Quarter In Review Q1 2023

Q1 Quarterly Calendar 2023 In Pdf Word Excel A positive q1 2023 for stocks and bond markets, but the coast isn’t clear. the key variable for investors to weigh will be the impact of the banking crisis on the economy. investors look past. The first quarter of 2023 ended with gains in both equity and fixed income markets. the u.s. equity market finished the first three months of the year up over 7%, which is similar to the results in q4 of 2022. however, the source of those returns was very different as the below chart details. value stocks protected investors from more.

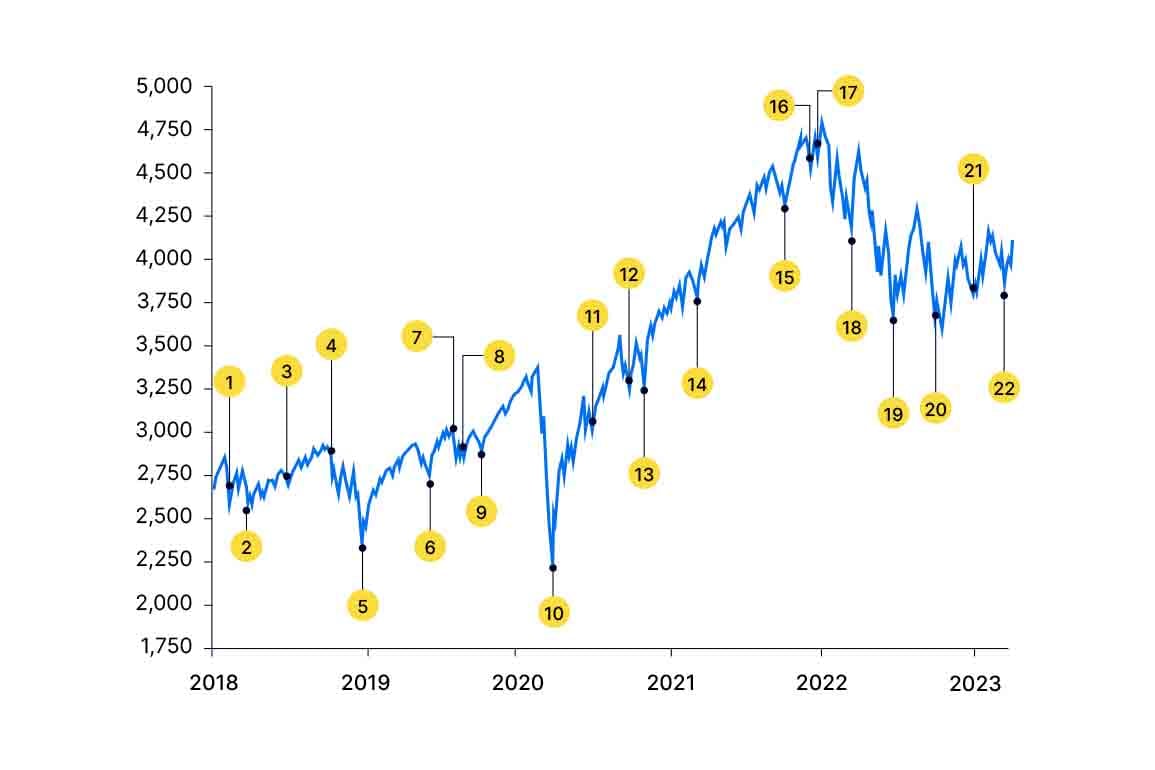

Youhodler Quarterly Review Q1 2023 First quarter 2023 highlights. » us equity markets: the s&p 500 increased by 7.5% in the first quarter, for the best start to a calendar year since 2019 and the second best overall in the last ten years. the s&p 500 closed the quarter at 4,109 and is now about 15.8% above the 2022 closing low of 3,577 on 10 12 22. Key stats: q1 2023 market performance. the morningstar us market index gained 7.4% during the first quarter. stocks are up 12.5% from their oct. 14 low but still down 13.5% from their latest high. For the s&p 500, the estimated q1 2023 earnings decline is 6.6%, which would mark the largest decline since q2 2020, according to factset. over the course of q1, the bottom up eps estimate for. First quarter performance review. the first quarter of 2023 saw a sharp reversal in index and sector performance compared to 2022. on an index level, the nasdaq (which badly underperformed in 2022) handily outperformed in the first quarter and finished with very impressive returns. that outperformance was driven by a decline in bond yields.

Quarter In Review Q1 2023 For the s&p 500, the estimated q1 2023 earnings decline is 6.6%, which would mark the largest decline since q2 2020, according to factset. over the course of q1, the bottom up eps estimate for. First quarter performance review. the first quarter of 2023 saw a sharp reversal in index and sector performance compared to 2022. on an index level, the nasdaq (which badly underperformed in 2022) handily outperformed in the first quarter and finished with very impressive returns. that outperformance was driven by a decline in bond yields. The quarter in summary: global equities gained in q1, buoyed by receding recession worries in developed markets. gains came despite the collapse of silicon valley bank, which caused significant volatility in bank shares. growth stocks outperformed value in the quarter. in fixed income, government bond yields were fell (meaning prices rose). From a year over year growth (y y) perspective, 2023 q1 earnings is currently $438.1 billion ( 0.7% y y, 0.4% q q). this marks the second consecutive quarter of negative growth and is expected to continue into next quarter (2023 q2: 4.7% y y). y y growth has increased by 4.3 percentage points (ppt) since the start of earnings season, which is.

Comments are closed.