Quarterly Markets Review Q1 2023

Q1 2023 Market Review The quarter in summary: global equities gained in q1, buoyed by receding recession worries in developed markets. gains came despite the collapse of silicon valley bank, which caused significant volatility in bank shares. growth stocks outperformed value in the quarter. in fixed income, government bond yields were fell (meaning prices rose). A positive q1 2023 for stocks and bond markets, but the coast isn’t clear. the key variable for investors to weigh will be the impact of the banking crisis on the economy. investors look past.

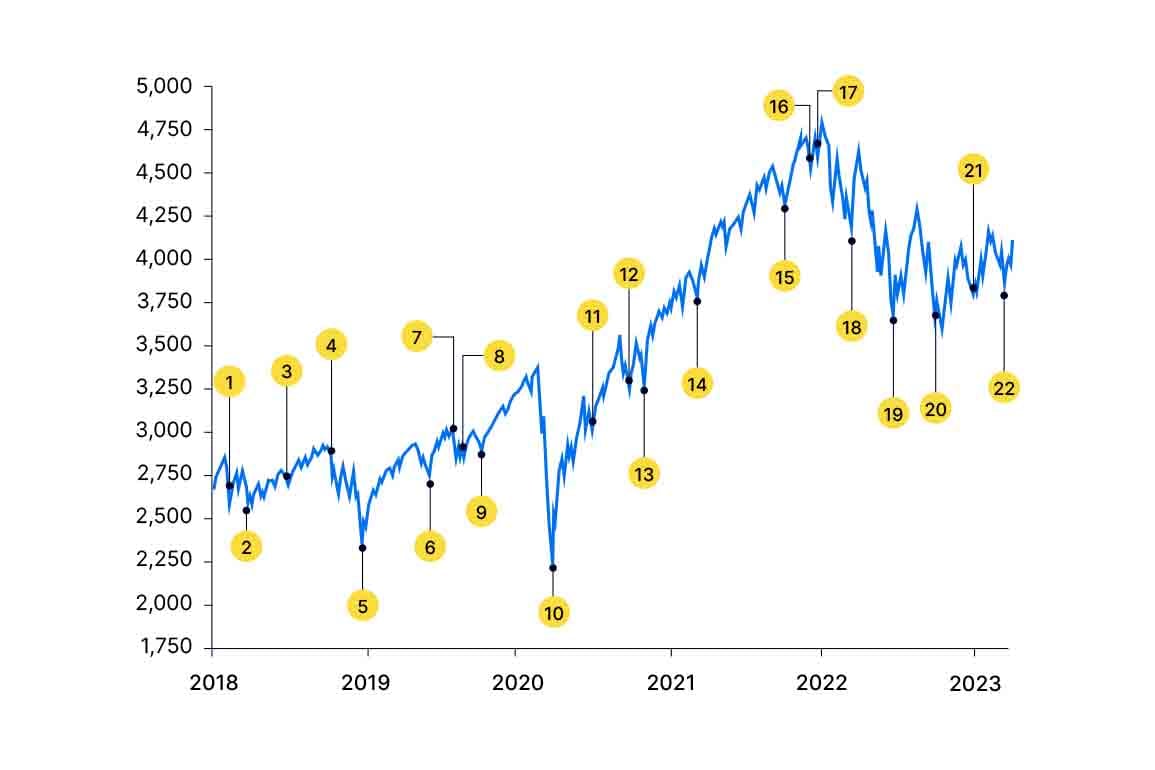

Quarter In Review Q1 2023 As markets reacted to fears of a banking crisis, government bond markets went from pricing in rate hikes to discounting sizeable rate cuts in some markets. during q1, growth improved as headwinds from higher inflation on consumers’ real incomes, stemming from energy prices, started to abate. First quarter 2023 highlights. » us equity markets: the s&p 500 increased by 7.5% in the first quarter, for the best start to a calendar year since 2019 and the second best overall in the last ten years. the s&p 500 closed the quarter at 4,109 and is now about 15.8% above the 2022 closing low of 3,577 on 10 12 22. Download paper. from a style agnostic perspective during the first quarter of 2023, large cap us stocks outpaced the small and large counterparts, and growth performed much better than value across all segments predominantly due to predominant macro uncertainties around fed hike and banking crisis. similarly, in developed markets outside the us. The first quarter of 2023 saw the most significant news making and market moving of these events, with the most extensive bank failures since the onset of the financial crisis 15 years ago. the sudden collapse of silicon valley bank (svb) and signature bank raised broad concerns that other small and regional financial institutions might face.

Quarterly Markets Review Q1 2023 Download paper. from a style agnostic perspective during the first quarter of 2023, large cap us stocks outpaced the small and large counterparts, and growth performed much better than value across all segments predominantly due to predominant macro uncertainties around fed hike and banking crisis. similarly, in developed markets outside the us. The first quarter of 2023 saw the most significant news making and market moving of these events, with the most extensive bank failures since the onset of the financial crisis 15 years ago. the sudden collapse of silicon valley bank (svb) and signature bank raised broad concerns that other small and regional financial institutions might face. The quarter in summary: global equities gained in q1, buoyed by receding recession worries in developed markets. gains came despite the collapse of silicon valley bank, which caused significant volatility in bank shares. growth stocks outperformed value in the quarter. in fixed income, government bond yields were fell (meaning prices rose). The broad u.s. fixed income market returned a positive 3% (bloomberg barclays u.s. aggregate) for the quarter. the best performing sector for the quarter was high yield corporate bond, returning a positive 3.6%. the worst performing sector for the quarter was cash, returning a positive 1.1%. download a copy of this market review document by.

Comments are closed.