Sequence Of Returns Risk How To Mitigate Using A Hecm Reverse

Sequence Of Returns Risk How To Mitigate Using A Hecm Reverse A deep dive case study from 2018 that holds true today, on how to use an fha hecm line of credit reverse mortgage to protect your investment portfolio during. Still, pfau identified two strategies that can use low interest rates to their advantage. one is delaying social security because it has a “built in implicit rate of return of 2.9% after.

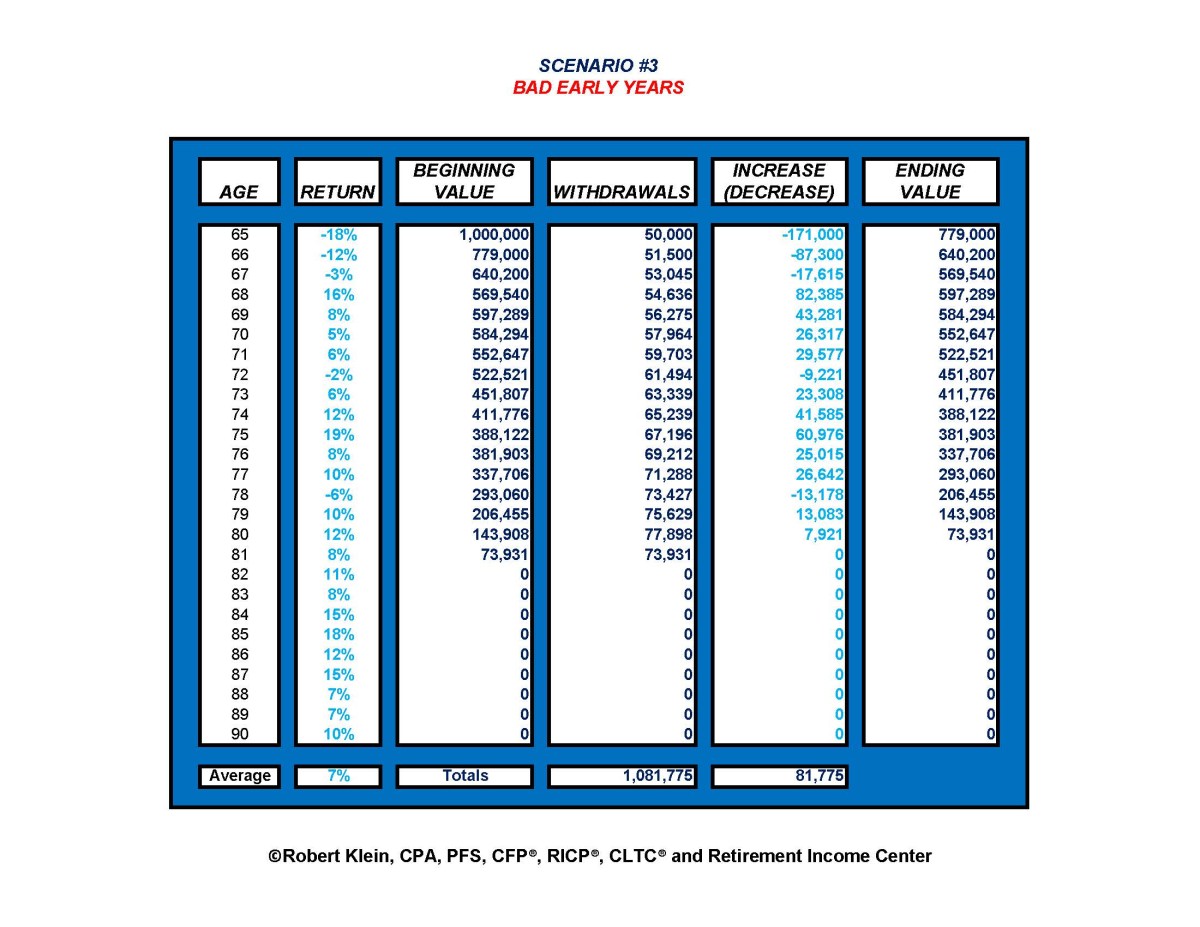

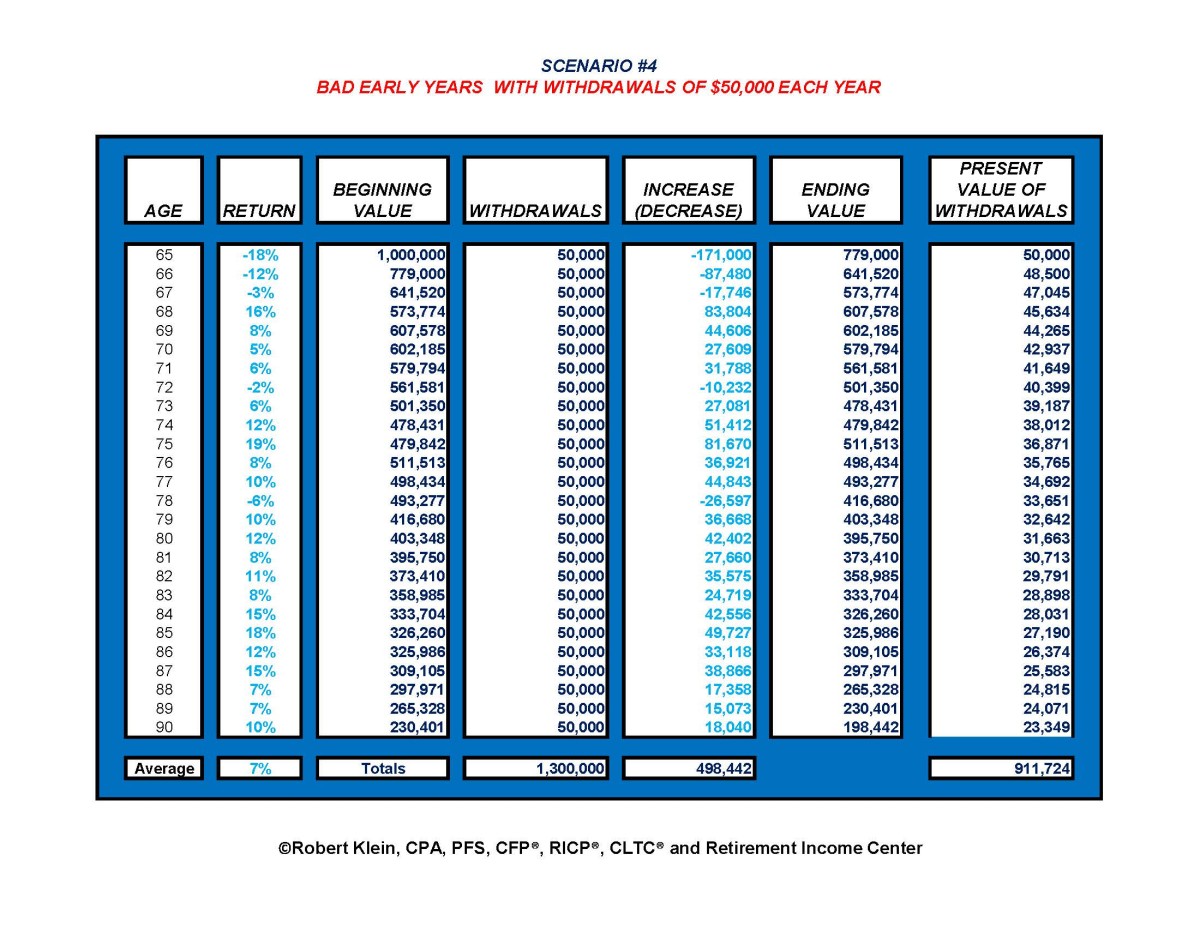

Using A Hecm Line Of Credit To Mitigate Sequence Of Return Risk A home equity conversion mortgage, better known as a reverse mortgage, can be used to manage and mitigate the sequence of returns risk according to robert klein, president of retirement income center. A home equity conversion mortgage (hecm) line of credit provides a tool that can be used to mitigate the impacts of sequence of returns risk (the risk of incurring portfolio losses early in retirement). since 2012, a series of research articles has highlighted how the strategic use of a reverse mortgage can either preserve greater overall. To help mitigate against sequence of returns risk, pfau offers four strategies, including “using buffer assets like cash, a reverse mortgage or whole life policy with cash value.” read the full article ready to look at reverse? find out more on our website, and reach out to us at reverse@plazahomemortgage . let’s explore adding reverse. An hecm line of credit provides a tool that can be used to mitigate the impacts of sequence of returns risk. since 2012, this has been the focus of a series of research articles highlighting how the strategic use of a reverse mortgage can either preserve greater overall legacy wealth for a given spending goal, or can otherwise sustain a higher.

