Self Employed Vs Business Owner

Business Owner Vs Self Employed Simplifying Success Learn how the irs classifies self employed and small business owners differently and how it affects their taxes. find out when and why you should transition from being self employed to being a small business owner. Self employed vs business owner: differences in benefits. self employed people might not be able to receive benefits that are typically provided to employees, including paid time off or health insurance. small business owners have more freedom to design their own benefits plan for both themselves and their staff.

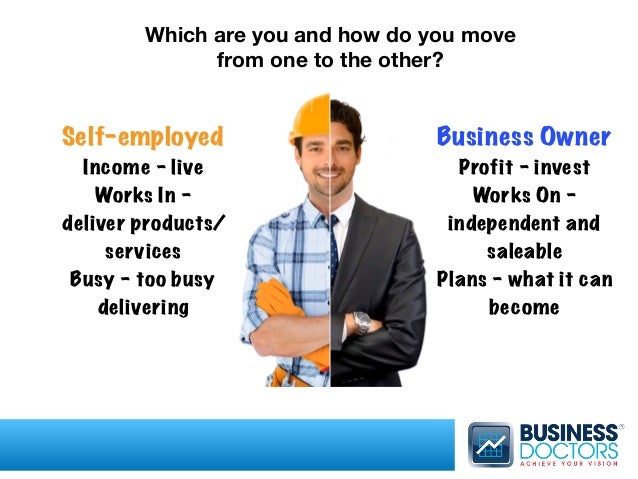

Business Owner Vs Self Employed Management And Leadership Learn the difference between being a business owner and a self employed individual, and the advantages and disadvantages of each entity structure. compare the costs, tax implications, liability risks, and insurance needs of sole proprietorships and llcs. Self employed vs. business owner. brad touesnard, ceo of the tech company spinupwp, says the difference is how you earn. he quotes rich dad poor dad author robert kiyosaki as saying that self employed people earn from their own work, but business owners earn from a system they created. “for example," touesnard says, “if you are a graphic. While being self employed is defined as being your own boss, being a small business owner is simply characterized by having others work for you. as a small business owner, you can hire independent contractors or employees. if you decide to hire employees, you will have the obligation of collecting taxes, offering sick and vacation pay, and. By either definition, both self employed and sole proprietors are responsible for taking care of their own payroll taxes and insurance. for instance, a sole proprietorship would include personal assets in a tax filing for their business, while a separate business entity, such as a limited liability company (llc), would not.

Business Owner Vs Self Employed Management And Leadership While being self employed is defined as being your own boss, being a small business owner is simply characterized by having others work for you. as a small business owner, you can hire independent contractors or employees. if you decide to hire employees, you will have the obligation of collecting taxes, offering sick and vacation pay, and. By either definition, both self employed and sole proprietors are responsible for taking care of their own payroll taxes and insurance. for instance, a sole proprietorship would include personal assets in a tax filing for their business, while a separate business entity, such as a limited liability company (llc), would not. Tax requirements for self employed professionals . self employed professionalsare typically required to file an annual income tax return and pay quarterly estimated taxes four times a year. similar to full time employees, they'll also pay a 15.3% self employment tax to cover social security and medicare contributions. The bottom line is this: if you identify as a small business owner, then that makes you a small business owner. period. but whether you consider yourself to be self employed or a small business owner, there are certain things you need in place to make sure your work and finances are protected. these include:.

Comments are closed.