Summary Of Latest Federal Income Tax Data

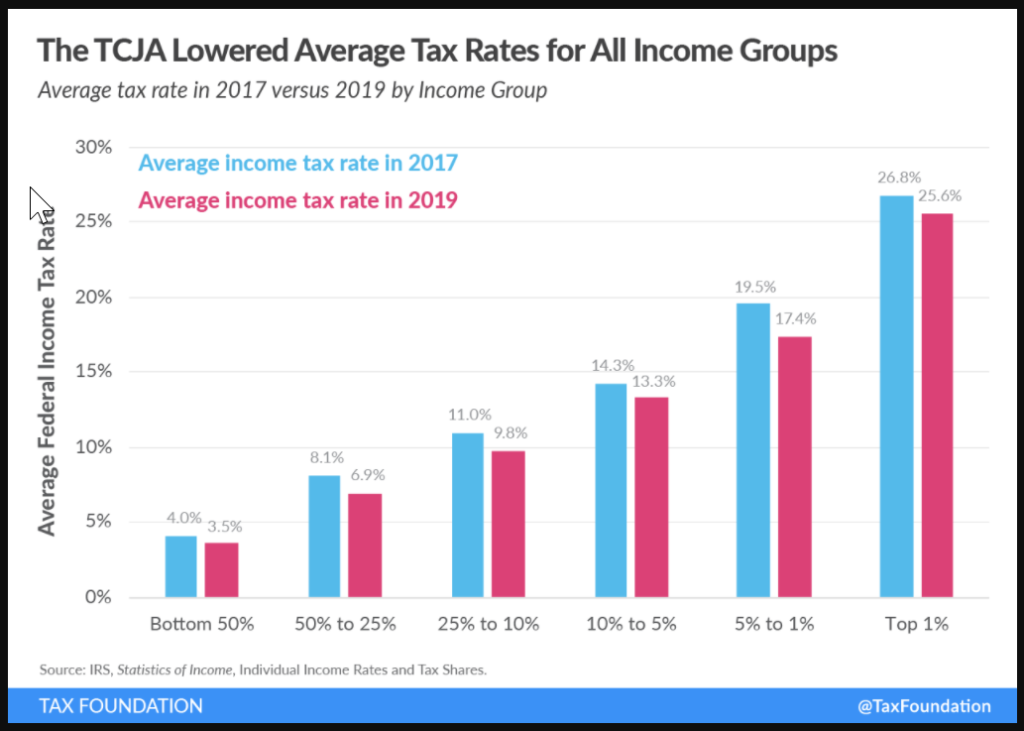

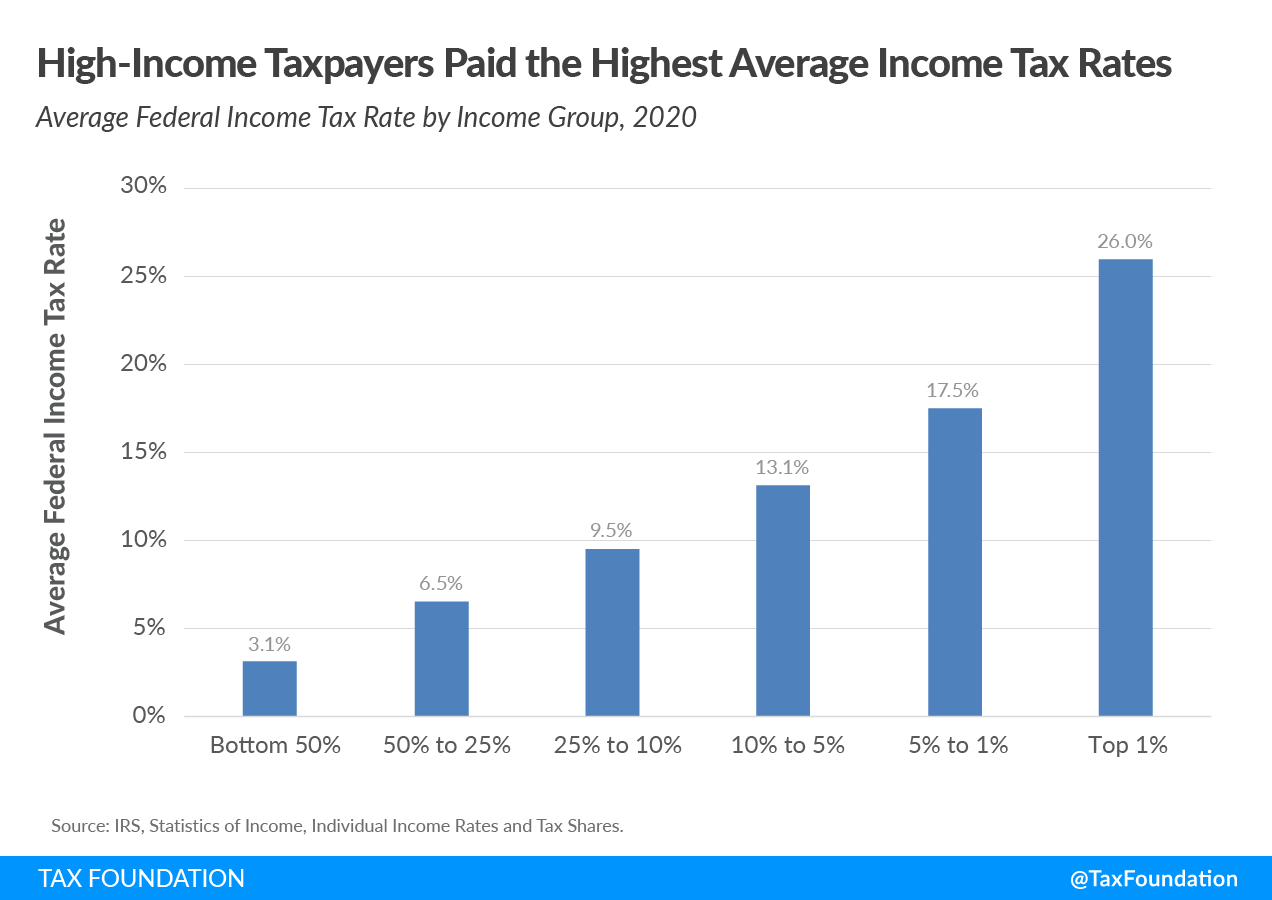

Summary Of The Latest Federal Income Tax Data 2022 Update вђ Act The average income tax rate in 2021 was 14.9 percent. the top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3 percent average rate paid by the bottom half of taxpayers. the top 1 percent’s income share rose from 22.2 percent in 2020 to 26.3 percent in 2021 and its share of federal income taxes. Summary of the latest federal income tax data, 2024 update. the 2021 tax year was the fourth since the tax cuts and jobs act (tcja) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more. 9 min read.

