Remote Deposit Capture Risk Assessment Template

Remote Deposit Capture Risk Assessment Template Risk management and controls for remote deposit capture can be monitored in two ways, depending on the level of risk determined by the financial institution: i.t. audit conducted by an independent internal auditor or by completing the risk self assessment form in this document. Background and purpose. remote deposit capture (rdc), a deposit transaction delivery system, allows a financial institution to receive digital information from deposit documents captured at remote locations. these locations may be the financial institution’s branches, atms, domestic and foreign correspondents, or locations owned or controlled.

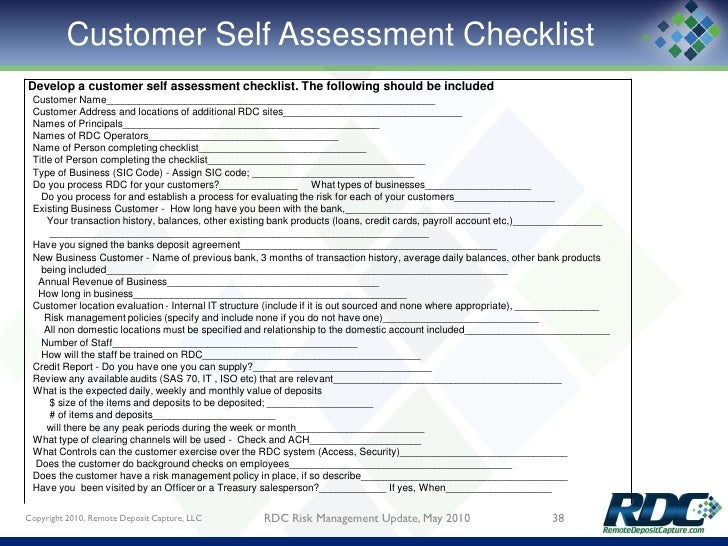

Remote Deposit Capture Risk Assessment Template Printable Word Searches Identify all remote deposit capture (rdc) systems. this task is focused on identifying all the remote deposit capture (rdc) systems that are currently in use. by doing so, we can gain a better understanding of the overall rdc landscape within the organization. the results of this task will help inform the risk assessment process and identify. Risk assessment the ffiec recommends in the 2009 guidance that financial institutions view remote deposit capture as a different and separate delivery system, and not simply an additional service. prior to implementing remote deposit capture, senior management should identify and assess legal, compliance and operational risks. Remote deposit capture (rdc) can be a risky proposition; therefore, it is critical that your organization has the appropriate controls in place to effectively and safely manage your rdc program. ffiec guidance recommends conducting an rdc risk assessment prior to deployment of remote deposit services and regularly thereafter. epcor's rdc risk. The remote deposit capture risk assessment workbook guides you in completing the step by step risk assessment questions. the user friendly excel worksheet questions are easily answered yes, no, or not applicable and include room for comments, to assist you in developing a comprehensive rdc risk management program. operations staff, risk.

Remote Deposit Capture Risk Management May 2010 Update Remote deposit capture (rdc) can be a risky proposition; therefore, it is critical that your organization has the appropriate controls in place to effectively and safely manage your rdc program. ffiec guidance recommends conducting an rdc risk assessment prior to deployment of remote deposit services and regularly thereafter. epcor's rdc risk. The remote deposit capture risk assessment workbook guides you in completing the step by step risk assessment questions. the user friendly excel worksheet questions are easily answered yes, no, or not applicable and include room for comments, to assist you in developing a comprehensive rdc risk management program. operations staff, risk. A customer receives a check (or even multiple checks) that they want to deposit on their own behalf or that of a business. the customer employs a remote deposit check scanner (such as a driverless scanner) or mobile device to capture images of the check. using a secure rdc software or app, the customer safely sends the check images to the bank. The remote deposit capture risk assessment workbook guides you in completing the step by step risk assessment questions. the user friendly excel worksheet questions are easily answered with yes, no, or not applicable and include room for comments, to assist you in developing a comprehensive rdc risk management program.

Comments are closed.