Rdc Remote Deposit Capture

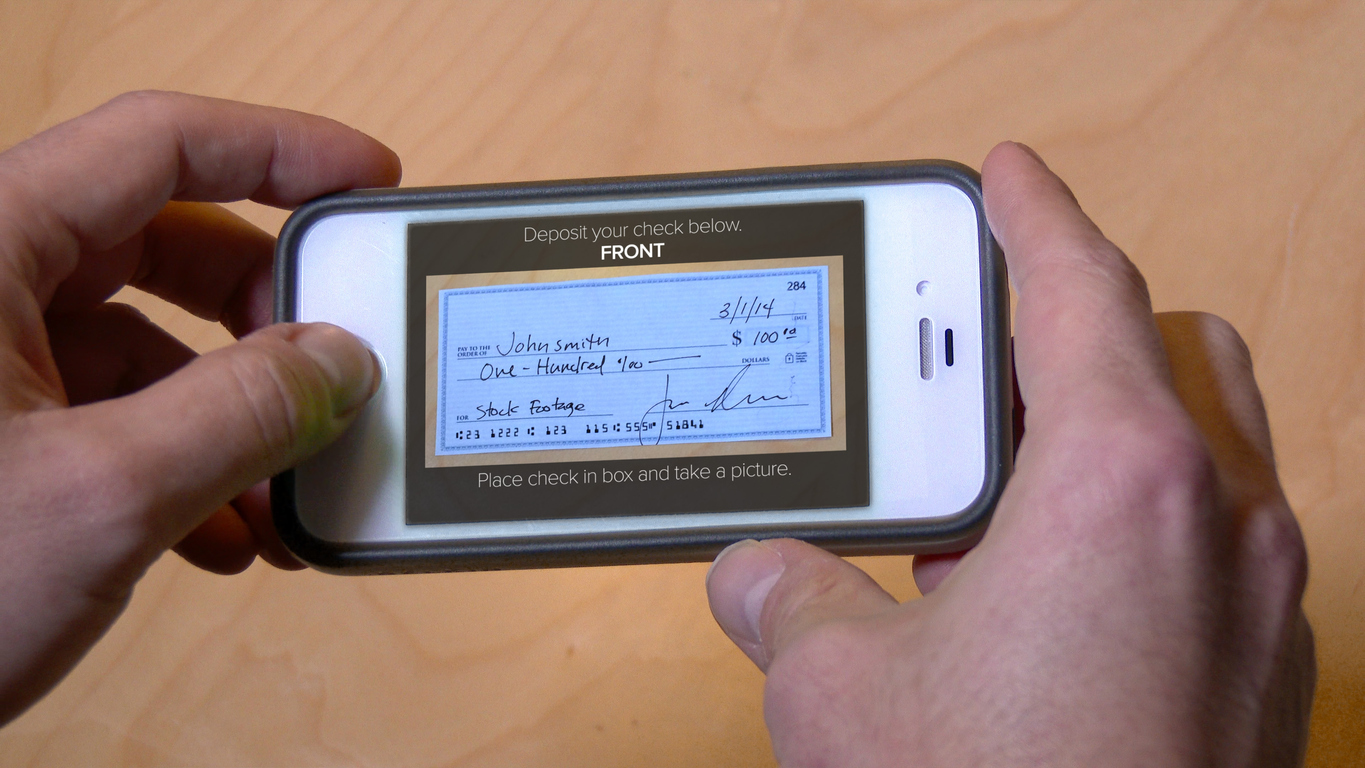

Remote Deposit Capture Greenville Federal Remote deposit capture. login: password: please wait help with security setup microsoft plug in not supportedwith current security settings. system requirements test. english (us) français canadien. Remote deposit capture (rdc) technology helps to streamline and improve the efficiency of one area of bank operations: processing check deposits. rdc allows financial institution customers to “deposit” checks electronically at remote locations, usually in the customers’ offices, for virtually instant credit to their account.

Rdc What Is Remote Deposit Capture Quick Overview Use our rdc savings calculator. extend deposits. remote deposits are fast and easy and extend your deposit window. images transmitted and confirmed by 10 pm et are posted for next business day availability. 1. secure and accurate. using secure encryption and authentication, initiate remote deposits and instantly verify they were received. Remote deposit capture (rdc) make your deposits without heading to the bank. huntington has a solution that saves time, increases accuracy, and helps to get. your money to your account faster with extended processing hours. deposit your checks—day or night—into your huntington business checking account without leaving your office. Remote deposit capture is a technology based method that lets banks accept checks for deposit using electronic images instead of the original, physical, paper versions. remote deposit capture lets. Access deposits online through u.s. bank singlepoint ®, our powerful online banking platform for businesses. collect payments from any of your business or remote locations and make deposits into one or multiple u.s. bank accounts. 10 p.m. ct daily deposit cutoff time. no daily deposit limit.

Remote Deposit Capture Rdc What Is It Examples Benefits Remote deposit capture is a technology based method that lets banks accept checks for deposit using electronic images instead of the original, physical, paper versions. remote deposit capture lets. Access deposits online through u.s. bank singlepoint ®, our powerful online banking platform for businesses. collect payments from any of your business or remote locations and make deposits into one or multiple u.s. bank accounts. 10 p.m. ct daily deposit cutoff time. no daily deposit limit. How to match rdc capabilities to your receivables needs remote deposit capture (rdc) has become a receivables essential for businesses large and small. but, with so many options in the market today, it’s important for financial institutions (fis) and businesses to evaluate rdc solutions carefully. the right mix of features—and the service you. • remote deposit capture, a deposit transaction delivery system, allows financial institution customers to deposit items electronically from remote locations. the primary rdc delivery chief treasury officer method is the internet. chief compliance officer • a financial institution offering rdc should have in.

The History Of Rdc вђ Remote Deposit Capture Checkissuing How to match rdc capabilities to your receivables needs remote deposit capture (rdc) has become a receivables essential for businesses large and small. but, with so many options in the market today, it’s important for financial institutions (fis) and businesses to evaluate rdc solutions carefully. the right mix of features—and the service you. • remote deposit capture, a deposit transaction delivery system, allows financial institution customers to deposit items electronically from remote locations. the primary rdc delivery chief treasury officer method is the internet. chief compliance officer • a financial institution offering rdc should have in.

Comments are closed.