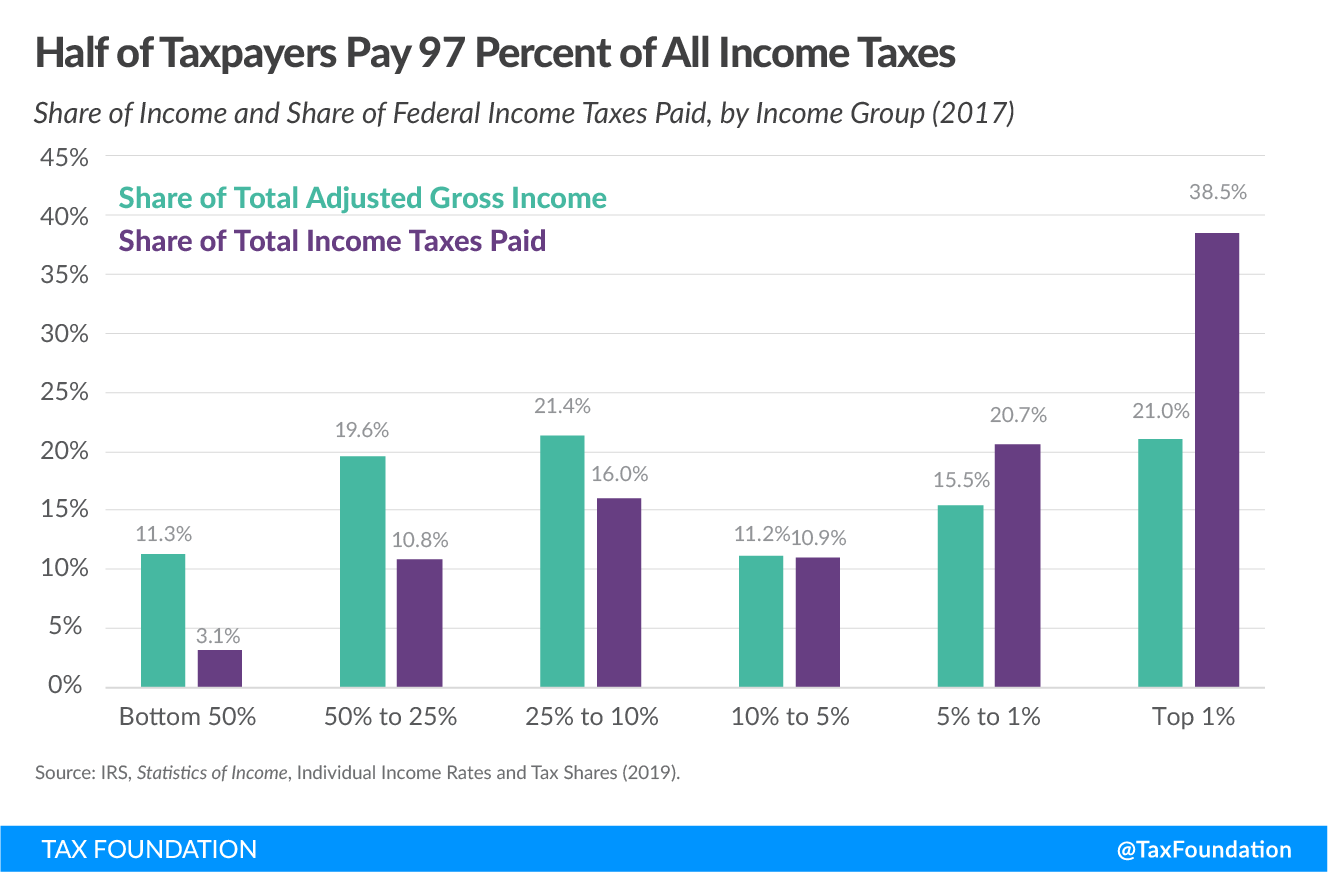

Summary Of The Latest Federal Income Tax Data 2020 Update Upstat About soi. dissemination policy. soi products and services. soi data releases. statistical methodology. all topics. page last reviewed or updated: 01 may 2024. get details on tax statistics. find tables, articles and data that describe and measure elements of the united states tax system. The income tax burden share increased by 1.6 percentage points to 40.1 percent from 38.5 percent in 2017. table 1. summary of federal income tax data, tax year 2018 top 1% top 5% top 10% top 25% top 50% bottom 50% all taxpayers number of returns 1,443,179 7,215,893 14,431,787 36,079,467 72,158,933 72,158,933 144,317,866 adjusted gross income. As your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer for a single taxpayer, the rates are:. A child must be under age 17 at the end of 2022 to be a qualifying child. for the eitc, eligible taxpayers with no children who received roughly $1,500 in 2021 will now get $560 for the 2022 tax year. the child and dependent care credit returns to a maximum of $2,100 in 2022 instead of $8,000 in 2021.

Summary Of The Latest Federal Income Tax Data 2023 Update Cashre As your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer for a single taxpayer, the rates are:. A child must be under age 17 at the end of 2022 to be a qualifying child. for the eitc, eligible taxpayers with no children who received roughly $1,500 in 2021 will now get $560 for the 2022 tax year. the child and dependent care credit returns to a maximum of $2,100 in 2022 instead of $8,000 in 2021. Statistics provides tax information for citizens, policy analysts, legislators, and the press. data are compiled from a variety of sources, including the urban institute, brookings institution, internal revenue service, the joint committee on taxation, the congressional budget office, the department of the treasury, the federation of tax administrators, and the organization for economic. Furthermore, the share of income taxes paid by the top 1% increased from 33.2% in 2001 to 42.3% in 2020. in the same time frame, the share of income taxes paid by those in the bottom 50% decreased.

Summary Of The Latest Federal Income Tax Data Tax Foundati Statistics provides tax information for citizens, policy analysts, legislators, and the press. data are compiled from a variety of sources, including the urban institute, brookings institution, internal revenue service, the joint committee on taxation, the congressional budget office, the department of the treasury, the federation of tax administrators, and the organization for economic. Furthermore, the share of income taxes paid by the top 1% increased from 33.2% in 2001 to 42.3% in 2020. in the same time frame, the share of income taxes paid by those in the bottom 50% decreased.

Comments are closed.