Insure Sequence Of Returns Risk With A Hecm Mortgage Retirement Daily To help mitigate against sequence of returns risk, pfau offers four strategies, including “using buffer assets like cash, a reverse mortgage or whole life policy with cash value.” read the full article ready to look at reverse? find out more on our website, and reach out to us at reverse@plazahomemortgage . let’s explore adding reverse. An hecm line of credit provides a tool that can be used to mitigate the impacts of sequence of returns risk. since 2012, this has been the focus of a series of research articles highlighting how the strategic use of a reverse mortgage can either preserve greater overall legacy wealth for a given spending goal, or can otherwise sustain a higher. Approaches for managing sequence of returns risk in retirement. (1) spend conservatively. (2) maintain spending flexibility. (3) reduce volatility (when it matters most) build a retirement income. •reverse mortgages cannot be viewed in isolation: their costs can be more than offset by gains elsewhere in the financial plan •conventional “last resort” wisdom hurts retirement sustainability •strategic hecm use: improved retirement sustainability, larger legacy •why it works: buffer to mitigate sequence risk; growing line of credit.

Insure Sequence Of Returns Risk With A Hecm Mortgage Retirement Daily Approaches for managing sequence of returns risk in retirement. (1) spend conservatively. (2) maintain spending flexibility. (3) reduce volatility (when it matters most) build a retirement income. •reverse mortgages cannot be viewed in isolation: their costs can be more than offset by gains elsewhere in the financial plan •conventional “last resort” wisdom hurts retirement sustainability •strategic hecm use: improved retirement sustainability, larger legacy •why it works: buffer to mitigate sequence risk; growing line of credit.

Sequence Of Return Risk Youtube

Comments are closed.