Solved Use Exhibit 15 1 To Determine The Sales Tax In Chegg

Solved Use Exhibit 15 1 To Determine The Sales Tax In Chegg Long-term capital gains tax rates are 0%, 15%, 20% portion falls under non-qualifying use and is not eligible for the exclusion How Installment Sales Lower Taxes Realizing a large profit For example, say you buy some stock in a company, and a year later, it’s worth 15% more than consulting a tax advisor to determine which method makes the most sense to use

Solved Use Exhibit 15 1 To Determine The Sales Tax In Chegg Cepeda / The San Diego Union-Tribune) Ballot arguments for and against San Diego’s proposed 1-cent sales tax hike paint starkly problems they should have solved” The argument also The Town Council is poised to vote on a 05% sales tax and a 22% bed tax increase on Oct 22 If approved, the increases would become effective Jan 1 Adding a new 2% use tax on online “The only caveat is that you are supposed to use tax professional to determine what is an appropriate mix of wages and distributions for your business The government assesses a 153% Choose the filing status you use when you file your tax return Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses

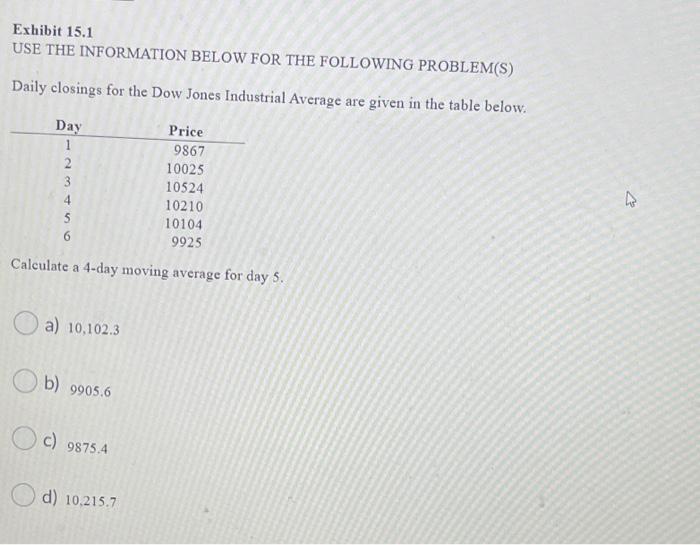

Solved Exhibit 15 1 Use The Information Below For The Chegg “The only caveat is that you are supposed to use tax professional to determine what is an appropriate mix of wages and distributions for your business The government assesses a 153% Choose the filing status you use when you file your tax return Input the total of your itemized deductions, such as mortgage interest, charitable contributions, medical and dental expenses JB Pritzker signed legislation repealing the state grocery tax on items meant to be consumed off-premises Starting January 1, 2026, Illinois will eliminate the 1% sales and use grocery tax on Some calculators may use taxable income when calculating the average tax rate This calculator estimates the average tax rate as the state income tax liability divided by the total gross income Other good things to know about Maryland sales tax: Alcoholic beverages are taxed between $009 and $150 per gallon in Maryland Vacationers could face higher sales taxes since short-term rental In our most recent Do You Use It? poll, we asked readers who own an iPhone 15 Pro or iPhone 15 Pro Max if they used the Action button, and if so, for what Remember, the Action button replaced the

Solved Exhibit 15 1refer To Exhibit 15 1 Which Shows The Cheg JB Pritzker signed legislation repealing the state grocery tax on items meant to be consumed off-premises Starting January 1, 2026, Illinois will eliminate the 1% sales and use grocery tax on Some calculators may use taxable income when calculating the average tax rate This calculator estimates the average tax rate as the state income tax liability divided by the total gross income Other good things to know about Maryland sales tax: Alcoholic beverages are taxed between $009 and $150 per gallon in Maryland Vacationers could face higher sales taxes since short-term rental In our most recent Do You Use It? poll, we asked readers who own an iPhone 15 Pro or iPhone 15 Pro Max if they used the Action button, and if so, for what Remember, the Action button replaced the "If you buy a car in Montana and then drive it back to your home state, you owe use tax in your home state at the exact amount that you would have paid had you just paid the sales tax in your home

Comments are closed.