Reverse Mortgage Loan Pros And Cons Government Jobs Growth Mindset

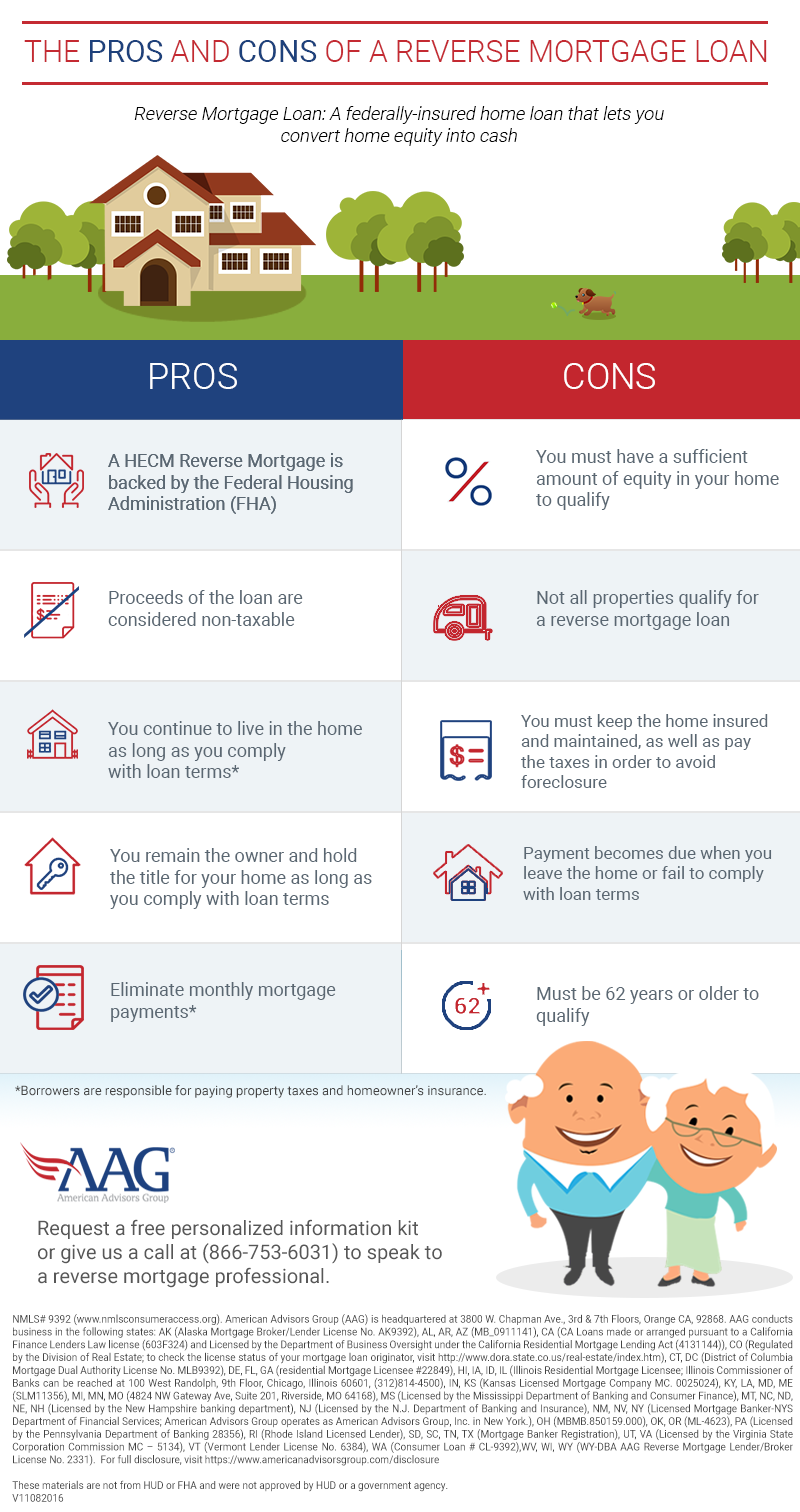

Reverse Mortgage Loan Pros And Cons Government Jobs Growth Mindset 3. it’s not free. you might not have to make payments with a reverse mortgage, but there are still plenty of expenses associated with one. not only do you have to keep up on your taxes. A reverse mortgage allows homeowners age 62 and older to tap the value of their home while continuing to live in it. no payments are due on the money borrowed until the homeowner moves out or dies. retirees often take out these loans deep into retirement when they have depleted their savings. caution: retirees in such situations often run.

Pros Cons Of A Reverse Mortgage Loan Lexleader Learn more about the pros and cons of reverse mortgages, including the typical criteria to get one. the 2024 loan limit for a government backed reverse mortgage is between $498,257 and. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. by borrowing against their equity, seniors get access to cash to. 4. you risk default or foreclosure. failing to adhere to the terms of a reverse mortgage could leave you in default on your loan. and from there, you risk foreclosure on your property. if you don. Reverse mortgages come with higher fees than most traditional loans, and borrowers are also faced with mortgage insurance costs up to 2.5% of the home value. what’s more, most reverse mortgage.

Comments are closed.