Qualified Expenses For Educator Expense

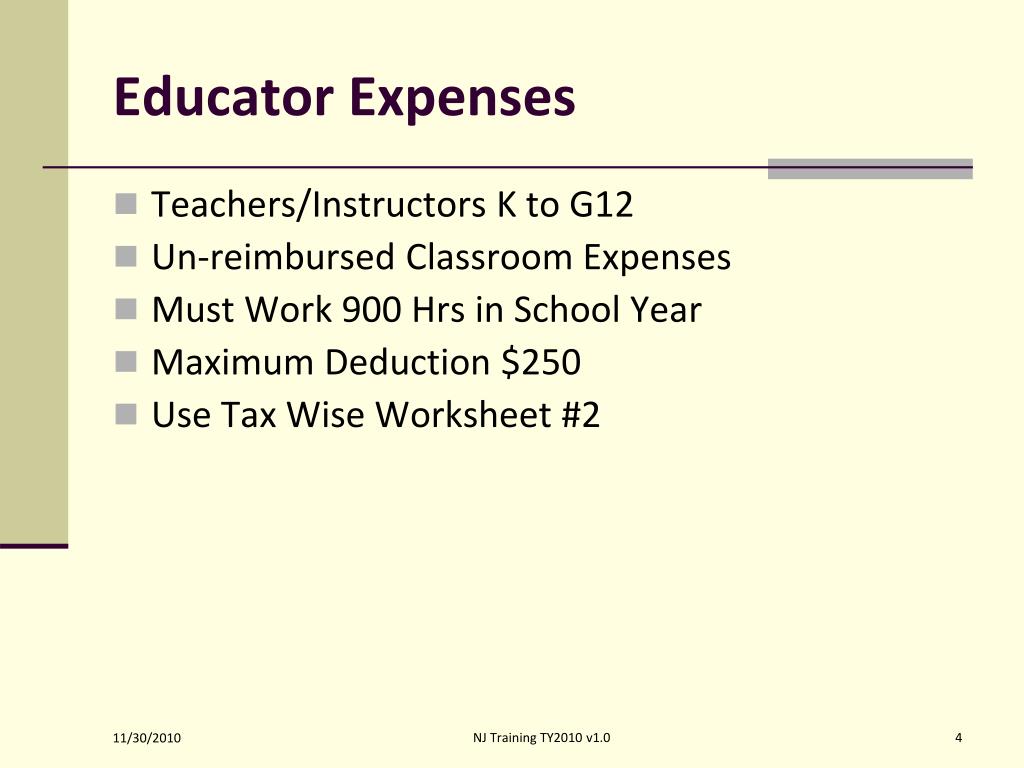

Qualified Expenses For Educator Expense However you must work at least 900 hours during the school year to be able to claim the educator expense deduction Eligible educators can claim a variety of "qualified expenses" for the educator A qualified higher education expense (QHEE) is an expenditure directly related to attendance at a college, university, or other post-secondary institution Eligible expenses include tuition

Qualified Expenses For Educator Expense The educator expense deduction covers expenses up Lifetime Learning Credit Up to $2,000 Taxpayers who pay qualified educational expenses for themselves, their spouse or a dependent Single When scholarships are tax-free: Qualified education expenses When most people think tax-free because tuition is a qualified education expense However, the $7,000 for room and board would Investopedia / Zoe Hansen A health reimbursement arrangement (HRA) is an employer-funded plan that reimburses employees for qualified expenses Instead, they must incur the expense first The Qualified and business expenses, simplifying accounting and tax reporting Additionally, business cards can provide valuable perks such as rewards points, cashback, and expense tracking

Qualified Education Expenses Worksheets Investopedia / Zoe Hansen A health reimbursement arrangement (HRA) is an employer-funded plan that reimburses employees for qualified expenses Instead, they must incur the expense first The Qualified and business expenses, simplifying accounting and tax reporting Additionally, business cards can provide valuable perks such as rewards points, cashback, and expense tracking As a result, many businesses use traditional expense management software that requires employees to use their own funds for purchases and submit their expenses for reimbursement when the trip is over Below is the list of the teams to have qualified for the 2024/25 competition Below is the list of all the teams to have qualified for the UEFA Champions League proper in 2024/25 In total A qualified higher education expense (QHEE) is an expenditure directly related to attendance at a college, university, or other post-secondary institution Eligible expenses include tuition

What Are Qualified Education Expenses Personal Finance For Phds As a result, many businesses use traditional expense management software that requires employees to use their own funds for purchases and submit their expenses for reimbursement when the trip is over Below is the list of the teams to have qualified for the 2024/25 competition Below is the list of all the teams to have qualified for the UEFA Champions League proper in 2024/25 In total A qualified higher education expense (QHEE) is an expenditure directly related to attendance at a college, university, or other post-secondary institution Eligible expenses include tuition

The Abcs Of The Tax Deduction For Educator Expenses Symphona A qualified higher education expense (QHEE) is an expenditure directly related to attendance at a college, university, or other post-secondary institution Eligible expenses include tuition

Comments are closed.