Stock Options For Employees 101 Vesting Exercising And Rsus Vs Isos Equity Startup Salary

Vesting Schedule Startup Template Blackout periods — times when an employer prohibits employees from exercising options or selling shares of stock; stringency depends on the employee’s role at the company; an iso gives an employee the right to buy company stock later based upon the price of the stock at the time of the initial agreement. the value of isos is based on the. A stock option is the right to buy shares of company stock for a fixed price (known as the exercise price) during a fixed period of time (usually 10 years). there are two types of stock options: non qualified stock options (“nqsos”) and incentive stock options (“isos”), and they differ in their tax treatment.

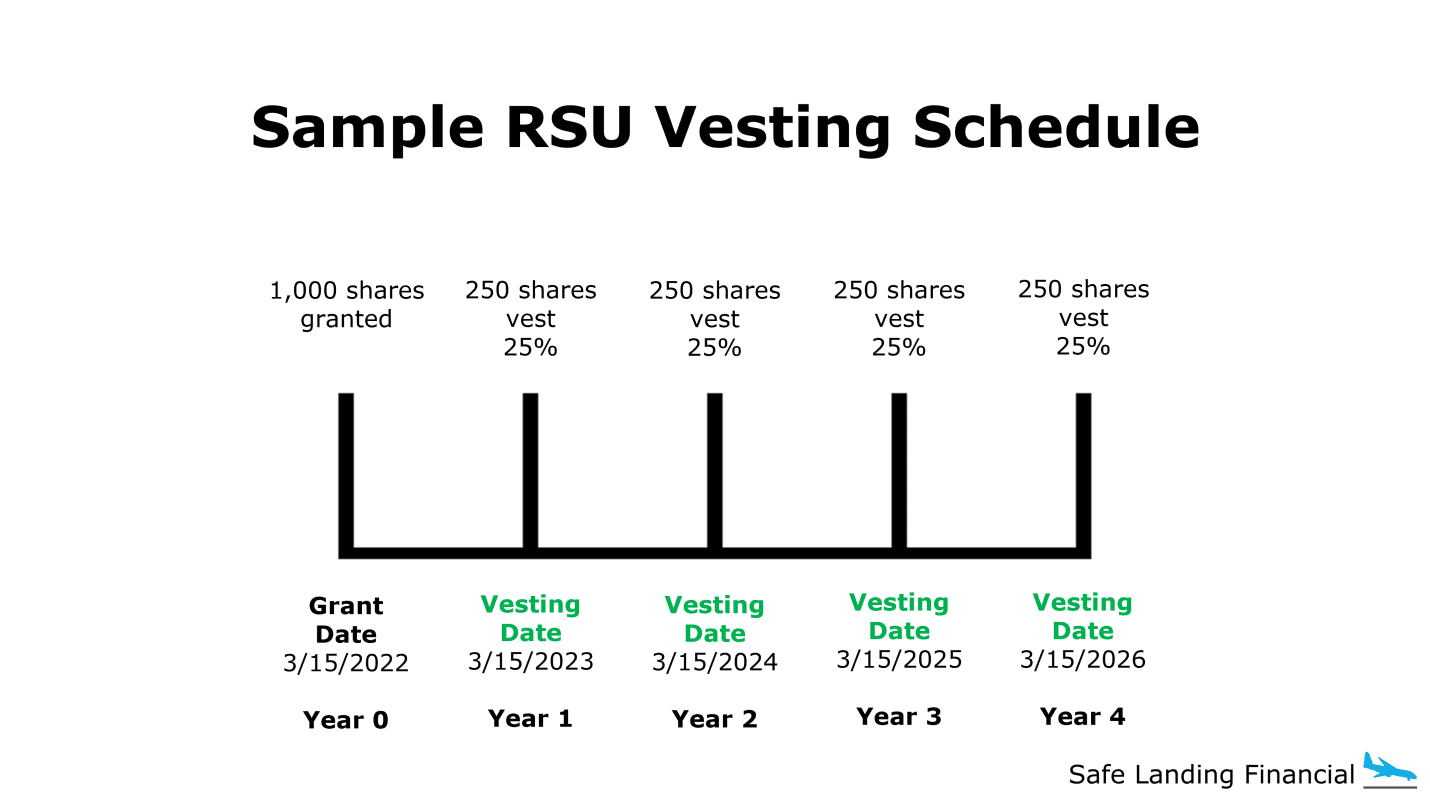

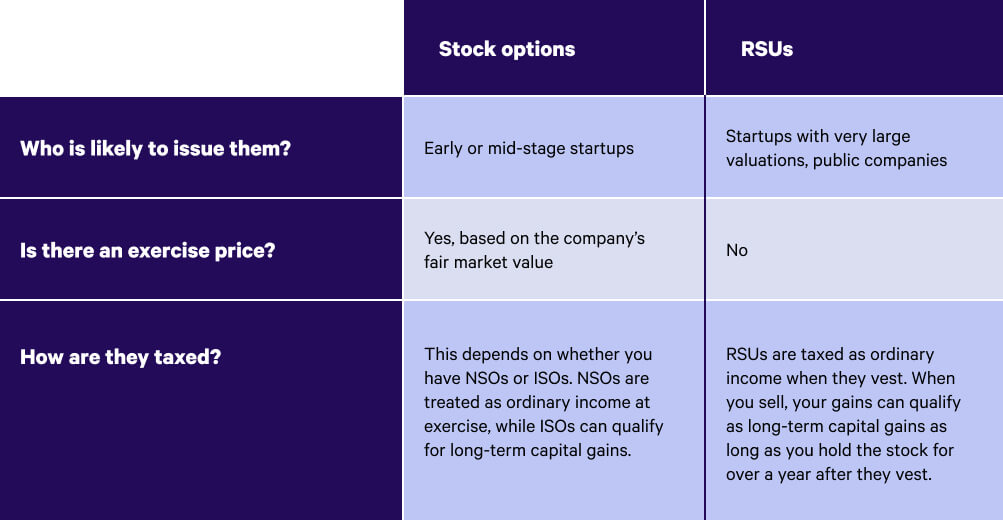

Rsus Vs Stock Options What S The Difference Wealthfront In essence, stock options grant employees the right to buy a specified number of company shares at a predetermined price, known as the exercise price or strike price. on the other hand, rsus offer employees the promise of company stock upon vesting. unlike stock options, rsus ensure stock ownership without the need for any upfront purchase. Summary. companies use equity compensation to incentivize employees to stay at the company and close the compensation gap between startup salaries and larger companies. most companies use either restricted stock, stock options or rsus to compensate employees with equity. restricted stock is typically given before a 409a valuation, stock options. Restricted stock units (rsus) the most common type of equity compensation and are typically offered after a private company goes public. like stock options, rsus vest over time, but unlike stock. An employee stock option gives an employee the option to buy company stock at a certain price, by a certain date. by contrast, an rsu is the promise that on a future date the employee will receive actual company stock. sometimes, employees get a choice between esos and rsus. understanding how each stock plan works, how they differ.

