Reverse Mortgage Explained How Do They Work Reverse Mor

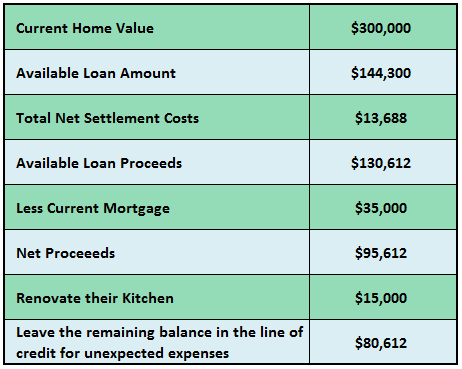

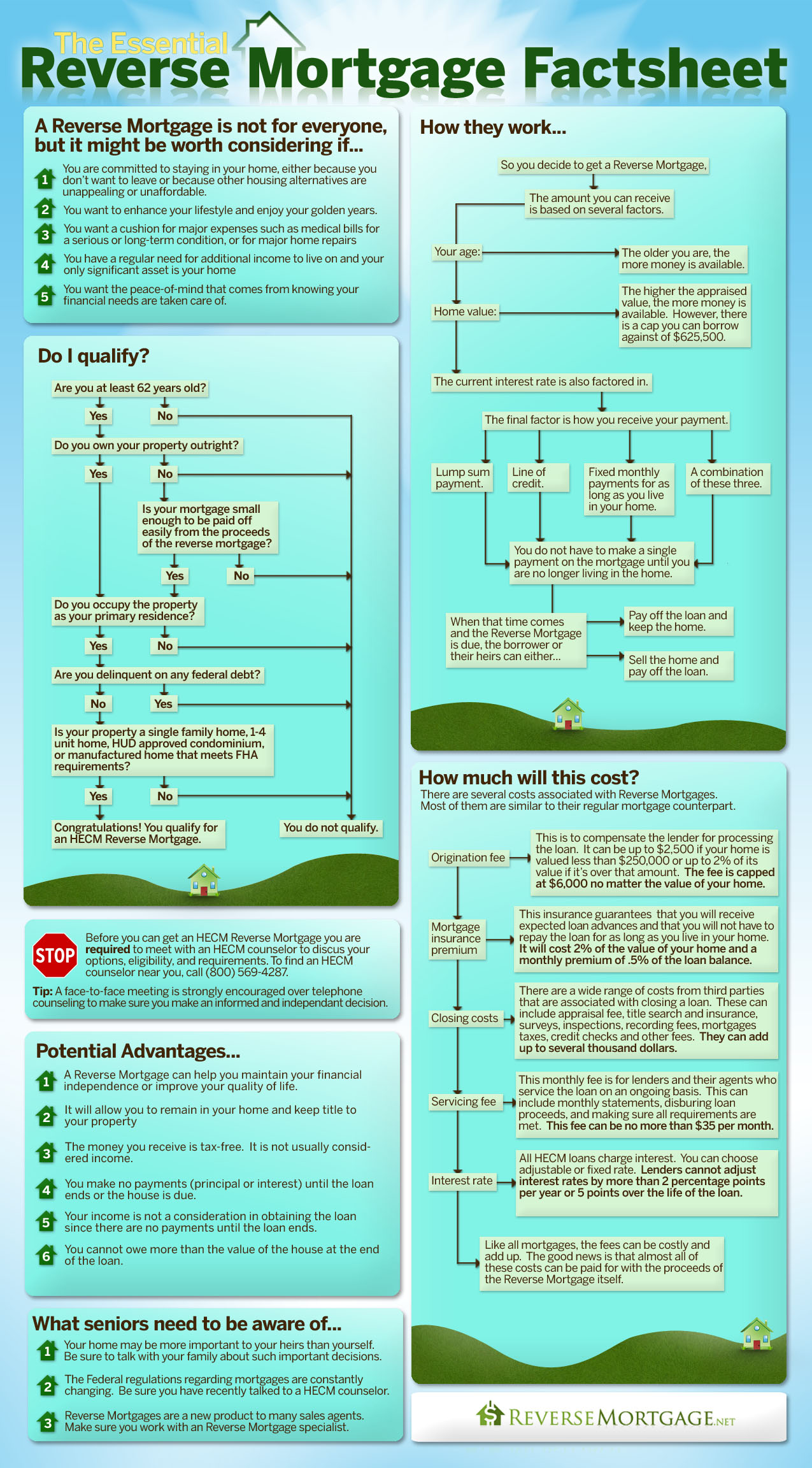

Reverse Mortgages Explained Upfront mortgage insurance premiums are fixed at 2% of the home's appraised value, so for every $100,000 in value, the borrower pays $2,000. on a $300,000 house, for example, the fee would be. Share your feedback. a reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. by borrowing against their equity, seniors.

How Does A Reverse Mortgage Work An Example To Explain How It Works A reverse mortgage is a loan that allows homeowners – most often those 62 or older – to borrow against a portion of the equity in their home. a reverse mortgage works differently than a traditional mortgage loan, though. instead of making payments to your lender, your lender will make a payment to you. the loan first pays off your existing. A reverse mortgage allows you to convert part of your home’s equity to cash for everyday living expenses and unexpected bills. however, reverse mortgages aren’t a one size fits all solution for everyone — only homeowners ages 62 or older can qualify. it’s important to first understand how they work to help you decide whether a reverse. A reverse mortgage is a type of loan that allows homeowners ages 62 and older to borrow against their home’s equity for tax free payments. the reverse mortgage lender makes these payments to the. If you think a reverse mortgage might be right for you, find an hecm counselor or call 800 569 4287 toll free to learn more about this financing option. if you decide to apply for a reverse.

Hereтащs How To Get Out Of A юааreverseюаб юааmortgageюаб A reverse mortgage is a type of loan that allows homeowners ages 62 and older to borrow against their home’s equity for tax free payments. the reverse mortgage lender makes these payments to the. If you think a reverse mortgage might be right for you, find an hecm counselor or call 800 569 4287 toll free to learn more about this financing option. if you decide to apply for a reverse. A reverse mortgage is a loan for homeowners 62 and up with a large amount of home equity. the homeowner can borrow money from a lender against the value of their home and receive the funds as a line of credit or monthly payments. chase does not offer reverse mortgages. when you typically think of a mortgage, the first thing that may come to. Key takeaways. a reverse mortgage lets you convert some of your home equity into cash, but they are designed for older homeowners. eligibility for a reverse mortgage is based on factors such as.

What Is A Reverse Mortgage How Do They Work Millionacres A reverse mortgage is a loan for homeowners 62 and up with a large amount of home equity. the homeowner can borrow money from a lender against the value of their home and receive the funds as a line of credit or monthly payments. chase does not offer reverse mortgages. when you typically think of a mortgage, the first thing that may come to. Key takeaways. a reverse mortgage lets you convert some of your home equity into cash, but they are designed for older homeowners. eligibility for a reverse mortgage is based on factors such as.

Reverse Mortgage Information

Comments are closed.