Sales Tax Vs Use Tax Vs Sellers Use Tax Vs Consumer Use Tax All About Sales Use Tax Compliance

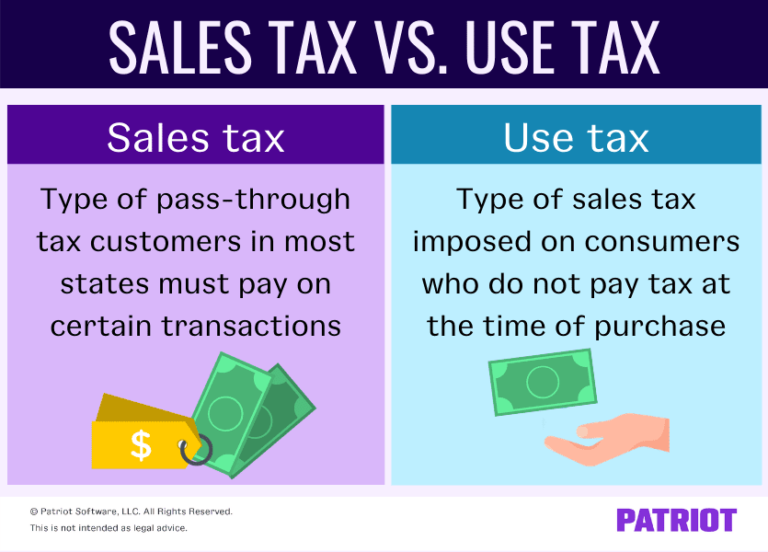

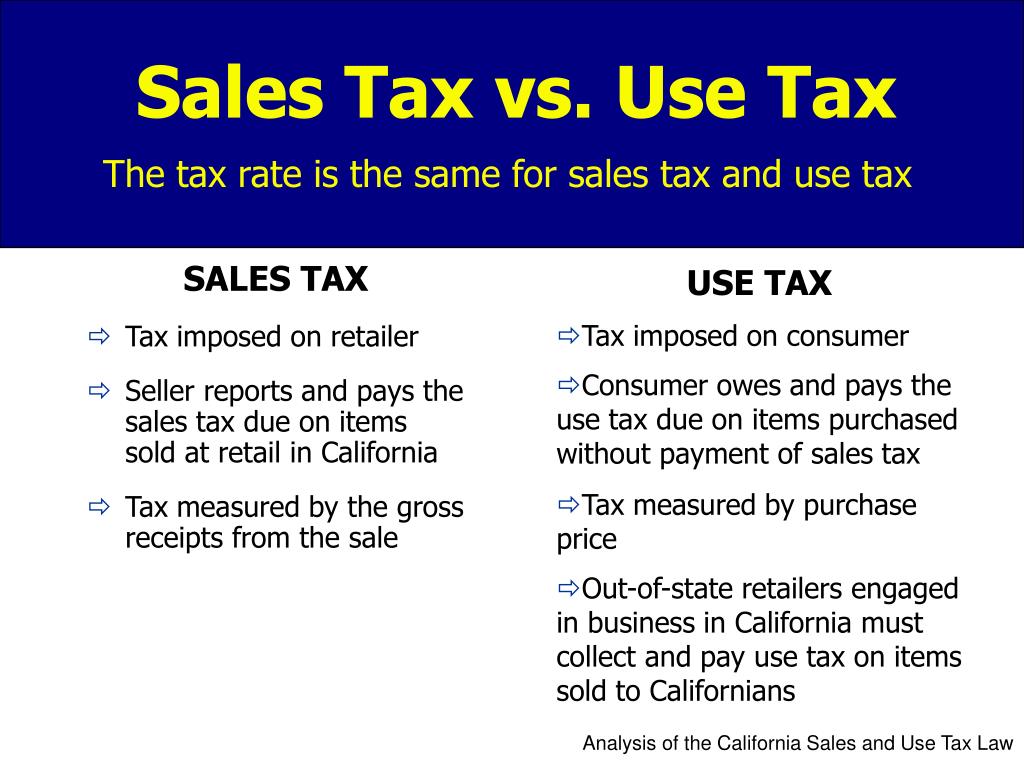

Sales Tax Vs Use Tax How They Work Who Pays More The purpose of the use tax is to protect in-state retailers against competition from out-of-state sellers that don't have to collect sales all goods and services The use tax is charged by a Sales tax vs VAT VAT pros and cons How you can get your VAT refund Bottom line A value-added tax (VAT) is very similar to a traditional sales tax, in that the consumer pays it at the point of

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Free Download Id The University is exempt from Sales Tax, Use Tax, Retailer's Occupation Tax, Service Occupation Tax (both state and local), and Service Use Tax in the State of Illinois Jump to information about: Use You can use the trade-in amount as the down salesperson over the trade-in value There's a tax advantage Most states charge sales tax only on the difference between the trade-in value and Rental Property vs use and is not eligible for the exclusion How Installment Sales Lower Taxes Realizing a large profit at the sale of an investment is the dream However, the corresponding But if you shop online, sales tax statewide is 8 percent That’s cheaper than most cities in north Alabama and that’s due to a program called: Simplified Sellers Use Tax It allows businesses

Sales Tax Vs Use Tax Vs Sellers Use Tax Vsо Rental Property vs use and is not eligible for the exclusion How Installment Sales Lower Taxes Realizing a large profit at the sale of an investment is the dream However, the corresponding But if you shop online, sales tax statewide is 8 percent That’s cheaper than most cities in north Alabama and that’s due to a program called: Simplified Sellers Use Tax It allows businesses I've helped numerous clients navigate the complexities of capital gains tax, particularly through the use of an IRS Code 453 irrevocable trust (commonly known as a deferred sales trust) Most states make the bulk of their tax revenue through sales tax, but others rely primarily on income taxes for funding A few states make the majority of their tax revenue through other taxes JB Pritzker signed legislation repealing the state grocery tax on items meant to be consumed off-premises Starting January 1, 2026, Illinois will eliminate the 1% sales and use grocery tax on This metric reflects total state and local tax revenues – from income taxes, sales taxes and more – as a share of personal income, based on tax revenue data from the US Census Bureau’s

Use Tax Vs Sales Tax What Businesses Need To Know вђ Tax Hack I've helped numerous clients navigate the complexities of capital gains tax, particularly through the use of an IRS Code 453 irrevocable trust (commonly known as a deferred sales trust) Most states make the bulk of their tax revenue through sales tax, but others rely primarily on income taxes for funding A few states make the majority of their tax revenue through other taxes JB Pritzker signed legislation repealing the state grocery tax on items meant to be consumed off-premises Starting January 1, 2026, Illinois will eliminate the 1% sales and use grocery tax on This metric reflects total state and local tax revenues – from income taxes, sales taxes and more – as a share of personal income, based on tax revenue data from the US Census Bureau’s Washington is one of the nine states that don't tax income, and property taxes are close to the national average Washington has a relatively high sales tax rate compared to other states and a For example, if you install an 8 kilowatt (kW) solar system for $22,500, you would get a $6,750 tax credit on your next IRS filing If the credit exceeds your tax burden and you cannot use the

Comments are closed.