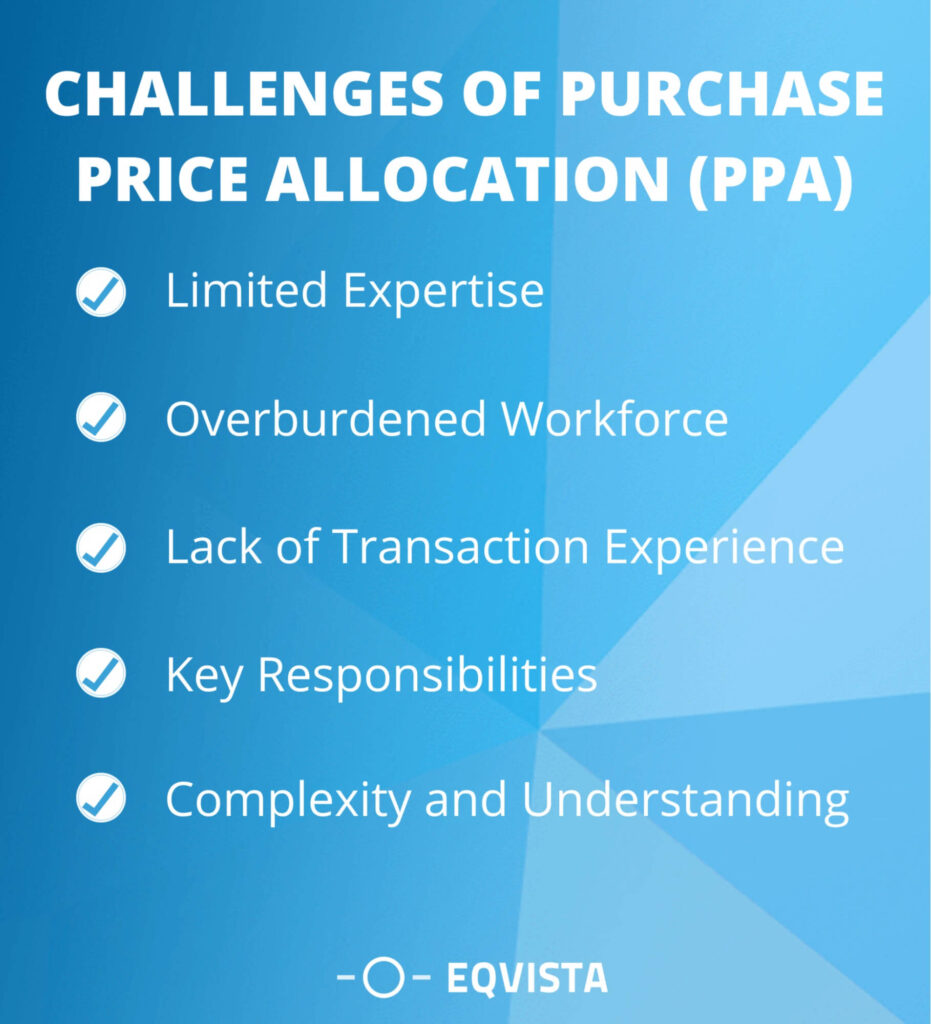

Understanding Of Purchase Price Allocation Ppa Valuation In 2024 Purchase price allocation (ppa) is a process in accounting in which the acquirer assigns the assets and liabilities of the company targeted. ppa is performed using three main components: net identifiable assets, goodwill, and fair value adjustments (write up). net identifiable assets are the total value of the acquired company's assets minus. Example of purchase price allocation. company a recently acquired company b for $10 billion. following the completion of the deal, company a, as the acquirer, must perform purchase price allocation according to existing accounting standards. the book value of company b’s assets is $7 billion, while the book value of the company’s. The purchase price allocation (ppa) is an important component of the accounting for a merger or acquisition and requires five key steps. step 1: determine the fair value of consideration transferred. consideration transferred in a business combination can take many forms, including cash, shares, promissory notes, contingent payments and earnouts. Purchase price allocation study houlihan lokey is pleased to share with you its purchase price allocation (ppa) study, one of the largest, most detailed investigations of its kind. our ppa study provides an in depth look at the recent allocations recorded by publicly traded registrants and can be used as a benchmark throughout the industry.

Understanding Of Purchase Price Allocation Ppa Valuation In 2024 The purchase price allocation (ppa) is an important component of the accounting for a merger or acquisition and requires five key steps. step 1: determine the fair value of consideration transferred. consideration transferred in a business combination can take many forms, including cash, shares, promissory notes, contingent payments and earnouts. Purchase price allocation study houlihan lokey is pleased to share with you its purchase price allocation (ppa) study, one of the largest, most detailed investigations of its kind. our ppa study provides an in depth look at the recent allocations recorded by publicly traded registrants and can be used as a benchmark throughout the industry.

Understanding Of Purchase Price Allocation Ppa Valuation In 2024

Comments are closed.