Solar Energy Tax Credits 2024 Roze Brandea

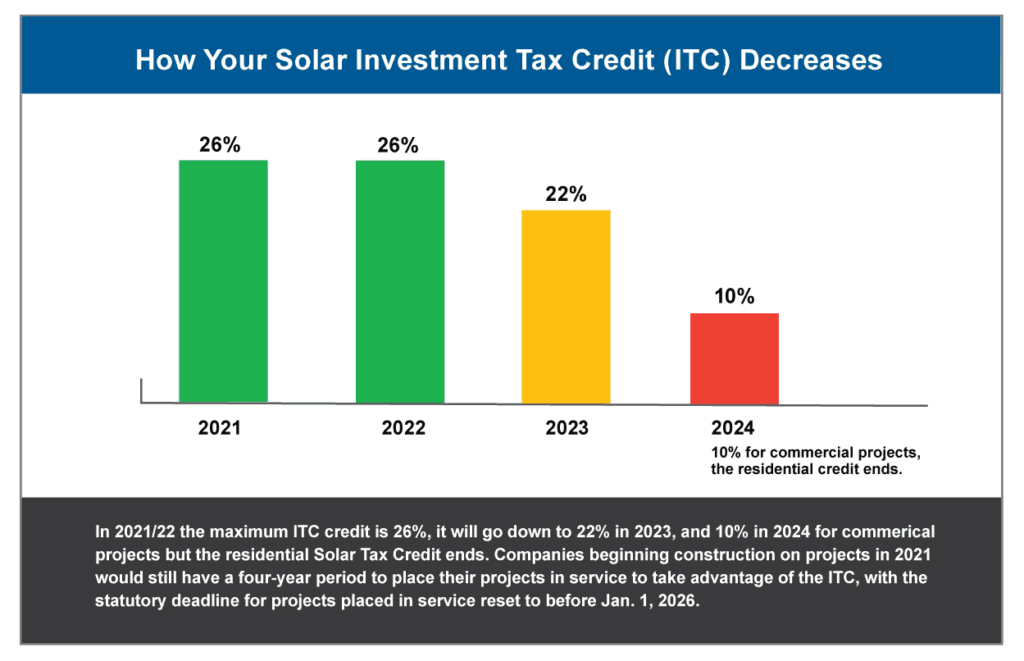

Federal Solar Tax Credits For Businesses Department Of Energy Customers can redeem any unused credits at the commodity energy supply rate in April Marylanders who install solar panels qualify for the federal Solar Investment Tax Credit (ITC) The ITC is Although switching to solar energy can be expensive initially, state and federal relief programs help make solar panels worth it One of the most significant tax credits is the federal solar tax

Solar Energy Tax Credits By State Md Nj Pa Va Dc Fl Tax season: It's certainly not a time of year most Americans look forward to But it might be a reason to celebrate if you made certain energy-related improvements to your home last year -- like California has a strong presence in the solar energy market, having ranked first in the nation for solar energy production in 2024 so far Solar tax credits encourage investments in solar There’s no way around it: Installing solar panels is expensive On the bright side, Louisiana residents can take advantage of federal solar tax credits for sending any excess solar energy With net metering, you can send excess solar energy generation back to the grid in exchange for billing credits to cover your nighttime consumption Along with the national tax credit, net

Comments are closed.