Surprising Ways Your Credit Score Is Affected Transunion

Surprising Ways Your Credit Score Is Affected Transunion Youtube Get in the know at: transunion personal credit credit reports credit history matters.page back taxes, hard credit inquiries, and unpaid parkin. The credit scoring process involves comparing your information to other borrowers that are similar to you. this process takes a tremendous amount of information into consideration, and the result is your three digit credit score number. remember, no one has just one credit score, because financial institutions use more than one scoring method.

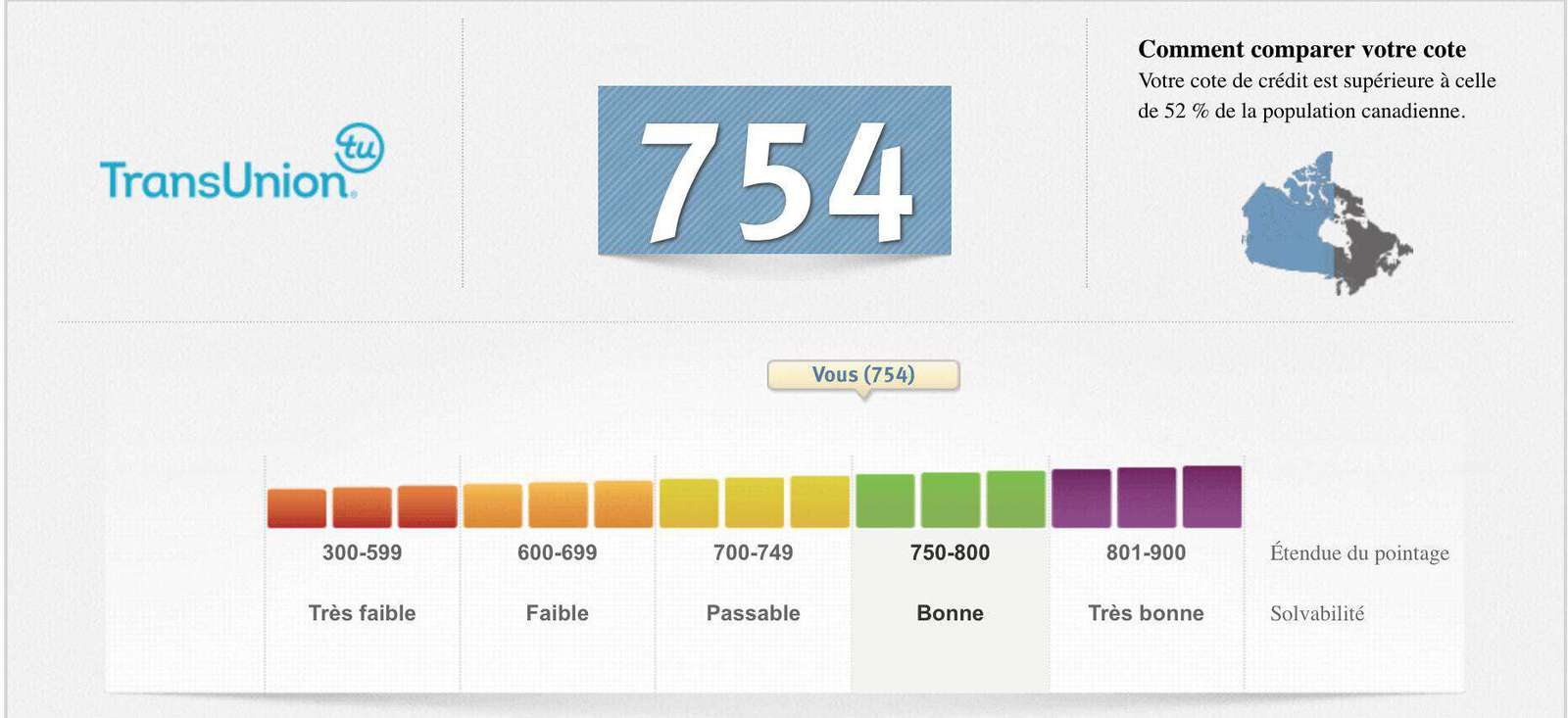

Credit Score Ranges Transunion At Kenneth Means Blog There are 5 factors that determine your credit score and all of them have to do with debt and payments, not education. a few other surprising aspects of your life that don't impact your credit. Lenders use a variety of credit scores and are likely to use a credit score different from vantagescore® 3.0 to assess your creditworthiness. subscription price is $29.95 per month (plus tax where applicable). cancel anytime. rate shopping is a good way to get the best deal on a loan. learn how to do it so you minimize the impact on your. Lenders like to see that the outstanding total balance on your credit cards is below 30% of what you have available. if your total credit limit across all your cards were $10,000, you’d want to keep your total balances below $3,000 to limit the negative impact on your score. of course, getting at or close to 0% is best. Chicago, ill. (march 12, 2015) – a recent transunion survey reveals consumers are largely confused about what affects their credit score and what is included in their credit report. in fact, nearly half of all consumers falsely identified rental (45 percent) and cell phone (47 percent) payments as those that directly affect their score; however,.

Be In The Know With Transunionв вђ See Your Credit Score Now Youtube Lenders like to see that the outstanding total balance on your credit cards is below 30% of what you have available. if your total credit limit across all your cards were $10,000, you’d want to keep your total balances below $3,000 to limit the negative impact on your score. of course, getting at or close to 0% is best. Chicago, ill. (march 12, 2015) – a recent transunion survey reveals consumers are largely confused about what affects their credit score and what is included in their credit report. in fact, nearly half of all consumers falsely identified rental (45 percent) and cell phone (47 percent) payments as those that directly affect their score; however,. Following nerdwallet’s general guidelines, a good credit score is within the 690 to 719 range on the standard 300 850 scale, regardless of age. credit scoring companies have their own measures. So, regardless of whether your payments are on time or late, your account activity won’t affect your credit score. affirm, on the other hand, does report payments to experian and “may report.

What Is A Credit Score Following nerdwallet’s general guidelines, a good credit score is within the 690 to 719 range on the standard 300 850 scale, regardless of age. credit scoring companies have their own measures. So, regardless of whether your payments are on time or late, your account activity won’t affect your credit score. affirm, on the other hand, does report payments to experian and “may report.

Transunion Credit Score Report Pros Cons Why It Matters

Comments are closed.