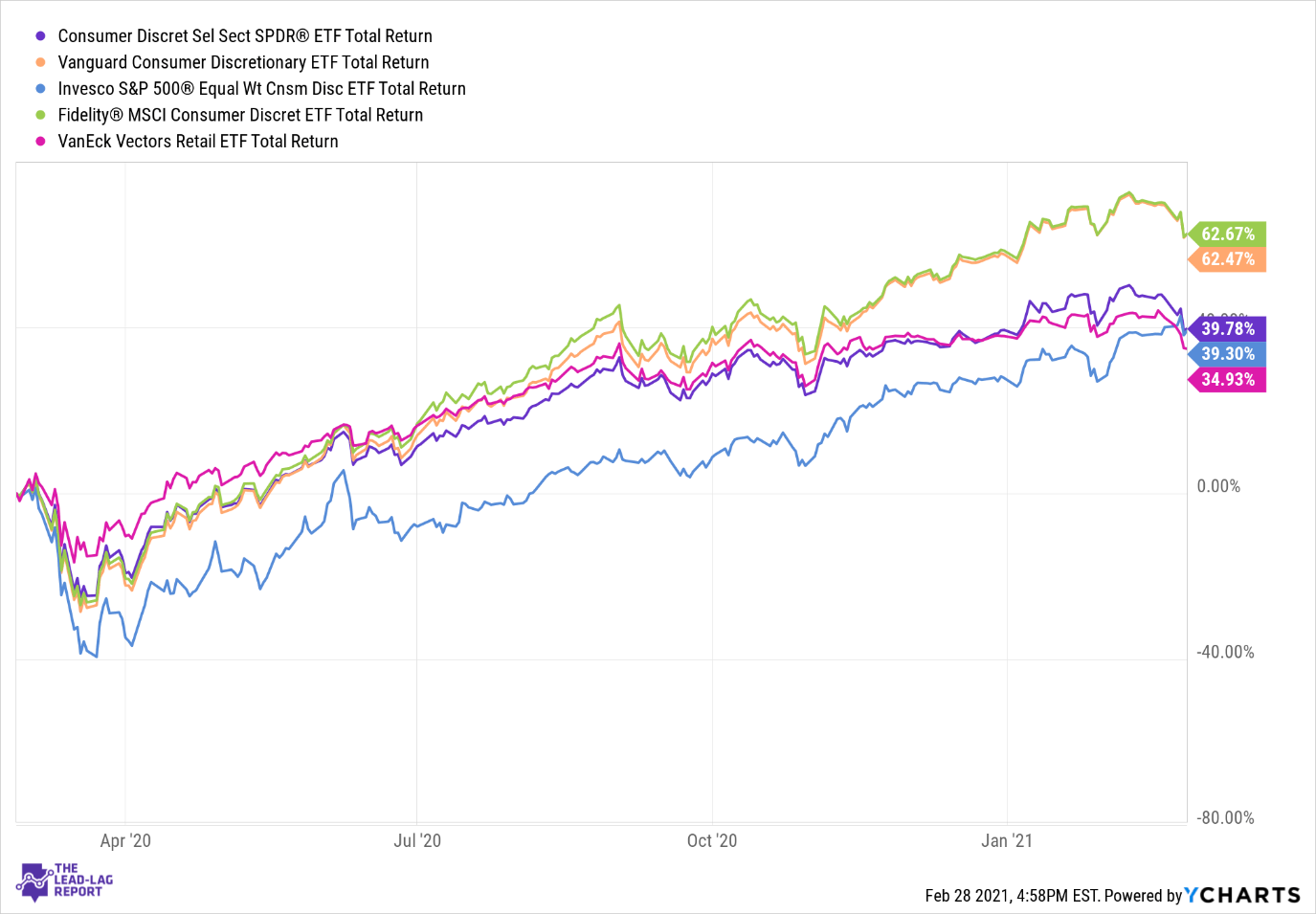

Sector Etfs Are Not The Same Consumer Discretionary

Best Worst Etfs Mutual Funds Consumer Discretionary Sector The two are not exactly the same, though. their top sector etfs often track subtly different sector indexes, resulting in different performance profiles. consumer discretionary select sector. This resilience helped support the stocks of the consumer discretionary sector, which encompasses companies that sell nonessential goods and services like clothes, new cars, and hotel stays. in 2024, these stocks are likely to continue to rise or fall with the fate of us consumers. because these companies sell nonessential goods and services.

Consumer Discretionary Meaning Sectors Stocks Etfs Decent earnings. the consumer discretionary sector is expected to record 26.3% earnings growth in the third quarter while earnings growth for the final quarter of 2023 is likely to be 18.1%. for. While consumer discretionary and consumer staples both cover industries that involve people buying things, they’re not the same. the latter covers all the things people need daily, such as food and hygiene products, so the sector’s fortunes are perceived to be fairly consistent. Year to date, the vanguard consumer discretionary etf return is roughly 5.21% so far, and is up about 16.41% over the last 12 months (as of 08 28 2024). vcr has traded between $247.89 and $331.81. The consumer discretionary sector lagged the broader market early in 2024, but that trend has reversed as the summer travel season arrived and consumer etfs are outperforming the s&p 500 again.

Best Worst Etfs Mutual Funds Consumer Discretionary Sector Year to date, the vanguard consumer discretionary etf return is roughly 5.21% so far, and is up about 16.41% over the last 12 months (as of 08 28 2024). vcr has traded between $247.89 and $331.81. The consumer discretionary sector lagged the broader market early in 2024, but that trend has reversed as the summer travel season arrived and consumer etfs are outperforming the s&p 500 again. Ishares us consumer discretionary etf (iyc) was launched on 6 12 2000 and tracks the russell 1000 consumer discretionary 40 act 15 22.5 daily capped index. it has a total expense ratio of 0.39. Xly, a highly liquid etf, holds a diversified portfolio of consumer discretionary stocks from the s&p 500. most notably, heavyweights amazon, tesla and home depot inc. (hd) account for 48% of the.

Consumer Discretionary Select Sector Spdr Etf Xly May Continue To Ishares us consumer discretionary etf (iyc) was launched on 6 12 2000 and tracks the russell 1000 consumer discretionary 40 act 15 22.5 daily capped index. it has a total expense ratio of 0.39. Xly, a highly liquid etf, holds a diversified portfolio of consumer discretionary stocks from the s&p 500. most notably, heavyweights amazon, tesla and home depot inc. (hd) account for 48% of the.

Comments are closed.