Solved Tabi E 1 Future Value Of 1table 2 Future Valueођ

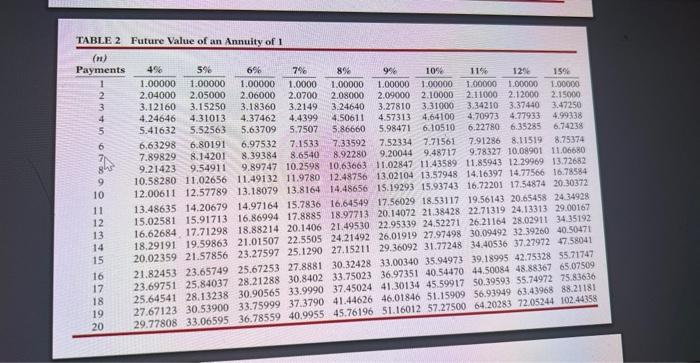

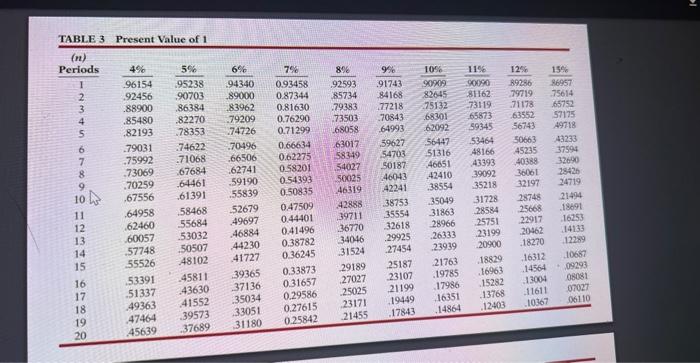

Solved Tabi E 1 Future Value Of 1table 2 Futureођ Tabi.e 1 future value of 1table 2 future value of an annuity of 1table 3 present value of 1table 4 present value of an annuity of 1 (n)blossom company is considering investing in an annuity contract that will return $30,500 annually at the end of each year for 19 years. click here to view the factor table. Tabi.e 1 future value of 1 (ti) table 2 future value of an annuity of 1 table 3 present value of 1 table 4 present value of an annuity of 1 current attempt in progress wildhorse enterprises earns 11% on an investment that pays back $85, 000 at the end of each of the next 7 years. click here to view the factor table (for calculation purposes.

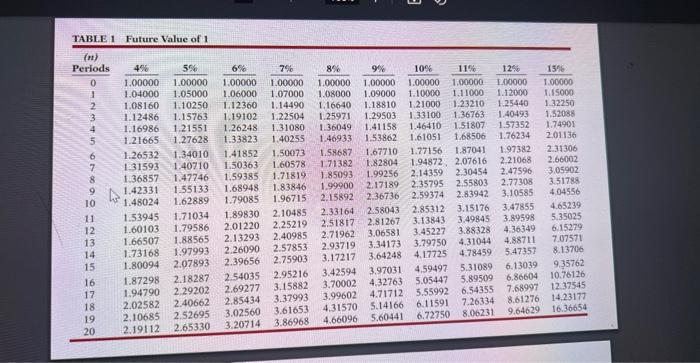

Solved Tabi E 1 Future Value Of 1table 2 Futureођ Table 1 future value of 1 tabi.e 2 future value of an annuity of itabi.e 2 future value of an annuity of 1table 3 present value of 1table 4 present value of an annuity of 1charles and susan garfield invested $5.700 in a savings account paying 6% annual interest when their daughter, margaret, was born. A good example of this kind of calculation is a savings account because the future value of it tells how much will be in the account at a given point in the future. it is possible to use the calculator to learn this concept. input $10 (pv) at 6% (i y) for 1 year (n). we can ignore pmt for simplicity's sake. pressing calculate will result in an. Use the future value (fv) formula: fv = pv⋅ (1 r)n. substitute the known values for present value (pv), annual interest rate (r) and number of years of the investment (n): fv = $1000⋅ (1 0.08)5. perform the corresponding numerical calculations and obtain the future value: fv = $1,469.33. The future value formula is fv=pv (1 i) n, where the present value pv increases for each period into the future by a factor of 1 i. the future value calculator uses multiple variables in the fv calculation: the present value sum. number of time periods, typically years.

Solved Tabi E 1 Future Value Of 1table 2 Futureођ Use the future value (fv) formula: fv = pv⋅ (1 r)n. substitute the known values for present value (pv), annual interest rate (r) and number of years of the investment (n): fv = $1000⋅ (1 0.08)5. perform the corresponding numerical calculations and obtain the future value: fv = $1,469.33. The future value formula is fv=pv (1 i) n, where the present value pv increases for each period into the future by a factor of 1 i. the future value calculator uses multiple variables in the fv calculation: the present value sum. number of time periods, typically years. Fvif calculator to create a printable compound interest table or a future value of $1 table. future value is calculated from the formula. f v = p v (1 i) n ⇒ f v = $ 1 (1 i) n. where fv is the future value, pv is the present value = $1, i is the interest rate in decimal form and n is the period number. pv is the present value (principal. Future value calculation example. let us assume a $100,000 investment with a known annual interest rate of 14% from which one wants to withdraw $5,000 at the end of each annual period. what is the future value of this investment if we expect 1, 2, 3, 5, or 10 years from now? the answers are shown in the table below.

Comments are closed.