Rsu Stock Tax Calculator Fionnthando Restricted stock units (rsus) the most common type of equity compensation and are typically offered after a private company goes public. like stock options, rsus vest over time, but unlike stock. An employee stock option gives an employee the option to buy company stock at a certain price, by a certain date. by contrast, an rsu is the promise that on a future date the employee will receive actual company stock. sometimes, employees get a choice between esos and rsus. understanding how each stock plan works, how they differ. Difference 1: the value of the shares. the value of stock options depends on stock price appreciation above the exercise price, whereas rsus are full value awards based on the value of company stock. that means rsus always have some value as long as the fmv of the stock is above zero. however, stock options will be worth nothing if the fmv of. Valuation: the value of stock options depends on the stock price at the time of exercise. the value of rsus is based on the fair market value of the stock at the time of vesting. risk: stock options are riskier than rsus. if the stock price plummets below the exercise price, the options’ value can go down to zero.

:max_bytes(150000):strip_icc()/Employee-Stock-Option-fffca69f497d469f9e0f6b0da712b06d.jpg)

Employee Stock Options Esos A Complete Guide Difference 1: the value of the shares. the value of stock options depends on stock price appreciation above the exercise price, whereas rsus are full value awards based on the value of company stock. that means rsus always have some value as long as the fmv of the stock is above zero. however, stock options will be worth nothing if the fmv of. Valuation: the value of stock options depends on the stock price at the time of exercise. the value of rsus is based on the fair market value of the stock at the time of vesting. risk: stock options are riskier than rsus. if the stock price plummets below the exercise price, the options’ value can go down to zero.

Comments are closed.