Reverse Mortgage вђ Pros And Cons Roofandfloor Blog

Reverse Mortgage вђ Pros And Cons Roofandfloor Blog A reverse mortgage is a special type of home loan that does not require any monthly mortgage payments. reverse mortgages are for older citizens (62 years and older) and can be part of their retirement planning. however, they are liable for all real estate taxes applicable as well as payments to utilities. when an individual. 3. it’s not free. you might not have to make payments with a reverse mortgage, but there are still plenty of expenses associated with one. not only do you have to keep up on your taxes.

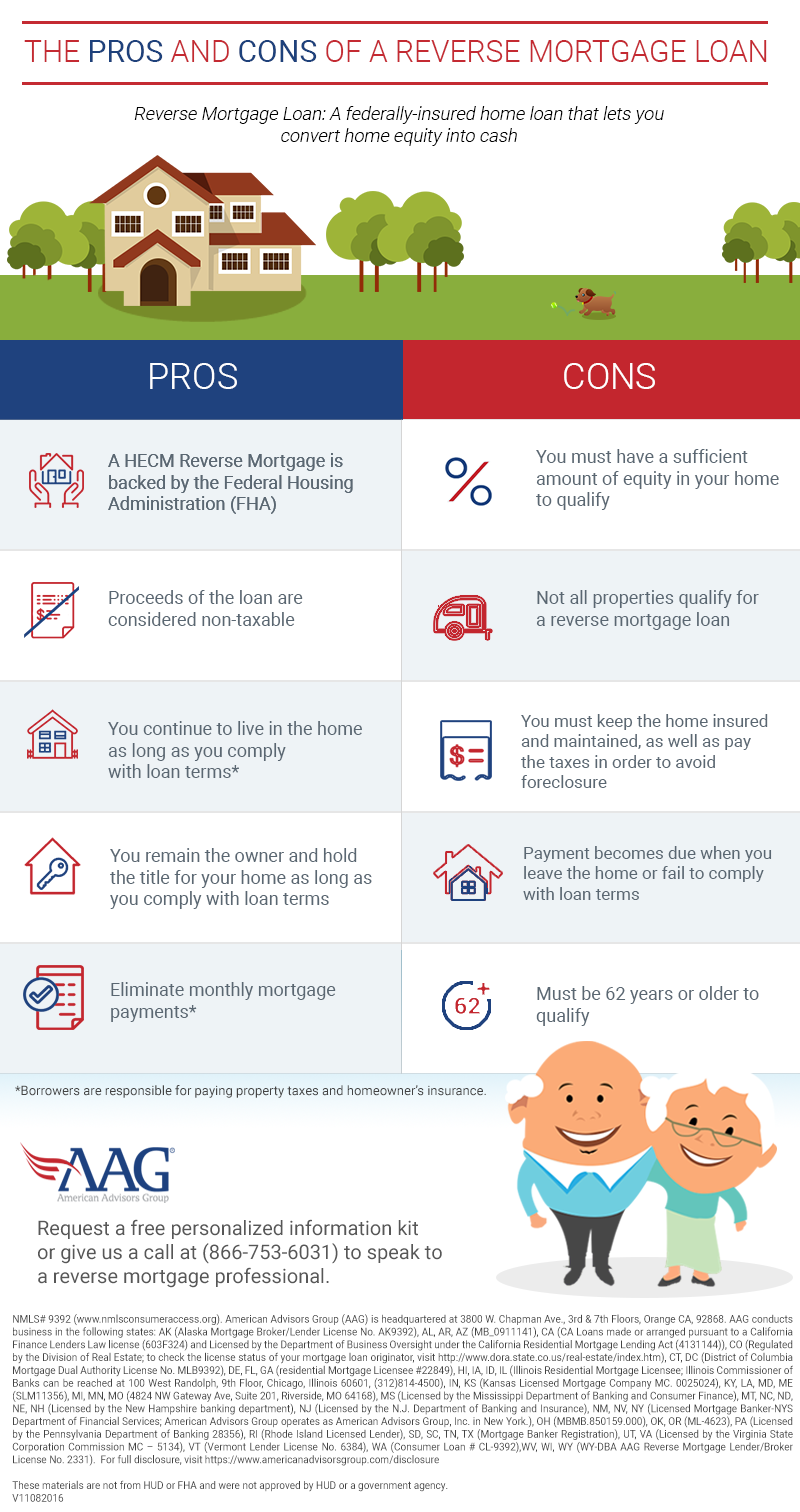

Pros Cons Of A Reverse Mortgage Loan Lexleader Pros and cons of a reverse mortgage. while a reverse mortgage may seem like a good way to access cash in your golden years, it’s important to understand the realities of this type of loan. here. Reverse mortgages: pros and cons. reverse mortgages can be a good way to shore up retirement income, but costs can outweigh benefits for some. updated may 22, 2024 · 4 min read. Key takeaways. a reverse mortgage lets you convert some of your home equity into cash, but they are designed for older homeowners. eligibility for a reverse mortgage is based on factors such as. Because of the up front costs, a reverse mortgage may be a costly choice for anyone planning to move soon. prospective borrowers should understand how spouses, partners, roommates, and heirs might.

Comments are closed.