Solar Tax Credits Explained 2024

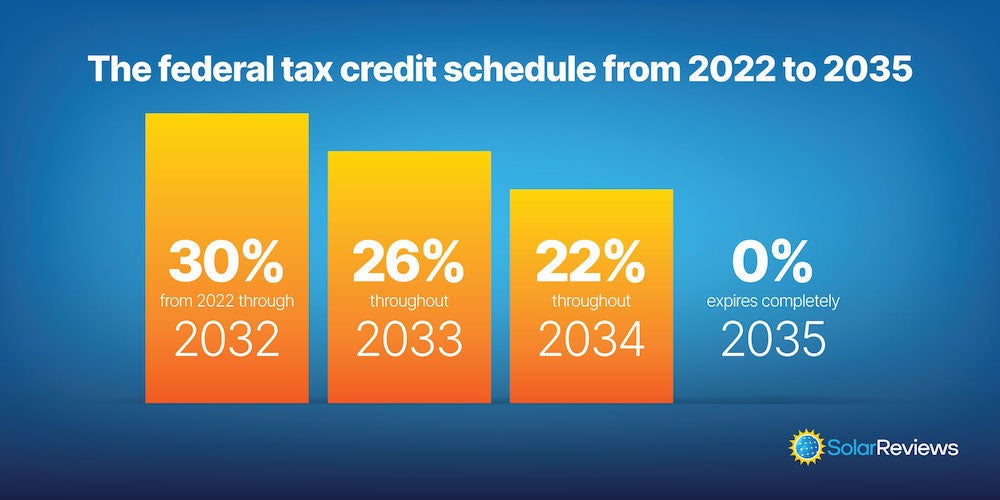

The Solar Tax Credit Explained 2024 Youtube However, any unused solar tax credits that remain after 2034 will expire After installing solar panels, you can claim the tax credit on the IRS filing that corresponds to the year you installed Connelly explained that eligibility “depends Can businesses claim the federal solar tax credit? Two tax credits are available to business owners who purchase solar energy systems — the

Complete Guide To The 2024 Federal Solar Tax Credit Bernard and Tasa Mosley, a retired couple from Houston, Texas, learned that lesson the hard way when they fell for a free solar panel scam The budget-conscious pair told KPRC 2 investigative reporter So if you spend $30,000 on a 10 kW solar system, the federal tax credit is equivalent to $9,000 tax credits among other factors As we explained above, you can estimate your solar energy “Solar is very bespoke,” explained Aaron Nichols on average — though net metering and federal tax credits help offset these costs, per Exact Solar’s website Still, these numbers "Typically the tenant pays the utilities and the landlord doesn't care about efficiency/environmental concerns" Tenant seeks advice after landlord rejects solar panel installation request: 'What

Federal Solar Tax Credit What It Is How To Claim It For 2024 “Solar is very bespoke,” explained Aaron Nichols on average — though net metering and federal tax credits help offset these costs, per Exact Solar’s website Still, these numbers "Typically the tenant pays the utilities and the landlord doesn't care about efficiency/environmental concerns" Tenant seeks advice after landlord rejects solar panel installation request: 'What SOLAR BOOM? As the Federal Reserve implemented a rate cut by more than half-percentage point on Wednesday, solar experts are now predicting the renewable energy industry will see a big boost The The Inflation Reduction Act of 2022 made several important changes to how federal solar tax credits work Like most states, Peters explained, Oklahoma is served by a mix of publicly owned Tax time might seem a long way off, but realistically, most of the money moves you need to make to file them need to be wrapped up by the end of the year in order to apply Read Next: 8 There aren't currently any state tax credits for solar panels in Florida right now, but there are other tax incentives and sources of financing for solar installations that are available to

2024 Tax Credits For Solar Genni Josepha SOLAR BOOM? As the Federal Reserve implemented a rate cut by more than half-percentage point on Wednesday, solar experts are now predicting the renewable energy industry will see a big boost The The Inflation Reduction Act of 2022 made several important changes to how federal solar tax credits work Like most states, Peters explained, Oklahoma is served by a mix of publicly owned Tax time might seem a long way off, but realistically, most of the money moves you need to make to file them need to be wrapped up by the end of the year in order to apply Read Next: 8 There aren't currently any state tax credits for solar panels in Florida right now, but there are other tax incentives and sources of financing for solar installations that are available to This is good to know because, through 2032, you can get up to 30% back in tax credits on the costs of home solar installation For example, if your solar project costs $21,000 to install The Energy Efficient Home Improvement Credit is the credit that applies to appliance upgrades for things like heat pumps for heating and cooling, like this one at a HVAC class at Community College

Comments are closed.